Why Investors Shouldn't Be Surprised By LANXESS Aktiengesellschaft's (ETR:LXS) P/S

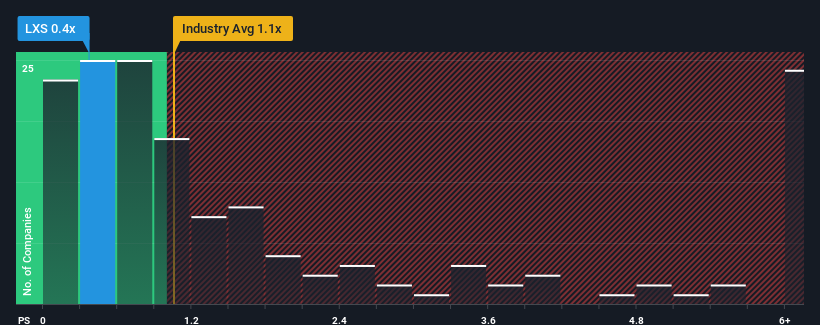

There wouldn't be many who think LANXESS Aktiengesellschaft's (ETR:LXS) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Chemicals industry in Germany is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for LANXESS

How LANXESS Has Been Performing

The recently shrinking revenue for LANXESS has been in line with the industry. The P/S ratio is probably moderate because investors think the company's revenue trend will continue to follow the rest of the industry. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. At the very least, you'd be hoping that revenue doesn't accelerate downwards if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LANXESS.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, LANXESS would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 10.0% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 2.4% per annum as estimated by the analysts watching the company. That's shaping up to be similar to the 4.3% per year growth forecast for the broader industry.

With this information, we can see why LANXESS is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On LANXESS' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that LANXESS maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you take the next step, you should know about the 1 warning sign for LANXESS that we have uncovered.

If these risks are making you reconsider your opinion on LANXESS, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:LXS

LANXESS

A specialty chemicals company, engages in the development, manufacture, and marketing of chemical intermediates, additives, and consumer protection products worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives