- Germany

- /

- Personal Products

- /

- XTRA:BEI

Should a Major Share Sale Alter Beiersdorf's (XTRA:BEI) Position in the AI Skincare Race?

Reviewed by Simply Wall St

- Earlier this week, an unidentified shareholder sold five million shares in Beiersdorf through an accelerated bookbuilding process at €89 each, representing a 3.4% discount to the previous closing price and equal to 2.3% of the company's capital.

- This transaction comes as Beiersdorf gains industry attention for its involvement in the rapidly growing AI skincare segment, which is projected to expand substantially through 2030.

- We will explore how this significant share divestment and the company’s presence in AI-driven skincare affect Beiersdorf’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Beiersdorf Investment Narrative Recap

To invest in Beiersdorf, one must believe the company can capture premium growth in science-based skincare while navigating tough competition and cost pressures. The recent 5 million share sale, representing 2.3% of capital, does not materially affect key short-term catalysts like product innovation, but ongoing retailer pressure in Europe remains the most immediate risk for both sales volumes and margin stability.

Among recent announcements, the multi-year strategic partnership with Rubedo Life Sciences stands out. This move highlights Beiersdorf’s commitment to developing innovative skincare targeting cellular aging, reinforcing its strategy to build higher-margin offerings and diversify growth drivers amid sector disruption.

Yet, despite Beiersdorf’s progress, investors should not overlook the contrasting risk posed by sustained shelf pressure from European retailers and what this could mean for...

Read the full narrative on Beiersdorf (it's free!)

Beiersdorf's narrative projects €11.0 billion revenue and €1.2 billion earnings by 2028. This requires 3.8% yearly revenue growth and a €318 million earnings increase from €882.0 million.

Uncover how Beiersdorf's forecasts yield a €123.21 fair value, a 37% upside to its current price.

Exploring Other Perspectives

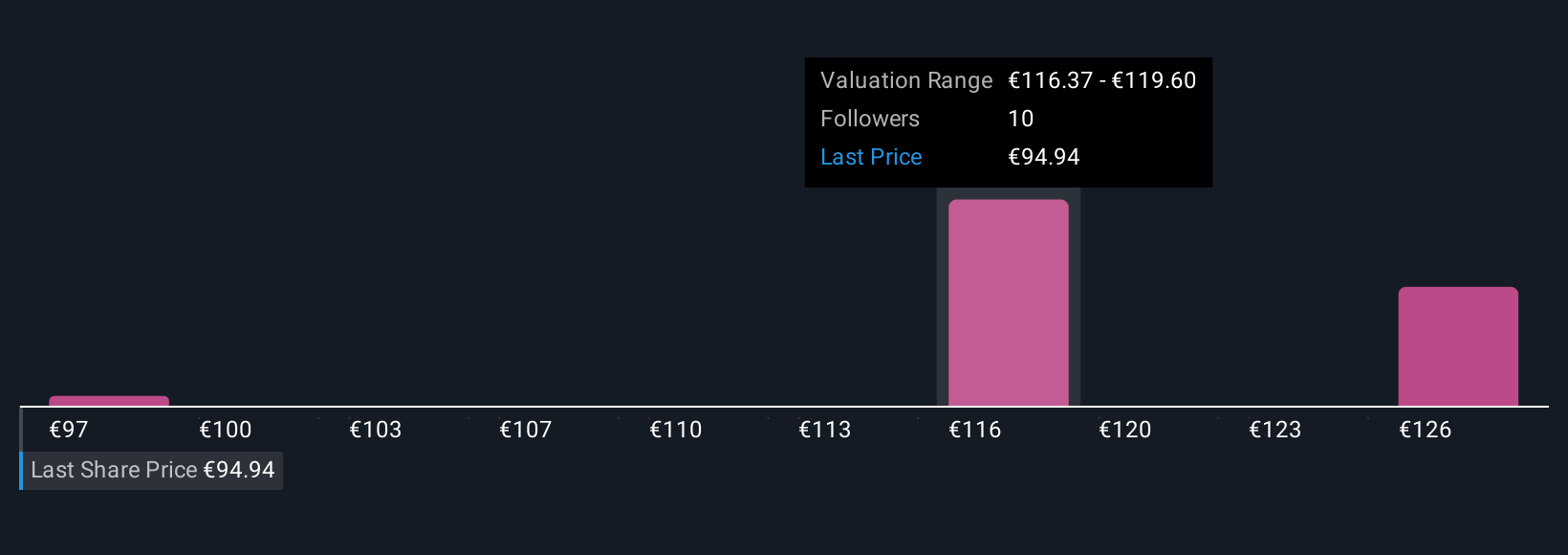

Simply Wall St Community members have provided two valuations for Beiersdorf, ranging from €123.21 to €130.50 per share. While opinions diverge, sustained pressure from European retailers could still weigh on near-term results, so it pays to check multiple viewpoints.

Explore 2 other fair value estimates on Beiersdorf - why the stock might be worth as much as 45% more than the current price!

Build Your Own Beiersdorf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Beiersdorf research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Beiersdorf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Beiersdorf's overall financial health at a glance.

No Opportunity In Beiersdorf?

Our top stock finds are flying under the radar-for now. Get in early:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beiersdorf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BEI

Beiersdorf

Manufactures and distributes consumer goods in Europe, the United States, Africa, Asia, and Australia.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives