Allianz (XTRA:ALV) Valuation Spotlight Following Strategic India Leadership Appointment

Reviewed by Kshitija Bhandaru

Allianz (XTRA:ALV) has named Ritu Arora as its new India country head, signaling a strategic push to deepen its footprint in India’s fast-growing insurance and investment landscape. This appointment draws on Arora’s substantial experience in both regional and global roles.

See our latest analysis for Allianz.

Allianz’s announcement comes following a strong 17.2% year-to-date share price return and a remarkable 19.2% total shareholder return over the last year, reflecting confidence in its strategic direction even as the stock experienced some short-term volatility. Momentum remains solid for long-term holders, especially after a 132% total return in three years.

If Allianz’s latest leadership move has you curious about broader opportunities, now is the perfect moment to check out fast growing stocks with high insider ownership.

With shares trading close to analyst price targets and the company’s strong gains, investors must now ask: is Allianz undervalued after its recent rally, or is the market already anticipating future growth?

Most Popular Narrative: 4.2% Undervalued

The most popular narrative suggests that Allianz's fair value is slightly higher than its last close price, hinting at modest upside. The market appears to factor in a wide range of future scenarios, with room for debate on how much optimism is warranted.

Strategic expansion into high-potential emerging markets (notably India and Africa) via joint ventures and partnerships is expected to unlock significant new sources of revenue growth. As rising middle classes drive demand for insurance and asset management products, ongoing digital transformation and AI-driven operational efficiencies are set to drive sustained improvements in expense ratios and underwriting profitability. These factors are anticipated to support higher net margins and overall earnings growth.

Want to know which bold financial projections and game-changing cost strategies are powering this price target? The backbone involves massive global expansion and digital reinvention. Analysts are betting on a strategic revenue surge and margin transformation. Curious what scenario justifies the premium? The narrative’s full breakdown might surprise you.

Result: Fair Value of $363.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency volatility, or challenges with digital threats and integration, could quickly shift Allianz’s growth story in another direction.

Find out about the key risks to this Allianz narrative.

Another View: Looking at the Numbers From a Different Angle

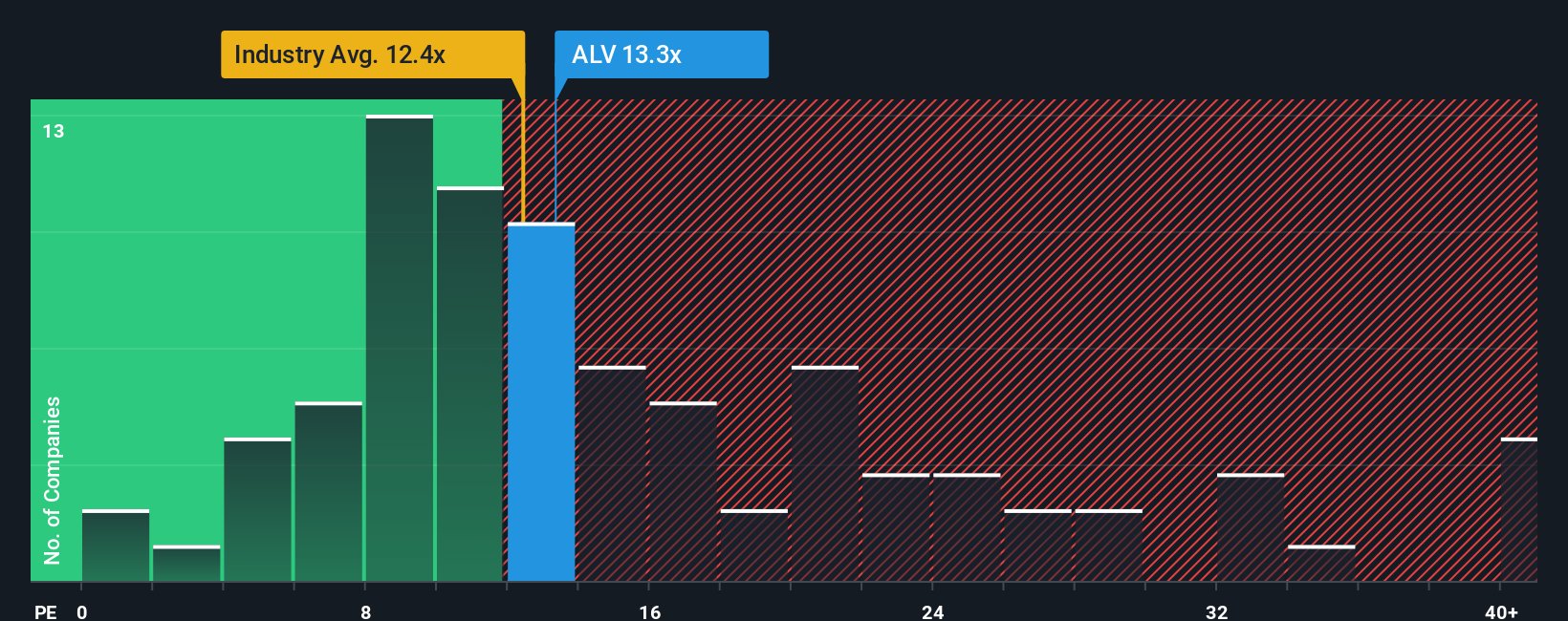

While analyst consensus suggests Allianz is fairly valued, our look at its price-to-earnings ratio tells a different story. Allianz trades at 13.1 times earnings, which makes it pricier than both the European insurance sector average of 12.3x and similar peers. Interestingly, this is still below the fair ratio of 13.4x; a level markets could easily shift towards, raising the stakes for those betting on value today. Does this subtle gap signal a higher valuation risk, or a chance for further upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Allianz Narrative

If the current view does not match your perspective or you have insights of your own, shaping a personal narrative from the data is quick and straightforward. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Allianz.

Looking for More Investment Ideas?

Confidently step up your investing game with fresh opportunities you do not want to miss. The right screeners can lead you to tomorrow’s winners.

- Capture real potential by reviewing these 878 undervalued stocks based on cash flows that are flying under the radar and could offer compelling value for your portfolio.

- Capitalize on big trends shaping digital health with these 33 healthcare AI stocks to spot companies harnessing artificial intelligence to revolutionize medicine.

- Unlock reliable income streams with these 18 dividend stocks with yields > 3% delivering steady yields above 3 percent, an option for building long-term financial security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ALV

Allianz

Provides property-casualty insurance, life/health insurance, and asset management products and services Internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives