- Germany

- /

- Metals and Mining

- /

- XTRA:TKA

How Investors Are Reacting To thyssenkrupp (XTRA:TKA) Steel’s Major Restructuring And Capacity Cuts

Reviewed by Sasha Jovanovic

- In late 2025, thyssenkrupp Steel reached a restructuring collective agreement with IG Metall, securing financing while cutting or outsourcing around 11,000 jobs and reducing steel shipping capacity to about 8.7–9 million tons.

- This marks a major reset of the group’s steel footprint, with large workforce changes and capacity cuts likely to reshape cost structure and competitive positioning.

- We’ll now examine how this large workforce reduction and steel capacity cut could influence thyssenkrupp’s previously outlined investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

thyssenkrupp Investment Narrative Recap

To own thyssenkrupp today, you need to believe that the group can turn a complex mix of steel, materials and technology assets into a leaner, more profitable portfolio. The new agreement to cut or outsource around 11,000 steel jobs and trim capacity is a major move in that direction, but it also reinforces the biggest near term risk: execution on restructuring without undermining revenues and margins in already soft demand conditions.

The restructuring accord follows months of upheaval in thyssenkrupp Steel Europe, including the October 2025 plan to shrink the division’s workforce from about 27,000 to roughly 16,000 by 2030. Seen alongside group wide efficiency programs like APEX 2.0, this latest step is tightly linked to the key catalyst of cost savings and cash generation, even as earlier guidance still pointed to a narrow EBIT outcome between minus €7 million and plus €7 million.

Yet while these measures aim to fix deep seated cost issues, investors also need to be aware that...

Read the full narrative on thyssenkrupp (it's free!)

thyssenkrupp's narrative projects €37.0 billion revenue and €1.5 billion earnings by 2028. This requires 3.5% yearly revenue growth and an earnings increase of about €2.7 billion from €-1.2 billion today.

Uncover how thyssenkrupp's forecasts yield a €10.20 fair value, a 15% upside to its current price.

Exploring Other Perspectives

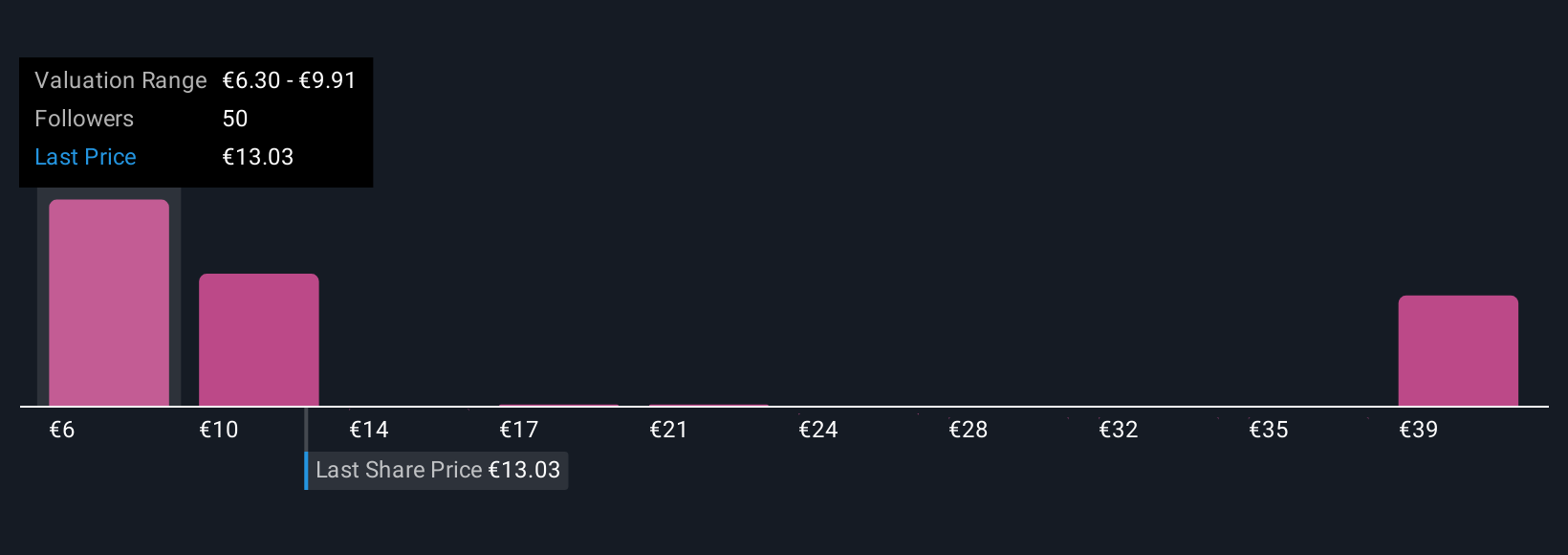

Sixteen fair value estimates from the Simply Wall St Community span a wide range, from €7.29 up to €42.40 per share, showing how differently you might assess the same numbers. As you weigh these views against the execution risk around thyssenkrupp’s large scale steel restructuring, it is worth exploring several perspectives on what that could mean for future earnings power and resilience.

Explore 16 other fair value estimates on thyssenkrupp - why the stock might be worth 18% less than the current price!

Build Your Own thyssenkrupp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your thyssenkrupp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free thyssenkrupp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate thyssenkrupp's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026