What BASF (XTRA:BAS)'s Asian PolyTHF Consolidation and New Eco Foams Mean For Shareholders

Reviewed by Sasha Jovanovic

- In early November 2025, BASF announced the consolidation of its Asian PolyTHF business by ending production at its Ulsan, South Korea site and introduced two new sustainable insulation and acoustic foam products, Cavipor clay foam and Basotect Dark EcoBalanced. These initiatives target overcapacity challenges in chemicals and highlight BASF’s push for sustainability and design innovation in construction and materials markets.

- By integrating production assets and launching advanced materials like Cavipor, BASF is seeking both operational efficiency and differentiation through eco-friendly product offerings.

- We'll examine how the introduction of BASF's climate-friendly insulation foams fits within the company's broader transformation and growth plans.

Find companies with promising cash flow potential yet trading below their fair value.

BASF Investment Narrative Recap

To be a BASF shareholder right now, you need to believe in the company’s ability to adapt through organizational streamlining, innovation, and sustainability leadership, even as it faces ongoing pressure from overcapacity and subdued demand in core chemicals. The recent business consolidation in Asian PolyTHF and product launches are timely, but do not materially shift the biggest near-term catalyst: continued progress on cost savings and portfolio optimization. Operational risks from persistent overcapacity in base chemicals remain the biggest threat to group profitability, especially as sluggish demand persists.

Among the latest updates, the launch of Cavipor mineral-based insulation exemplifies BASF's focus on product innovation with a clear sustainability edge. This is highly relevant as increased regulatory and market demand for greener materials could complement ongoing restructuring efforts to support margin recovery and differentiate offerings in slower-growing segments.

However, against this drive for efficiency and new growth avenues, investors should also consider how persistent margin pressure from global chemical overcapacity is an ongoing reality that could...

Read the full narrative on BASF (it's free!)

BASF's narrative projects €70.9 billion revenue and €3.3 billion earnings by 2028. This requires 3.0% yearly revenue growth and a €2.9 billion increase in earnings from €388.0 million.

Uncover how BASF's forecasts yield a €48.32 fair value, a 10% upside to its current price.

Exploring Other Perspectives

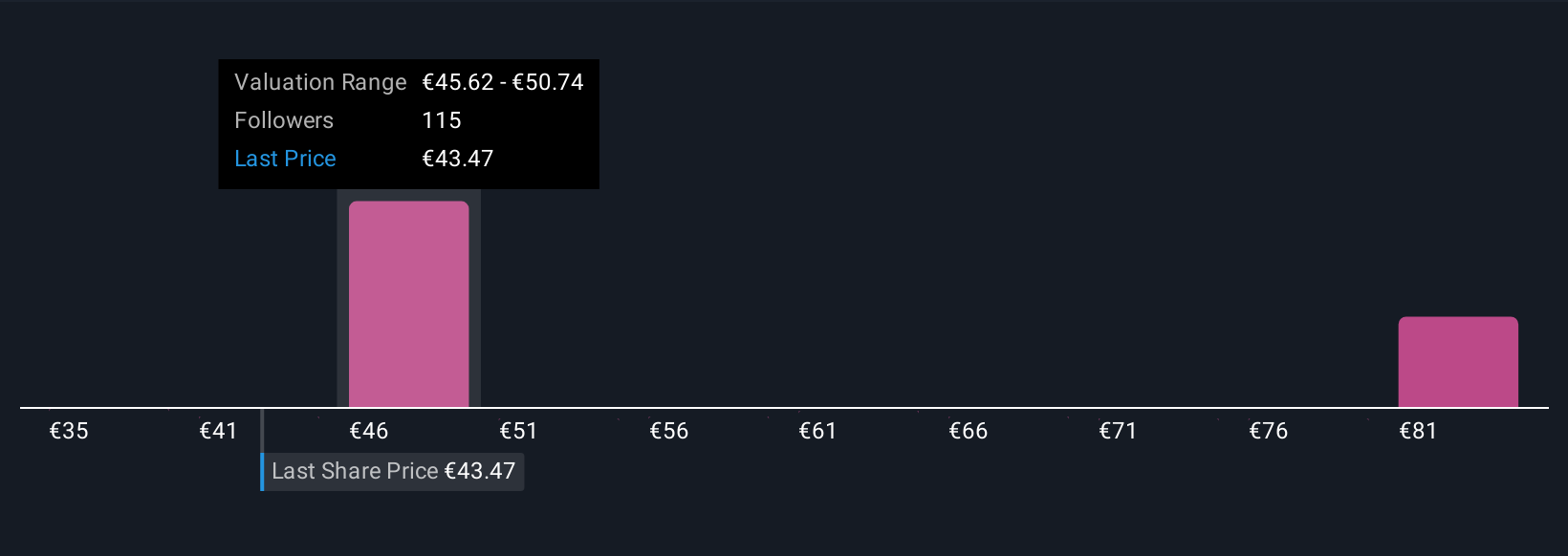

With 11 fair value estimates from the Simply Wall St Community ranging from €35.39 to €86.54, views on BASF's future potential vary widely. In light of ongoing overcapacity risks in base chemicals, these differences highlight why it’s important to see how others understand the company’s outlook.

Explore 11 other fair value estimates on BASF - why the stock might be worth 19% less than the current price!

Build Your Own BASF Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BASF research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free BASF research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BASF's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BASF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAS

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives