BASF (XTRA:BAS) Turns Profitable, but One-Off Loss Raises Doubts on Earnings Quality

Reviewed by Simply Wall St

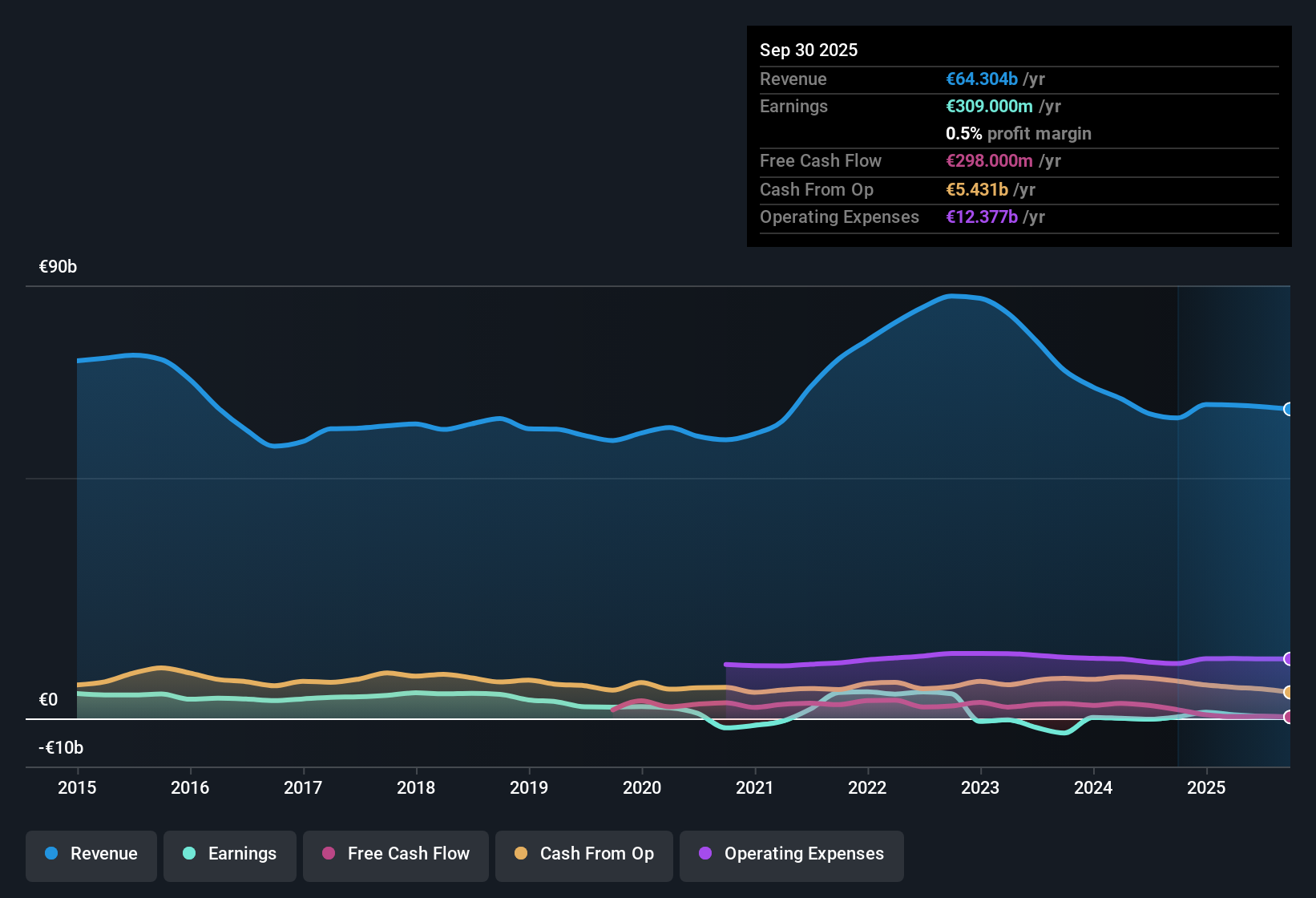

BASF (XTRA:BAS) has returned to profitability, with net profit margins improving compared to last year. Over the past five years, however, the company’s earnings have declined by an average of 16.6% per year. Looking ahead, BASF’s earnings are forecast to grow at 19.4% annually, exceeding the German market’s average of 16.7%. However, anticipated revenue growth of 2.4% lags behind the expected 6.1% rate for the broader German market. Investors face a mixed picture as they weigh signs of recovery and future growth against a recent history of declining earnings and the company’s slower top-line momentum.

See our full analysis for BASF.Next up, we’ll see how these headline numbers stack up against the narratives making the rounds in the Simply Wall St community and which assumptions may need a reality check.

See what the community is saying about BASF

DCF Fair Value Nearly Twice Current Price

- BASF's current share price is €43.02, sitting well below the DCF fair value estimate of €86.03. This presents a 50% gap that highlights a substantial disconnect according to discounted cash flow modeling.

- Analysts' consensus view expects the gap to narrow as net profit margins are forecast to rise from 0.6% today to 4.7% in three years, supported by portfolio optimization and cost savings.

- Consensus narrative notes that upcoming IPOs and expansion in the Agricultural and Advanced Technologies segments are anticipated to deliver higher, more stable revenues and contribute to margin accretion.

- What is surprising is that even with the optimistic modeling, achieving the consensus price target of €49.38 (just 10.5% upside from today’s price) would require BASF to trade at a forward PE of 16.1x by 2028. This would be a significant decrease from the current 99x, underscoring a high bar for earnings delivery and a marked contraction in valuation multiples.

Consensus forecasts see BASF’s expected profit margin recovery as a catalyst for re-rating. However, the weight of today’s high valuation suggests that big expectations are already priced in.

📊 Read the full BASF Consensus Narrative.

One-Off Charges Cloud Earnings Quality

- BASF reported a €1.0 billion one-off loss in the last twelve months, indicating that its positive net profit margin this year included significant non-recurring expenses.

- Consensus narrative emphasizes that while cost-savings programs (targeting €2.1 billion in savings by 2026) and new energy partnerships are expected to boost operating leverage and resilience,

- Critics point out that persistent low margins and overcapacity, particularly at the new Zhanjiang site in China, could continue to constrain profitability and limit earnings improvement.

- It is notable that the combination of impressive cost initiatives comes with visible risks from Europe’s structural challenges, which could erode expected margin gains if market and regulatory headwinds intensify.

Valuation Premium Signals High Expectations

- BASF’s Price-to-Earnings ratio stands at 99x, significantly higher than the European Chemicals industry average of 17.2x and the peer group average of 20.2x. This points to a notable valuation premium despite a subdued revenue outlook.

- Consensus narrative observes that the current share price suggests investors are placing substantial bets on forecast profit growth materializing.

- What is noteworthy is that even with revenue projected to grow at a modest 2.4% per year (lagging the broader German market’s 6.1%), the market is pricing in a sharp turnaround with little room for underperformance.

- Bears argue that unless BASF delivers consistently expanding margins and executes flawlessly on its divestments and cost controls, today’s elevated multiples could quickly decline if there is any earnings miss or operational setback.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BASF on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Share your perspective and shape your own view in a few minutes, then Do it your way

A great starting point for your BASF research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

BASF faces uncertainty with high valuation multiples and modest profit growth forecasts, which leaves investors exposed if the expected turnaround in earnings does not materialize.

If you want stocks where today's price leaves room for upside, check out these 848 undervalued stocks based on cash flows to discover companies offering better value compared to their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BASF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAS

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion