Covestro (XTRA:1COV): A Fresh Look at Valuation as Investor Interest Rises

Reviewed by Simply Wall St

Event Piques Investor Curiosity in Covestro (XTRA:1COV) Stock

Something has caught the attention of investors surrounding Covestro (XTRA:1COV), even though there is no headline-grabbing news driving recent market activity. When a stock shifts direction without a clear catalyst, it often sparks lively questions: are traders trying to get ahead of something, or is the price movement just noise? For Covestro, this moment serves as a reminder to look deeper at what may be going on beneath the surface.

Looking back, Covestro’s share price has drifted slightly lower over the past year, with muted momentum despite a few ups and downs along the way. Short-term returns have been soft, and while the company saw a net loss this year, its three-year performance remains solidly positive. Recent movements signal neither a clear new uptrend nor a complete loss of confidence, setting the stage for a neutral but potentially pivotal discussion about valuation.

So, is Covestro trading at a bargain the market is overlooking, or are investors already pricing in any growth on the horizon?

Most Popular Narrative: 9.8% Undervalued

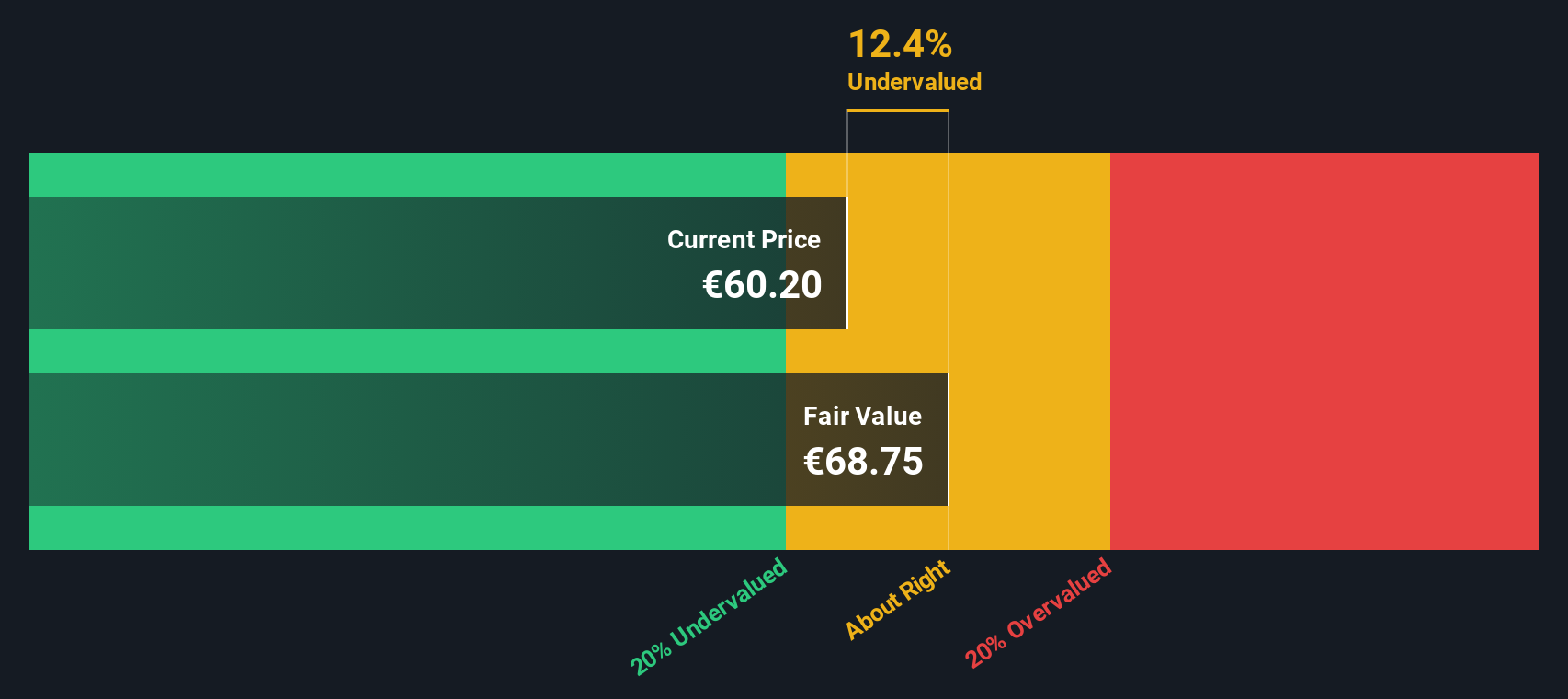

According to the most widely followed narrative, Covestro is currently trading below what analysts believe to be its fair value. This suggests a moderate undervaluation in the share price.

Covestro's recent bolt-on acquisition of Pontacol expands its specialty films portfolio and strengthens its position in high-growth applications such as security glazing, flexible printed electronics, and wind blade protection. This move directly benefits from increased demand for eco-friendly, advanced materials and supports future revenue and margin upside as these markets scale.

Curious about what is fueling this value gap? The calculation behind the fair value rests on bold forecasts for Covestro’s sales and profits, underpinned by a future earnings multiple that may surprise most investors. Are these ambitious financial projections within reach, or is it just a market overreaction? Review the full breakdown that supports this valuation and consider where you stand on the outlook.

Result: Fair Value of €61.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin pressure from global overcapacity or spikes in raw material costs could quickly challenge even the most optimistic growth outlook.

Find out about the key risks to this Covestro narrative.Another View: SWS DCF Model Offers a Different Perspective

While analyst targets suggest Covestro may be slightly undervalued, our SWS DCF model takes a deeper look at the company’s long-term cash flows and presents a noticeably different perspective. Which approach will prove more accurate as circumstances evolve?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Covestro Narrative

If you have a different perspective or want to dig into the numbers independently, you can shape your own in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Covestro.

Looking for More Sharpened Investment Ideas?

Smart investors rarely stick to a single angle. Expand your horizons and take the lead on tomorrow’s opportunities with tailored stock themes that could accelerate your portfolio’s potential.

- Tap into high-growth potential by scanning for penny stocks with robust financials using our penny stocks with strong financials. Spot companies that could become tomorrow’s leaders.

- Capture the momentum in artificial intelligence by spotting unique opportunities among innovative tech companies through our powerful AI penny stocks.

- Unlock promising value picks by accessing stocks currently trading at compelling valuations via our undervalued stocks based on cash flows. Never let a bargain pass you by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About XTRA:1COV

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives