- Germany

- /

- Entertainment

- /

- XTRA:BVB

Does Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien's (ETR:BVB) CEO Salary Compare Well With The Performance Of The Company?

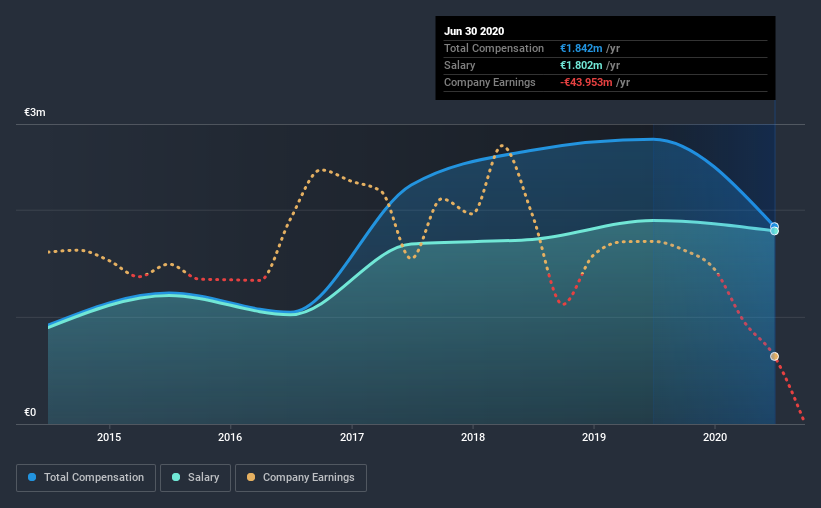

The CEO of Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien (ETR:BVB) is Hans-Joachim Watzke, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien

How Does Total Compensation For Hans-Joachim Watzke Compare With Other Companies In The Industry?

Our data indicates that Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien has a market capitalization of €490m, and total annual CEO compensation was reported as €1.8m for the year to June 2020. We note that's a decrease of 31% compared to last year. In particular, the salary of €1.80m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between €166m and €665m had a median total CEO compensation of €739k. Accordingly, our analysis reveals that Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien pays Hans-Joachim Watzke north of the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €1.8m | €1.9m | 98% |

| Other | €40k | €758k | 2% |

| Total Compensation | €1.8m | €2.7m | 100% |

Talking in terms of the industry, salary represented approximately 59% of total compensation out of all the companies we analyzed, while other remuneration made up 41% of the pie. Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien's Growth

Over the last three years, Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien has shrunk its earnings per share by 108% per year. It saw its revenue drop 25% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien Been A Good Investment?

Since shareholders would have lost about 1.5% over three years, some Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Hans-Joachim receives almost all of their compensation through a salary. As we touched on above, Borussia Dortmund GmbH & Co. Kommanditgesellschaft auf Aktien is currently paying its CEO higher than the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. What's equally worrying is that the company isn't growing by our analysis. Understandably, the company's shareholders might have some questions about the CEO's remuneration, given the disappointing performance.

Shareholders may want to check for free if Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien insiders are buying or selling shares.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:BVB

Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien

Operates a football club in Germany.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives