As European markets navigate the complexities of interest rate policies and trade uncertainties, the pan-European STOXX Europe 600 Index has remained relatively stable, reflecting a cautious investor sentiment. In such an environment, dividend stocks can offer a measure of stability and income potential, making them attractive to investors seeking reliable returns amidst market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.40% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.29% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.19% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.66% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.60% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.92% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.77% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.41% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.70% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.42% | ★★★★★☆ |

Click here to see the full list of 231 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

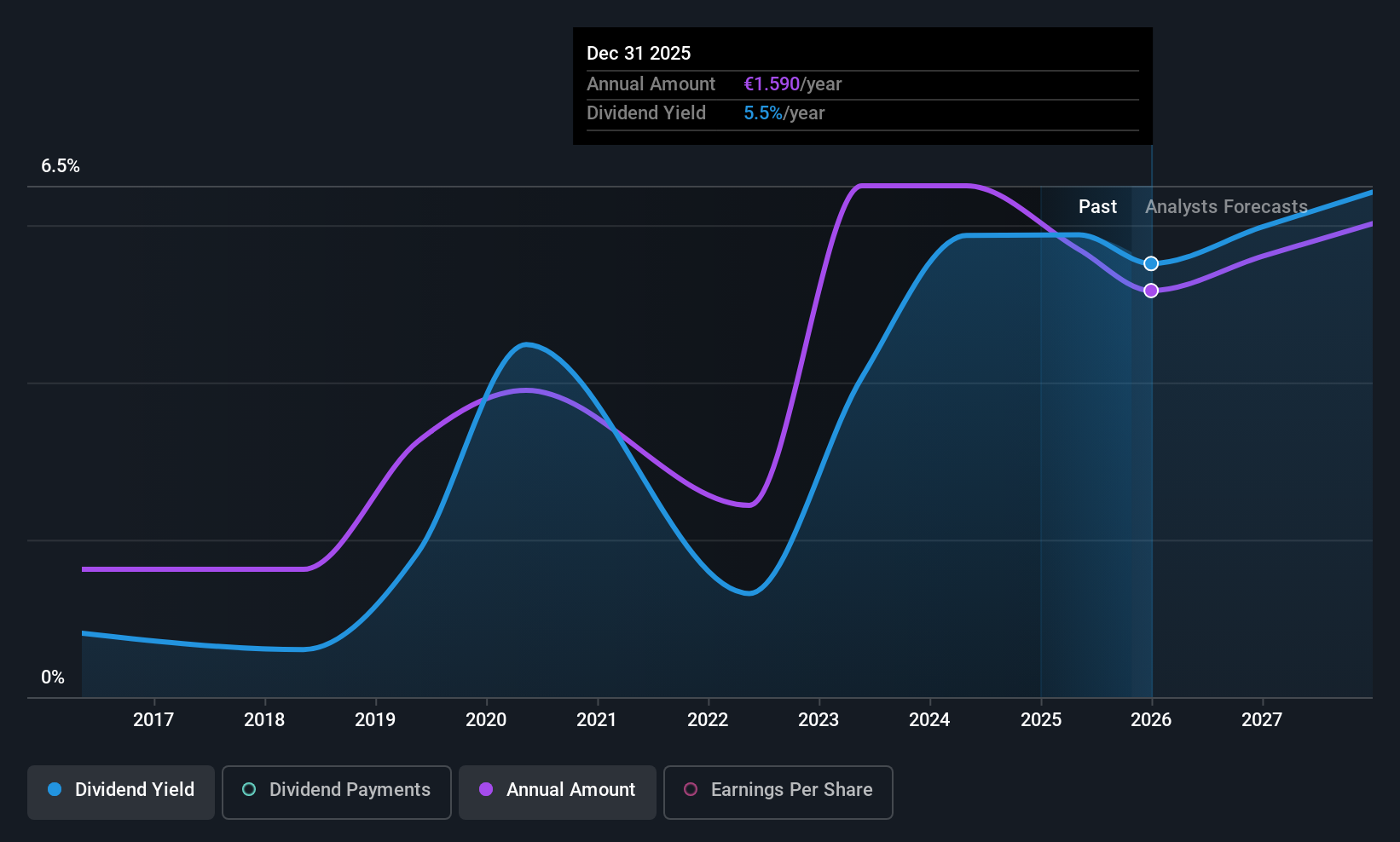

Erste Group Bank (WBAG:EBS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Erste Group Bank AG offers a variety of banking and financial services to retail, corporate, and public sector clients, with a market cap of approximately €33.09 billion.

Operations: Erste Group Bank AG generates revenue from several segments, including Retail (€4.93 billion), Corporates (€2.34 billion), Group Markets (€812 million), and Savings Banks (€2.36 billion).

Dividend Yield: 3.5%

Erste Group Bank offers a stable dividend profile, with dividends reliably paid over the past decade and a current payout ratio of 40.6%, indicating strong coverage by earnings. Despite a lower dividend yield of 3.52% compared to top Austrian payers, its dividends are forecasted to remain well-covered in three years at 43.1%. Recent earnings show modest growth, supporting its sustainable dividend strategy amidst high bad loan levels and low allowance for such loans.

- Get an in-depth perspective on Erste Group Bank's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Erste Group Bank's share price might be too pessimistic.

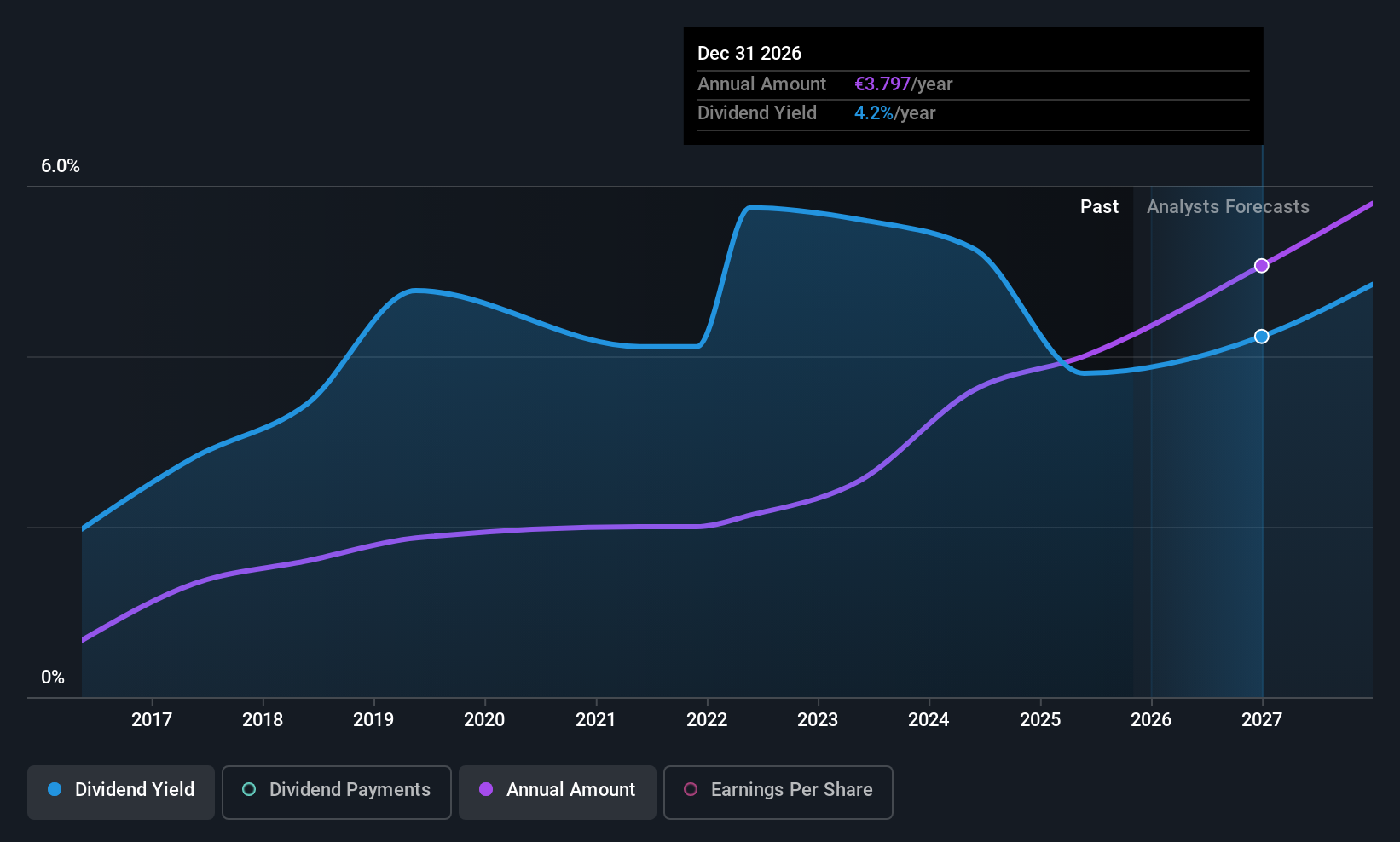

SBO (WBAG:SBO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SBO AG is a global manufacturer and seller of steel products, with a market capitalization of €426.29 million.

Operations: SBO AG generates its revenue from two main segments: Energy Equipment, contributing €318.24 million, and Precision Technology, accounting for €320.90 million.

Dividend Yield: 6.5%

SBO's dividend yield is among the top 25% in Austria, though its payments have been volatile over the past decade. Despite this instability, dividends are well-covered by a payout ratio of 70.9% and a cash payout ratio of 49.4%. Earnings growth forecast at 20.3% annually suggests potential improvement in stability. Recent earnings reported declines with sales at €253.62 million and net income at €18.53 million for the first half of 2025, reflecting challenges that may impact future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of SBO.

- Our valuation report here indicates SBO may be undervalued.

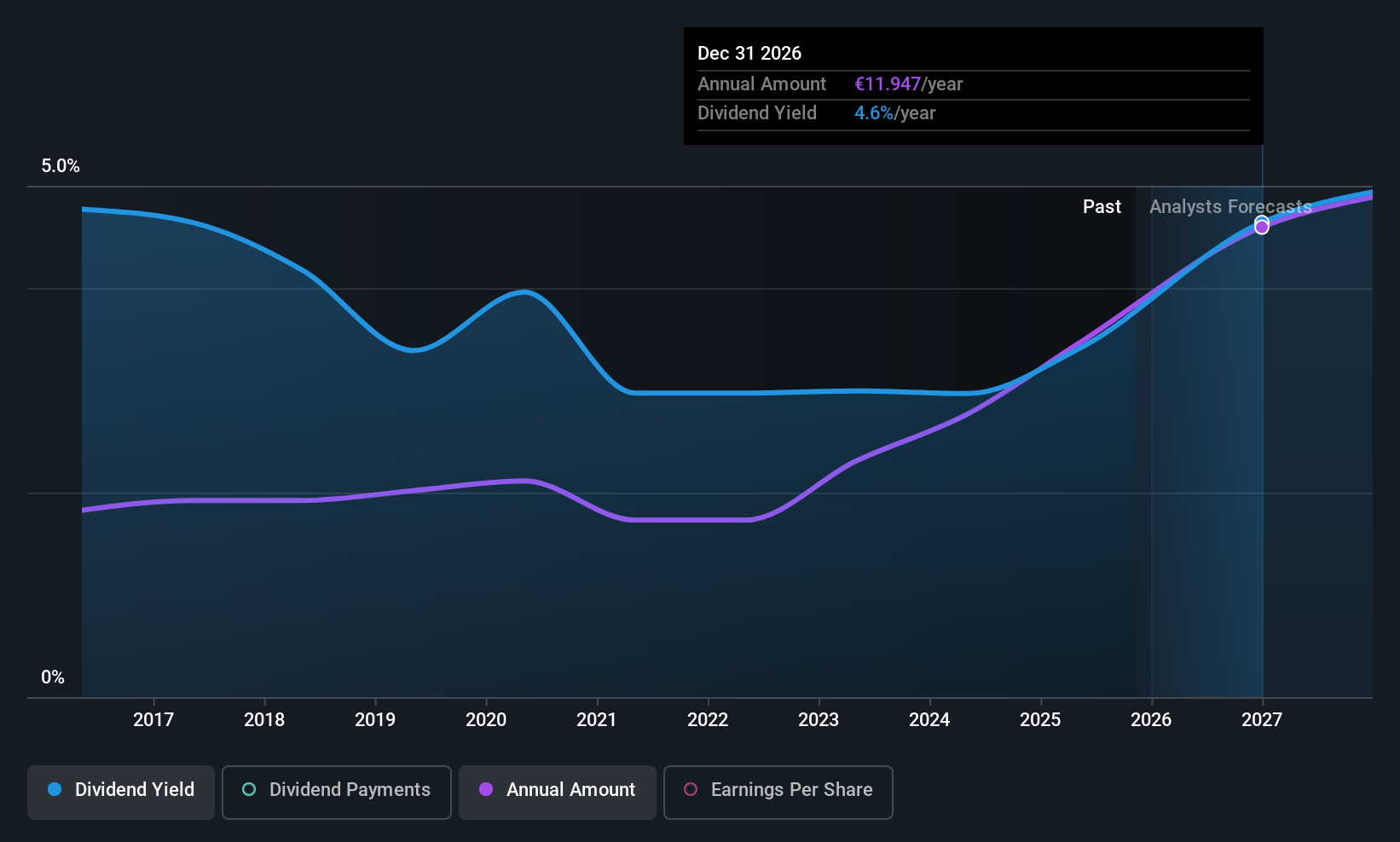

Hannover Rück (XTRA:HNR1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hannover Rück SE, with a market cap of €30.68 billion, offers reinsurance products and services across various regions including Germany, the UK, France, Europe, the US, Asia, Australia, Africa and internationally.

Operations: Hannover Rück SE generates revenue through its Life and Health Reinsurance segment, which accounts for €7.92 billion, and its Property & Casualty Reinsurance segment, contributing €19.80 billion.

Dividend Yield: 3.5%

Hannover Rück offers a stable dividend with consistent growth over the past decade, supported by a low payout ratio of 34% and cash payout ratio of 20.6%, ensuring sustainability from both earnings and cash flows. Despite its reliable track record, the dividend yield of 3.54% is below the top tier in Germany. Recent earnings show strong performance with net income reaching €833.5 million in Q2 2025, indicating robust financial health to support future dividends.

- Click here to discover the nuances of Hannover Rück with our detailed analytical dividend report.

- The analysis detailed in our Hannover Rück valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Click through to start exploring the rest of the 228 Top European Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erste Group Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:EBS

Erste Group Bank

Provides a range of banking and other financial services to retail, corporate, and public sector customers.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success