- Germany

- /

- Metals and Mining

- /

- XTRA:TKA

A look at thyssenkrupp (XTRA:TKA) valuation after profit return, loss warning and major restructuring plans

Reviewed by Simply Wall St

The latest buzz around thyssenkrupp (XTRA:TKA) comes from a mixed earnings story: a return to profit for 2025 paired with a stark warning that the coming year could swing back into a sizeable loss.

See our latest analysis for thyssenkrupp.

Investors have been whipsawed, with thyssenkrupp’s latest earnings rebound overshadowed by guidance for a fresh loss. This helped drive a sharp 1 day share price return of minus 6.49 percent, even after a powerful year to date share price return of 122.73 percent and an even stronger 1 year total shareholder return of 193.78 percent, signalling that long term momentum remains firmly positive despite the recent pullback.

If this kind of restructuring story has you rethinking your watchlist, it may be worth exploring fast growing stocks with high insider ownership as a way to uncover other dynamic opportunities.

With shares still trading below analyst targets, but a fresh loss and heavy restructuring looming, is thyssenkrupp now a classic turnaround at a discount, or are markets already pricing in every euro of future growth?

Most Popular Narrative Narrative: 11.4% Undervalued

With thyssenkrupp last closing at €8.94 against a narrative fair value of about €10.09, the current share price sits below the projected upside path.

Continued investments and visible progress in green hydrogen initiatives and DRI plant construction for Steel Europe strategically align the company with rising customer demand and regulatory pressure for decarbonized steel, offering the potential to command premium pricing and improve segment margins.

Curious how steady revenue gains, margin rebuild and a surprisingly low future earnings multiple all combine into that valuation gap? The narrative reveals the full playbook.

Result: Fair Value of €10.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro headwinds and execution risks around significant workforce reductions and restructuring could derail the margin rebuild story that investors are currently supporting.

Find out about the key risks to this thyssenkrupp narrative.

Another Lens on Value

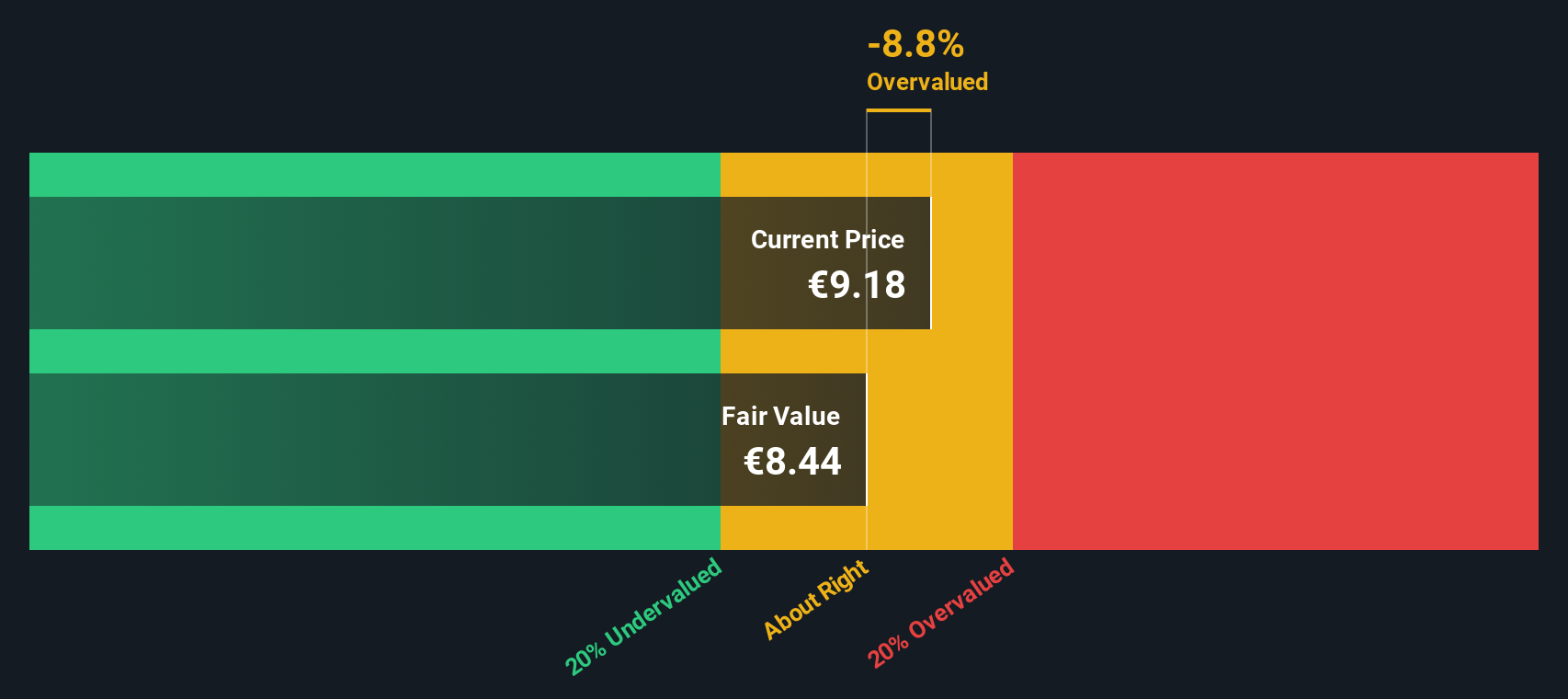

While the narrative fair value points to upside, the SWS DCF model is more cautious, putting fair value nearer €8, slightly below today’s €8.94. That implies thyssenkrupp could be modestly overvalued if cash flows disappoint and raises the question: which story blinks first, the price or the forecasts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out thyssenkrupp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own thyssenkrupp Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can craft a custom narrative in just a few minutes, Do it your way.

A great starting point for your thyssenkrupp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Do not stop at a single turnaround story. Put Simply Wall Street’s Screener to work and lock onto opportunities other investors have not acted on yet.

- Capture potential mispricings by targeting quality companies trading at attractive valuations through these 899 undervalued stocks based on cash flows before the market closes the gap.

- Tap into structural growth themes in medicine and diagnostics by zeroing in on innovators harnessing smart algorithms with these 30 healthcare AI stocks.

- Boost your income strategy by focusing on reliable cash generators that share profits with shareholders via these 15 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026