Evaluating BASF (XTRA:BAS): How New Products and Asia Restructuring Shape the Valuation Outlook

Reviewed by Simply Wall St

BASF (XTRA:BAS) has made several moves that speak to its current strategy. The company is rolling out Cavipor clay foam for building insulation and launching a new sustainable Basotect product. BASF is also reorganizing its PolyTHF operations in Asia.

See our latest analysis for BASF.

BASF’s recent momentum reflects how investors are weighing its wave of product innovations and business realignment. The stock’s 1-year total shareholder return of 8.3% shows steady progress, while shorter-term share price gains hint at growing optimism as the new initiatives roll out.

If these forward-looking moves have you curious about what else is gaining traction, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With BASF’s shares still trading at a meaningful discount to analyst price targets, the question remains: does this present a timely entry point for investors, or is the market already accounting for the company’s bold transformation?

Most Popular Narrative: 9.8% Undervalued

According to the most widely followed narrative, BASF’s fair value stands nearly 10% above the last close, suggesting material upside if analyst assumptions are met. With the consensus emphasizing execution and margin expansion, investors are watching closely to see how transformative projects and restructuring could play out.

Significant cost-savings programs (targeting €2.1 billion annual savings by end of 2026), along with the completion of the major China Verbund investment (with project costs under budget and CapEx falling below depreciation from 2026), are expected to meaningfully improve operating leverage and free cash flow. Cost competitiveness is seen as directly supporting improved net margins.

Want to see what propels that ambitious price target? The entire earnings outlook hangs on bold cost cuts, a bet on global expansion, and a profit surge only seen in rising stars. Ready to discover which high-stakes projections underpin this valuation? Uncover the real story inside the full consensus narrative.

Result: Fair Value of €48.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low margins or a prolonged weakness in European demand could challenge these forecasts and potentially limit the anticipated profit recovery for BASF.

Find out about the key risks to this BASF narrative.

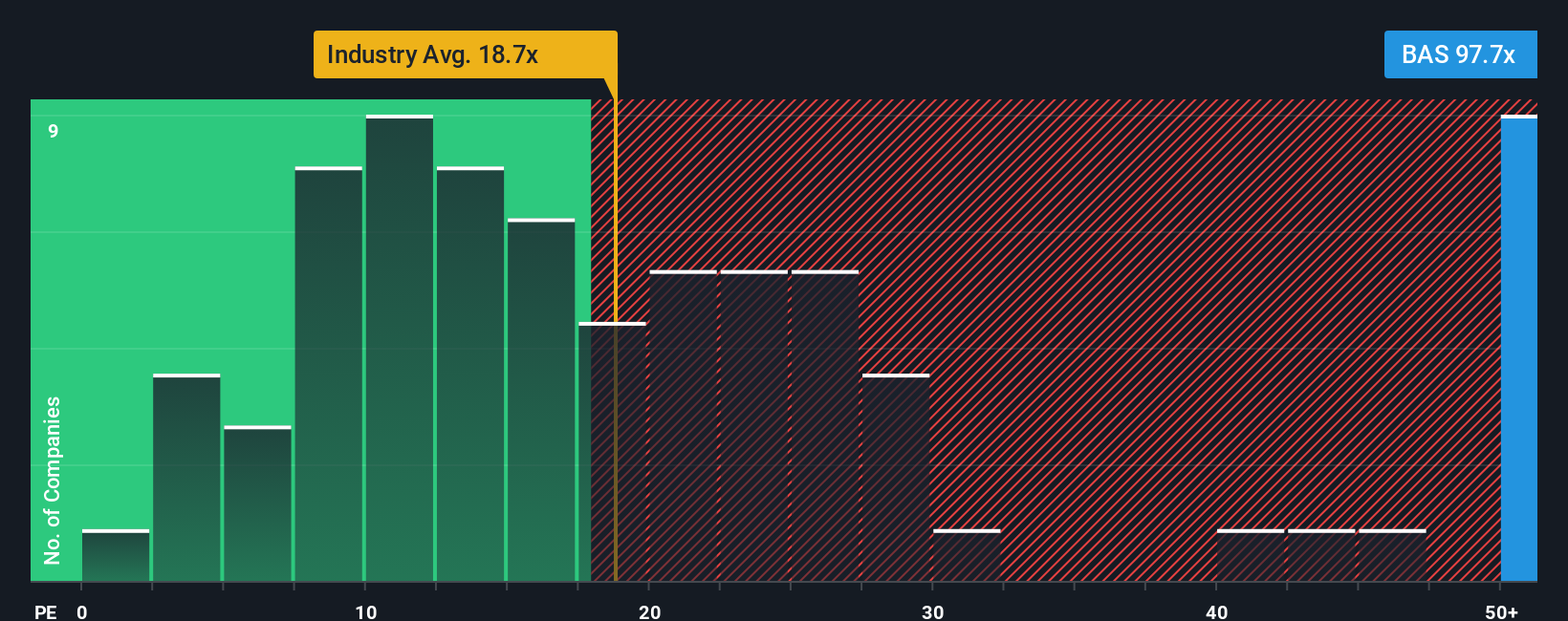

Another View: Multiples Tell a Different Story

While some see upside in BASF’s price, a look at its current earnings multiple paints a more cautious picture. The company trades at a price-to-earnings ratio of 125.8x, much higher than both the peer average (31.3x) and the European Chemicals sector at 17.7x. The market’s fair ratio stands at just 34.3x. This suggests BASF is expensive compared to industry benchmarks and where the market may eventually reset. Does this gap highlight a risk investors should pay close attention to?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BASF Narrative

If you take a different view or enjoy diving into the numbers on your own, you can build a unique BASF outlook in just a few minutes. Do it your way

A great starting point for your BASF research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Capitalize on the potential of tomorrow's winners by targeting opportunities others overlook. Don’t sit on the sidelines while fresh trends shape the future. Let Simply Wall Street’s powerful screener help you find your next move right now.

- Cash in on consistent yields by tracking these 15 dividend stocks with yields > 3% that are delivering strong income for their shareholders.

- Amplify your portfolio’s tech edge by zeroing in on these 26 AI penny stocks that are leading the charge in artificial intelligence innovation.

- Seize the chance for high potential upside by spotting these 872 undervalued stocks based on cash flows with attractive pricing based on their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BASF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAS

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives