Assessing BASF (XTRA:BAS) Valuation After a Steady Recent Share Price Climb

Reviewed by Simply Wall St

BASF (XTRA:BAS) has been quietly grinding higher this month, and that steady climb is catching investor attention. The stock’s recent gains sit against a mixed multi year track record and improving earnings momentum.

See our latest analysis for BASF.

At around $44.02, BASF’s recent 1 month share price return of just over 5% hints that sentiment is stabilising. A 1 year total shareholder return of roughly 9% points to gradually rebuilding momentum rather than a sharp rerating.

If BASF’s slow but improving trajectory has you rethinking where growth and resilience might come from next, this could be a good moment to explore fast growing stocks with high insider ownership.

Given BASF’s modest gains, still soft five year record, and a valuation that trades below some analyst and intrinsic estimates, is this a patient entry point for long term investors, or is the market already baking in the recovery?

Most Popular Narrative: 8.3% Undervalued

With BASF closing at €44.02 against a narrative fair value of about €48.0, the story hinges on selective growth bets and portfolio discipline.

Significant cost savings programs targeting €2.1 billion annual savings by end of 2026, alongside the completion of the major China Verbund investment with project costs under budget and CapEx falling below depreciation from 2026, will meaningfully improve operating leverage and free cash flow, with cost competitiveness directly supporting improved net margins.

Curious how modest top line growth, thinner margins, and a richer future earnings multiple still add up to upside from here? Unpack the full narrative to see which earnings, margin, and valuation assumptions underpin that gap between today’s price and its projected worth.

Result: Fair Value of €48.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering overcapacity in base chemicals and structural weakness in Europe could limit margin recovery and delay the upside that investors are counting on.

Find out about the key risks to this BASF narrative.

Another Angle on Valuation

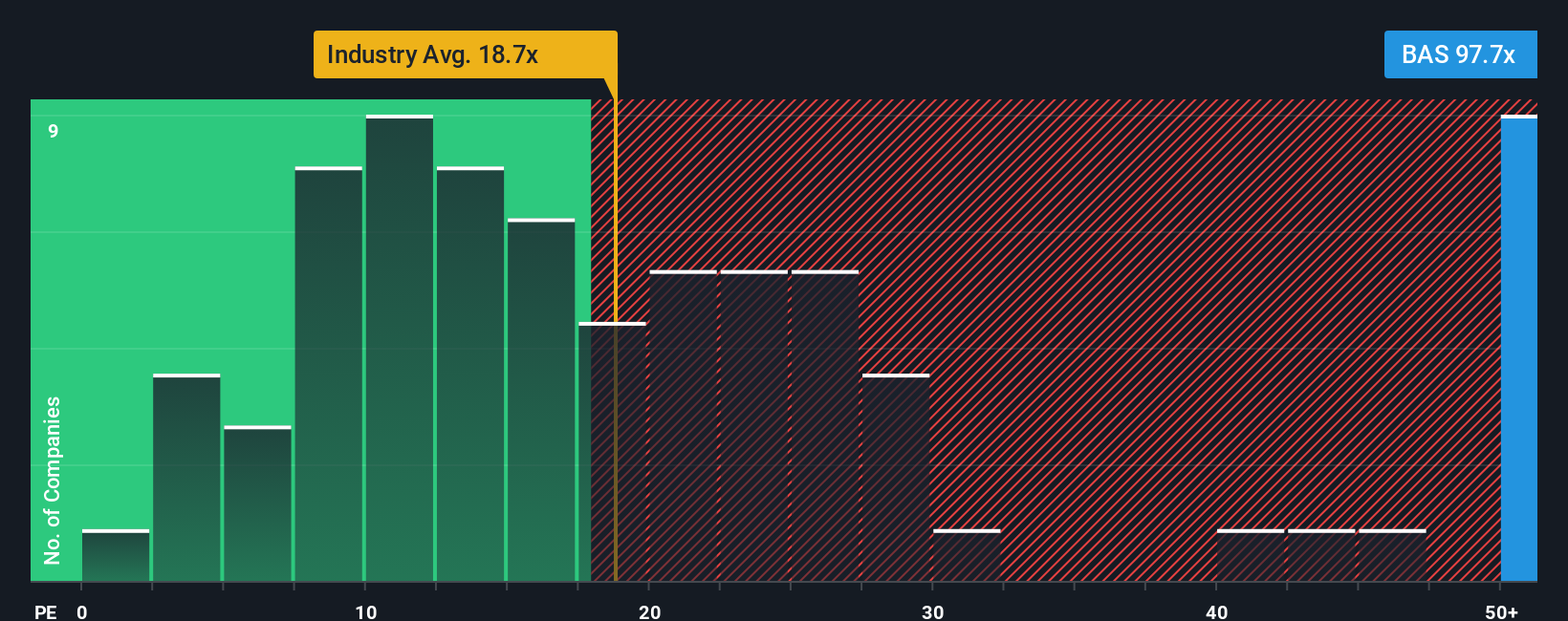

While the narrative fair value of about €48.0 suggests BASF is modestly undervalued, our ratio lens tells a different story. At a 126.5x price to earnings versus a 30.5x peer average and a 34.7x fair ratio, the shares look stretched, leaving little room if the recovery disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BASF Narrative

If you see the data differently or want to explore the drivers yourself, you can build a bespoke BASF story in minutes using Do it your way.

A great starting point for your BASF research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may want to run a quick screen on fresh opportunities that could complement or potentially outperform your BASF thesis.

- Target mispriced opportunities using these 913 undervalued stocks based on cash flows to find companies with strong cash flow potential that the market may be overlooking.

- Explore structural trends in digital infrastructure and payments with these 80 cryptocurrency and blockchain stocks to identify listed plays on blockchain and cryptocurrency adoption.

- Support a passive income strategy with these 13 dividend stocks with yields > 3% that focuses on companies offering dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BASF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAS

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion