- Philippines

- /

- Real Estate

- /

- PSE:CPG

Discovering Value: 3 Penny Stocks With Market Caps Over US$70M

Reviewed by Simply Wall St

As global markets continue to reach record highs, with indices like the Dow Jones Industrial Average and S&P 500 showing impressive gains, investors are exploring diverse opportunities. Amidst these developments, penny stocks remain a compelling area of interest for those looking beyond traditional large-cap investments. Although the term "penny stock" might seem outdated, these smaller or newer companies can offer significant value when supported by robust financials. In this article, we explore three penny stocks that demonstrate strong balance sheets and potential growth prospects, offering investors a chance to uncover hidden value in today's market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.725 | £190.77M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.96 | HK$43.61B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.415 | £438.1M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,696 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Century Properties Group (PSE:CPG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Century Properties Group, Inc., along with its subsidiaries, is a real estate company operating in the Philippines with a market capitalization of approximately ₱4.93 billion.

Operations: The company's revenue is primarily derived from Real Estate Development, which accounts for ₱12.10 billion, followed by Leasing at ₱1.25 billion, and Hotel and Property Management contributing ₱533.15 million.

Market Cap: ₱4.93B

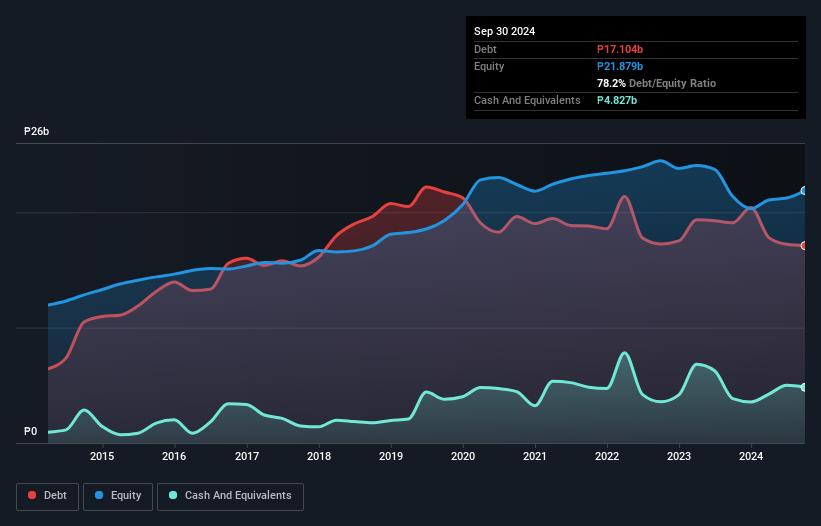

Century Properties Group has demonstrated significant earnings growth, with a 163.6% increase over the past year, outpacing industry averages. Despite this growth and an improvement in net profit margins from 6.8% to 15.7%, the company's financial position shows some weaknesses. Debt levels remain high with a net debt to equity ratio of 56.1%, and operating cash flow does not adequately cover debt obligations at only 19.7%. However, short-term assets comfortably exceed both short-term and long-term liabilities, suggesting liquidity strength amidst its challenges with debt coverage and low return on equity at 10.7%.

- Get an in-depth perspective on Century Properties Group's performance by reading our balance sheet health report here.

- Understand Century Properties Group's track record by examining our performance history report.

Marco Polo Marine (SGX:5LY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Marco Polo Marine Ltd. operates as an integrated marine logistics company across Singapore, Indonesia, Taiwan, Thailand, Malaysia, and internationally with a market cap of SGD206.45 million.

Operations: The company's revenue is derived from Ship Chartering Services, which generated SGD71.93 million, and Ship Building and Repair Services, contributing SGD51.60 million.

Market Cap: SGD206.45M

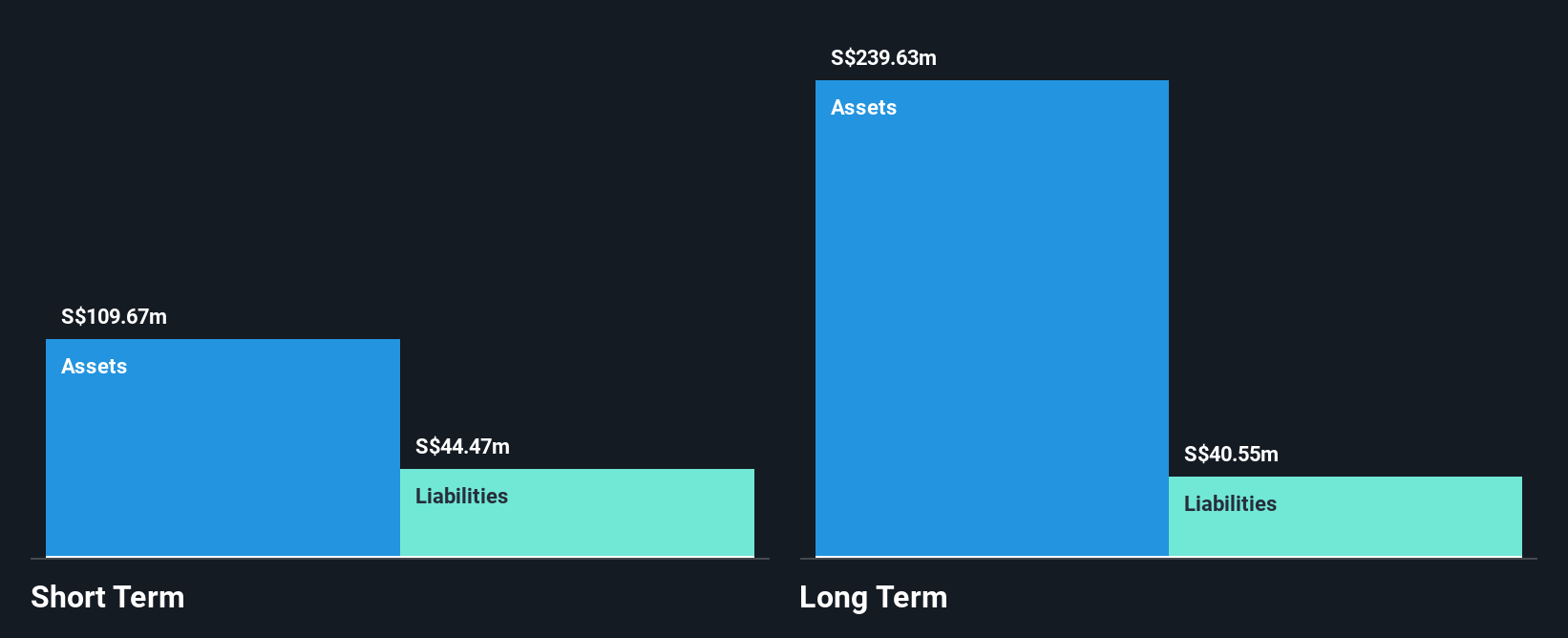

Marco Polo Marine Ltd. shows a stable financial position with short-term assets of SGD114.1 million exceeding both its short and long-term liabilities, indicating solid liquidity. The company has maintained profitability over the past five years, although recent earnings have slightly declined to SGD21.7 million from the previous year. Despite this, it trades at a good value compared to peers and is forecasted for earnings growth of 16.28% annually. Its debt is well covered by operating cash flow, and no significant shareholder dilution occurred recently, suggesting prudent financial management amidst industry challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Marco Polo Marine.

- Gain insights into Marco Polo Marine's outlook and expected performance with our report on the company's earnings estimates.

BRAIN Biotech (XTRA:BNN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BRAIN Biotech AG is involved in the research and development of bio-based products and solutions across Germany, the United States, France, the Netherlands, and the United Kingdom, with a market cap of €69.48 million.

Operations: The company's revenue is primarily derived from its Bioproducts segment at €42.66 million, followed by Bioscience (excluding Bioincubator) at €11.64 million, and Bioincubator contributing €2.08 million.

Market Cap: €69.48M

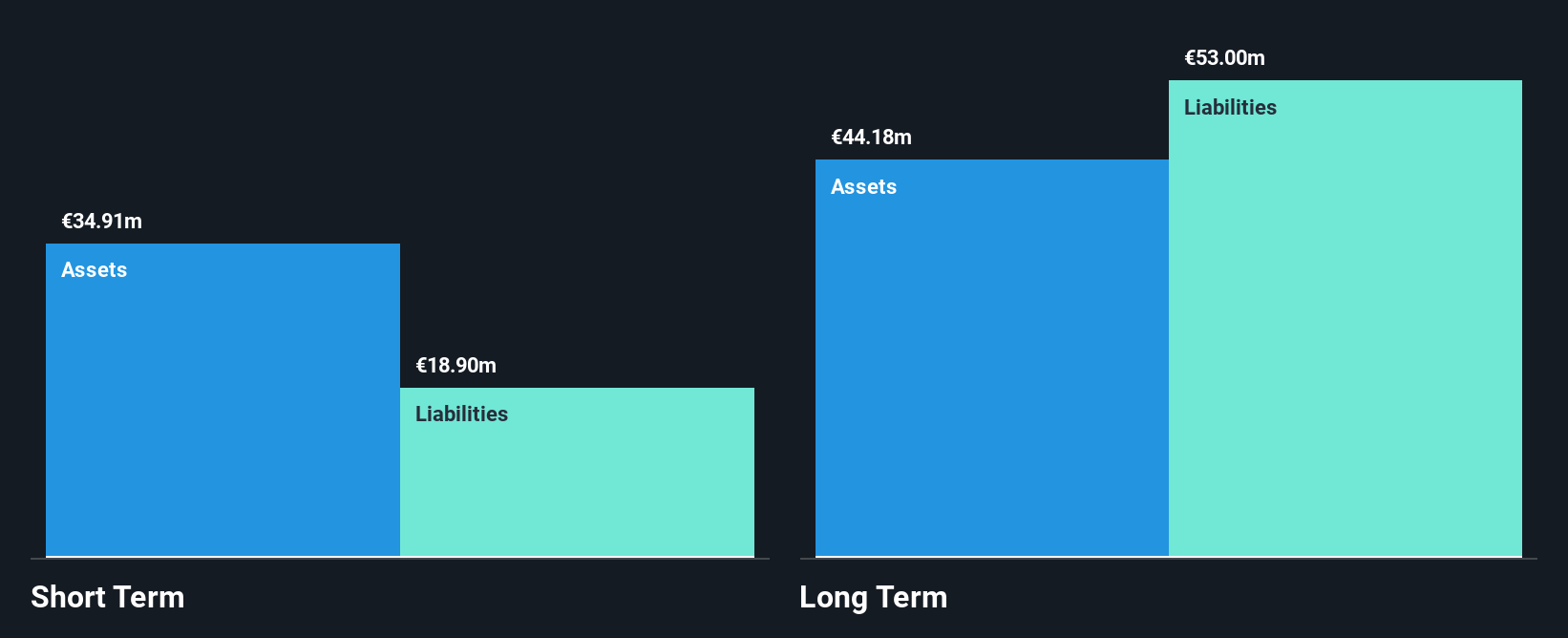

BRAIN Biotech AG, with a market cap of €69.48 million, derives substantial revenue from its Bioproducts segment (€42.66M). Despite being unprofitable, it has reduced losses by 7.7% annually over five years and forecasts earnings growth of 71.49% per year. The company is debt-free and has a cash runway exceeding three years if free cash flow continues to grow historically at 5.5%. Short-term assets (€30.6M) surpass short-term liabilities (€11.9M), although they fall short of covering long-term liabilities (€44.7M). Recent executive changes include the resignation of Supervisory Board member Prof. Dr. Wiltrud Treffenfeldt for personal reasons.

- Navigate through the intricacies of BRAIN Biotech with our comprehensive balance sheet health report here.

- Evaluate BRAIN Biotech's prospects by accessing our earnings growth report.

Where To Now?

- Unlock our comprehensive list of 5,696 Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:CPG

Century Properties Group

Operates as a real estate company in the Philippines.

Solid track record, good value and pays a dividend.