- Germany

- /

- Healthcare Services

- /

- XTRA:V3V

Revenues Tell The Story For VITA 34 AG (ETR:V3V) As Its Stock Soars 26%

VITA 34 AG (ETR:V3V) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

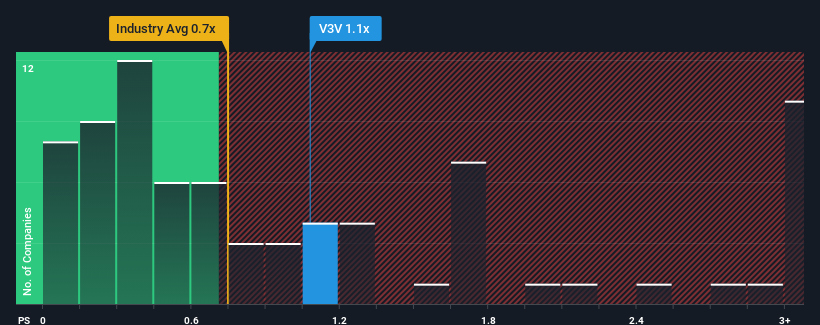

Since its price has surged higher, given close to half the companies operating in Germany's Healthcare industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider VITA 34 as a stock to potentially avoid with its 1.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for VITA 34

What Does VITA 34's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, VITA 34 has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think VITA 34's future stacks up against the industry? In that case, our free report is a great place to start.How Is VITA 34's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like VITA 34's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 280% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth will be highly resilient over the next three years growing by 6.2% per year. Meanwhile, the broader industry is forecast to contract by 4.8% each year, which would indicate the company is doing very well.

With this in consideration, we understand why VITA 34's P/S is a cut above its industry peers. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Final Word

VITA 34 shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of VITA 34's analyst forecasts revealed that its superior revenue outlook against a shaky industry is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Otherwise, it's hard to see the share price falling strongly in the near future under the current growth expectations.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for VITA 34 that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:V3V

FamiCord

Engages in the collection, processing, cryopreservation, and storage of stem cells from umbilical cord blood and tissue and postnatal tissue in Germany, Poland, Portugal, and internationally.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.