- Germany

- /

- Entertainment

- /

- XTRA:EVD

Will CTS Eventim (XTRA:EVD) Sustain Its Transformation Momentum as CFO Hohrein Prepares to Depart?

Reviewed by Simply Wall St

- CTS Eventim AG & Co. KGaA recently announced that Chief Financial Officer Holger Hohrein will leave the Executive Board at the end of December 2025, with both parties mutually agreeing not to extend his contract and a successor to be named later.

- Hohrein’s tenure was marked by significant transformation initiatives, including finance process modernization, digitalization, and international expansion, shaping the company’s evolution during an intense growth period.

- We’ll explore how the upcoming CFO transition could influence momentum in CTS Eventim’s global transformation and integration efforts.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CTS Eventim KGaA Investment Narrative Recap

To be a CTS Eventim shareholder, you generally need confidence that margin improvements will follow as recent acquisitions are integrated and the business continues to expand internationally, despite ongoing cost pressures in Live Entertainment. The announced CFO transition appears unlikely to materially impact near-term catalysts, such as the anticipated margin lift from post-acquisition integration, but it does put a spotlight on execution risk around these same integration efforts just as synergies are expected to materialize.

Among recent announcements, the group’s strong international ticketing growth stands out, with ticketing revenues outside Germany climbing sharply year-on-year. This momentum is directly related to the company’s efforts to unify global operations and could be sensitive to any disruption or slowdown in operational integration during leadership transitions.

However, investors should also be aware that, if integration costs remain elevated or synergies are delayed, operating margins and near-term profit growth expectations could be pressured...

Read the full narrative on CTS Eventim KGaA (it's free!)

CTS Eventim KGaA's narrative projects €3.5 billion revenue and €450.0 million earnings by 2028. This requires 6.7% yearly revenue growth and a €166.7 million earnings increase from €283.3 million today.

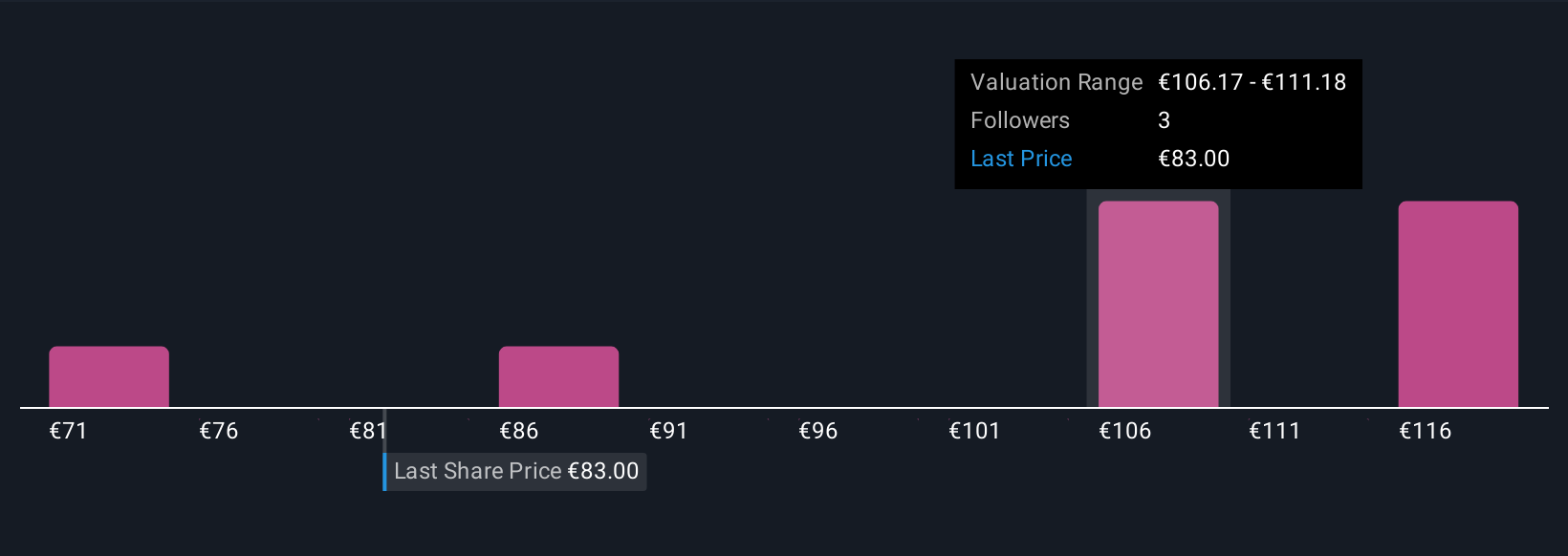

Uncover how CTS Eventim KGaA's forecasts yield a €106.75 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community fair value estimates for CTS Eventim range widely from €71.12 to €121.52. While many expect integration-led margin gains, cost risks tied to expanding Live Entertainment are on the minds of both analysts and private investors, review several perspectives to inform your own view.

Explore 4 other fair value estimates on CTS Eventim KGaA - why the stock might be worth as much as 45% more than the current price!

Build Your Own CTS Eventim KGaA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CTS Eventim KGaA research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CTS Eventim KGaA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CTS Eventim KGaA's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EVD

CTS Eventim KGaA

Operates in the leisure events market in Germany, Italy, Switzerland, the United States, Austria, the United Kingdom, Spain, Netherlands, Finland, France, Denmark, Sweden, Norway, Chile, Brazil, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives