- Germany

- /

- Metals and Mining

- /

- XTRA:TKA

Why thyssenkrupp (XTRA:TKA) Is Up 6.1% After Marine Systems Strength and Spin-Off Hints

Reviewed by Sasha Jovanovic

- In the past month, thyssenkrupp's shares have seen a substantial rise even without a major event or announcement driving the move.

- This momentum has been fueled by strong performance in the Marine Systems division, a focus on decarbonized steel, and planned structural reforms including a potential Marine Systems spin-off.

- To see how the Marine Systems momentum and structural reforms might influence thyssenkrupp's outlook, let's review its updated investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

thyssenkrupp Investment Narrative Recap

To be a shareholder in thyssenkrupp right now, you need to believe in the company's ability to execute its major transformation, delivering value from Marine Systems momentum, decarbonized steel ambitions, and structural reforms, all while navigating ongoing macro challenges and operational inefficiencies. The recent 28% share price rise closely tracks optimism around these catalysts, but it does not fundamentally alter the most significant short-term catalyst, which remains the Marine Systems division's strong order backlog, nor does it reduce the risk of persistent weakness in core segments and the drag from high fixed costs.

Among the latest announcements, the planned spin-off of 49% of thyssenkrupp Marine Systems stands out as the most relevant; this move directly relates to investor optimism in the defense and naval segment, with potential to drive operational efficiency and unlock value if executed effectively. For investors, it connects closely to the current excitement fueling the share price, yet many will closely watch whether this structural change delivers sustainable margin improvement rather than just a short-term boost.

However, even as Marine Systems offers a clear growth story ahead, investors should be aware that persistent underperformance in Steel or Materials Services segments could...

Read the full narrative on thyssenkrupp (it's free!)

thyssenkrupp's outlook projects €37.0 billion in revenue and €1.5 billion in earnings by 2028. This is based on analysts assuming a 3.5% annual revenue growth rate and a €2.7 billion increase in earnings from the current €-1.2 billion.

Uncover how thyssenkrupp's forecasts yield a €10.20 fair value, a 22% downside to its current price.

Exploring Other Perspectives

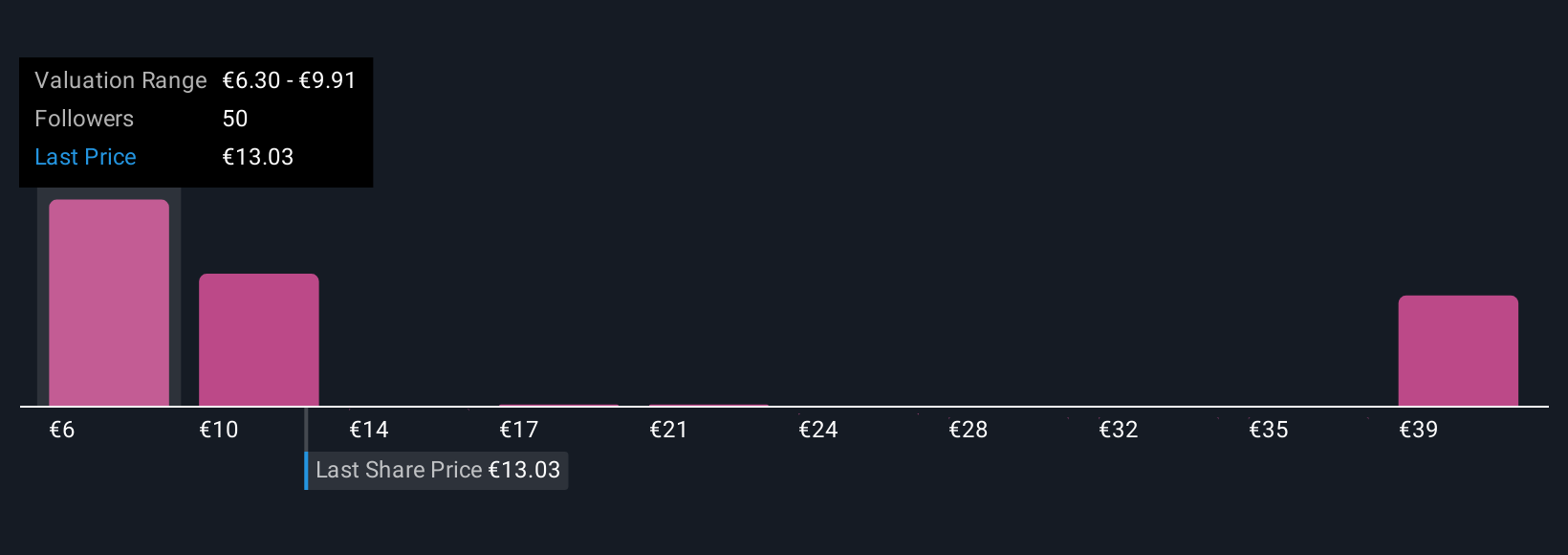

Seventeen private investors in the Simply Wall St Community estimate thyssenkrupp’s fair value from €6.30 up to €42.40. While optimism is high for Marine Systems’ backlog, ongoing core segment weakness may still weigh on results, so check multiple viewpoints before forming your own view.

Explore 17 other fair value estimates on thyssenkrupp - why the stock might be worth less than half the current price!

Build Your Own thyssenkrupp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your thyssenkrupp research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free thyssenkrupp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate thyssenkrupp's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives