- Germany

- /

- Household Products

- /

- XTRA:HEN3

How Henkel KGaA's $30 Million US Facility Expansion (XTRA:HEN3) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Henkel marked a major milestone with the recent $30 million expansion of its Brandon, South Dakota manufacturing facility, doubling its size to 70,000 square feet to enhance capacity for thermal management and adhesive solutions for the EV and electronics sectors.

- The upgraded site stands out as Henkel's first North American Adhesive Technologies facility to achieve LEED certification, highlighting the company’s strengthened commitment to sustainable manufacturing and digital process enhancements.

- We'll examine how Henkel’s investment in sustainable North American production could influence its long-term growth outlook and industry positioning.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Henkel KGaA Investment Narrative Recap

To be a shareholder in Henkel KGaA, you need to believe in the company's ability to harness sustainable innovation and digital efficiency, leveraging expanded North American production to strengthen long-term market relevance, especially in adhesives and EV-oriented thermal management. While the Brandon facility expansion underscores Henkel's commitment to these priorities, it does not have a material impact on the most critical short term catalyst, accelerating premiumization to drive top-line growth, or on the largest risk, which remains competitive pricing pressure in key consumer markets.

Of the recent announcements, Henkel’s corporate guidance revision on August 7, 2025, is particularly relevant in this context. The company lowered its 2025 organic sales growth expectations, pointing to cautious market sentiment in developed regions, even as investments in manufacturing sustainability and capacity continue to build the foundation for future differentiation.

Yet, in contrast, investors should be aware that persistent market share battles in mature consumer markets could ...

Read the full narrative on Henkel KGaA (it's free!)

Henkel KGaA's outlook anticipates €22.2 billion in revenue and €2.3 billion in earnings by 2028. This scenario assumes 1.5% yearly revenue growth and a €0.2 billion increase in earnings from the current €2.1 billion.

Uncover how Henkel KGaA's forecasts yield a €80.36 fair value, a 15% upside to its current price.

Exploring Other Perspectives

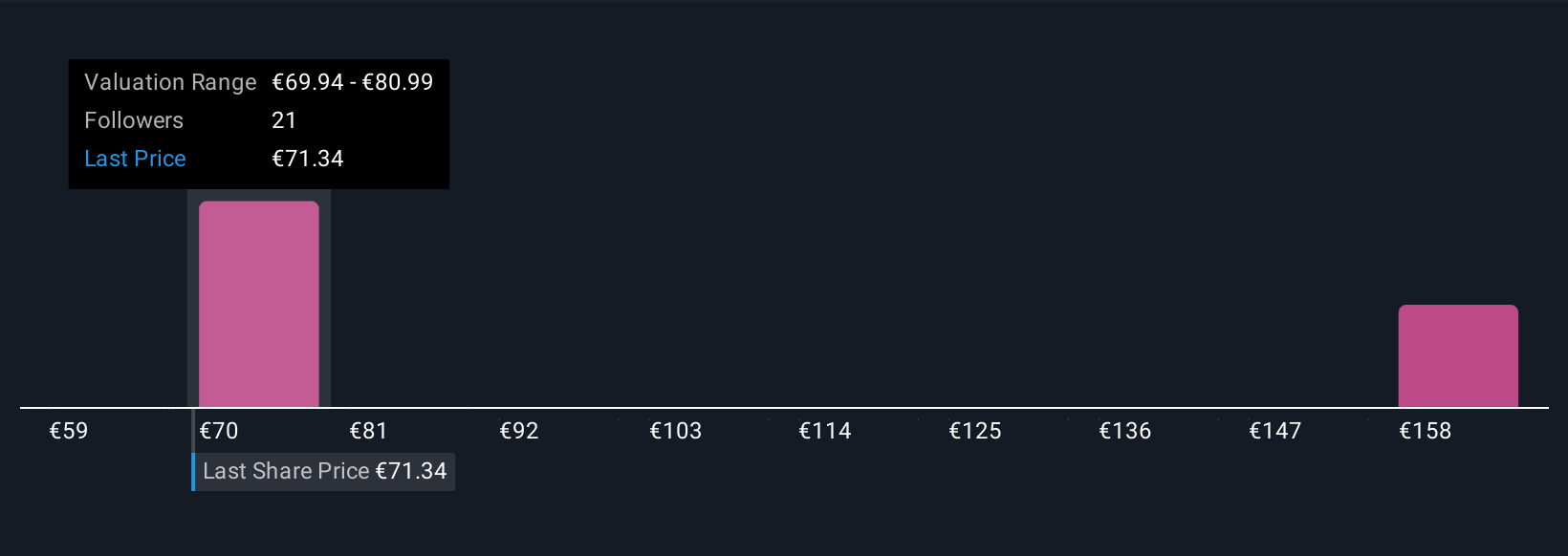

Four fair value estimates from the Simply Wall St Community range from €58.90 to €168.53, highlighting sharply divergent opinions. With continued pressure from private labels and digitally native brands, you may want to review these perspectives to weigh Henkel’s positioning against potential earnings or margin volatility.

Explore 4 other fair value estimates on Henkel KGaA - why the stock might be worth over 2x more than the current price!

Build Your Own Henkel KGaA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Henkel KGaA research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Henkel KGaA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Henkel KGaA's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henkel KGaA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HEN3

Henkel KGaA

Engages in the adhesive technologies and consumer brands businesses in Europe, India, the Middle East, Africa, North America, Latin America, the Asia Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives