IBU-tec advanced materials (ETR:IBU shareholders incur further losses as stock declines 10% this week, taking three-year losses to 50%

It is a pleasure to report that the IBU-tec advanced materials AG (ETR:IBU) is up 54% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 50% in the last three years, falling well short of the market return.

With the stock having lost 10% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

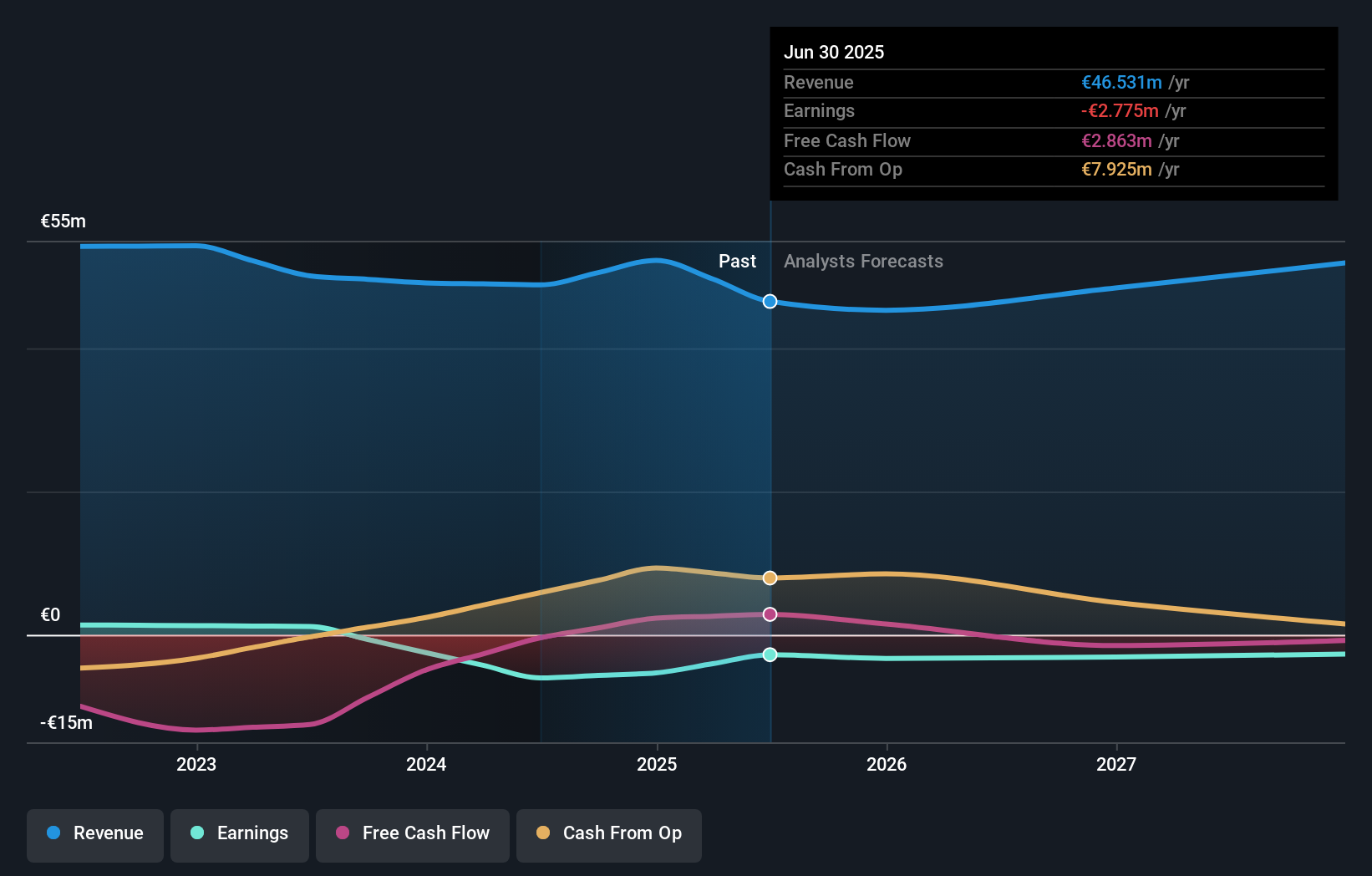

Because IBU-tec advanced materials made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, IBU-tec advanced materials' revenue dropped 3.7% per year. That is not a good result. The stock has disappointed holders over the last three years, falling 14%, annualized. That makes sense given the lack of either profits or revenue growth. Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on IBU-tec advanced materials' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

IBU-tec advanced materials provided a TSR of 6.3% over the last twelve months. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 0.5% endured over half a decade. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for IBU-tec advanced materials that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:IBU

IBU-tec advanced materials

Offers services and products for the chemical industry Germany, rest of Europe, and internationally.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives