- Spain

- /

- Healthcare Services

- /

- BME:CBAV

Uncovering 3 European Small Caps with Promising Potential

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index continues its longest streak of weekly gains since August 2012, driven by encouraging company results and resilience in defense stocks, investors are increasingly interested in uncovering small-cap opportunities that could benefit from these positive market trends. In this context, identifying promising small-cap stocks involves looking for companies with strong fundamentals and potential to thrive amidst mixed economic signals such as varying inflation rates across major European economies.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Clínica Baviera (BME:CBAV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics with a market capitalization of €557.93 million.

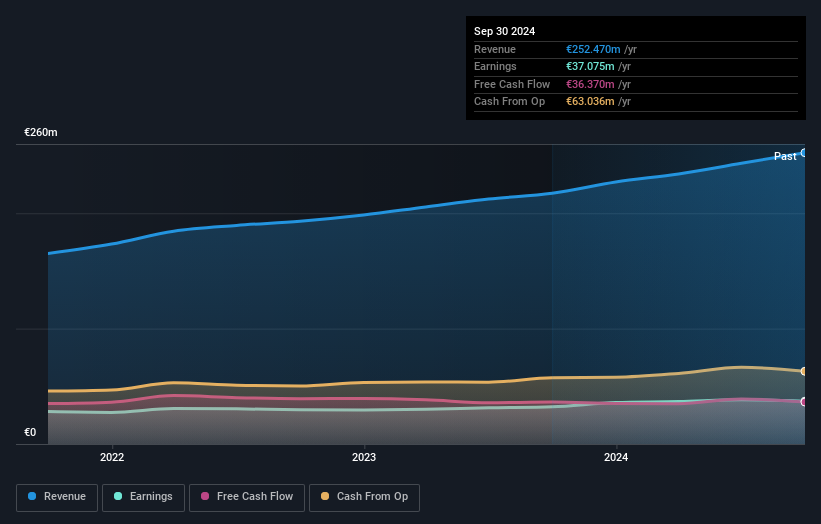

Operations: Clínica Baviera generates revenue primarily from its ophthalmology services, amounting to €252.47 million.

Clínica Baviera, a notable player in the European healthcare sector, has shown robust financial health with earnings growing by 15% over the past year, outpacing industry averages. Trading at 35.5% below its estimated fair value suggests potential undervaluation. Over the last five years, it significantly reduced its debt to equity ratio from 63.2% to just 9.5%, indicating strong financial management. With high-quality earnings and more cash than total debt, Clínica Baviera is well-positioned financially and operationally within its industry context, offering a compelling profile for those seeking value in under-the-radar stocks.

- Delve into the full analysis health report here for a deeper understanding of Clínica Baviera.

Explore historical data to track Clínica Baviera's performance over time in our Past section.

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative (ENXTPA:CRAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative operates as a provider of banking products and services in France, with a market capitalization of approximately €725.20 million.

Operations: Crédit Agricole Alpes Provence generates its revenue primarily from retail banking, amounting to €434.27 million.

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence exhibits a robust financial structure with total assets of €26.2 billion and equity of €3.3 billion, supported by total deposits amounting to €9.0 billion against loans of €18.8 billion. The bank's allowance for bad loans stands at 109%, indicating strong risk management, while non-performing loans are a manageable 1.7%. Despite trading at 49% below its estimated fair value, the bank faces challenges with 61% of liabilities sourced from higher-risk funding avenues, which might impact stability amidst an evolving financial landscape in Europe.

RHÖN-KLINIKUM (XTRA:RHK)

Simply Wall St Value Rating: ★★★★★★

Overview: RHÖN-KLINIKUM Aktiengesellschaft, along with its subsidiaries, provides in-patient, semi-patient, and outpatient healthcare services across Germany with a market capitalization of approximately €984 million.

Operations: RHÖN-KLINIKUM generates revenue primarily from providing healthcare services in Germany. The company's financial performance is reflected in its market capitalization of approximately €984 million.

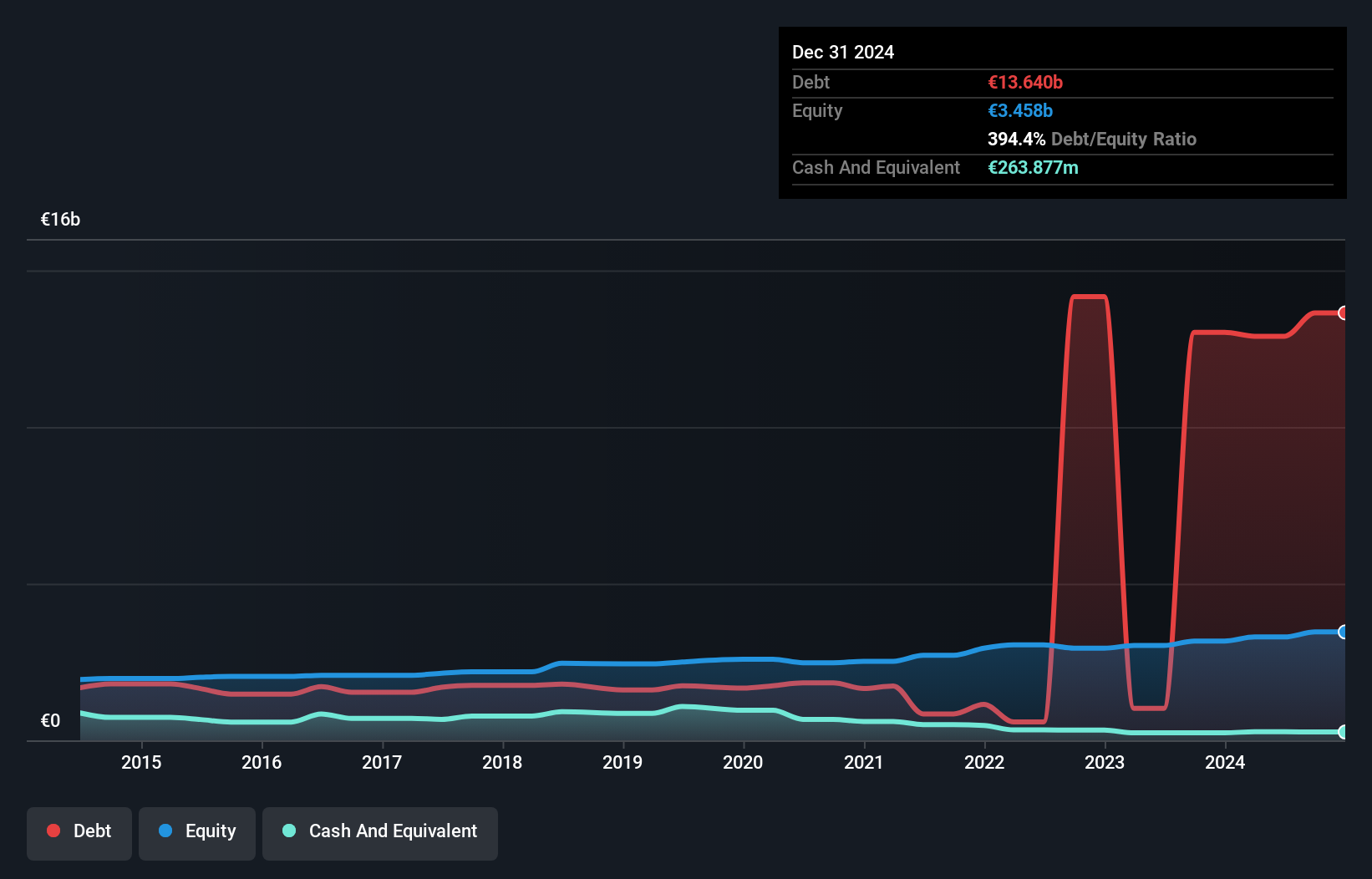

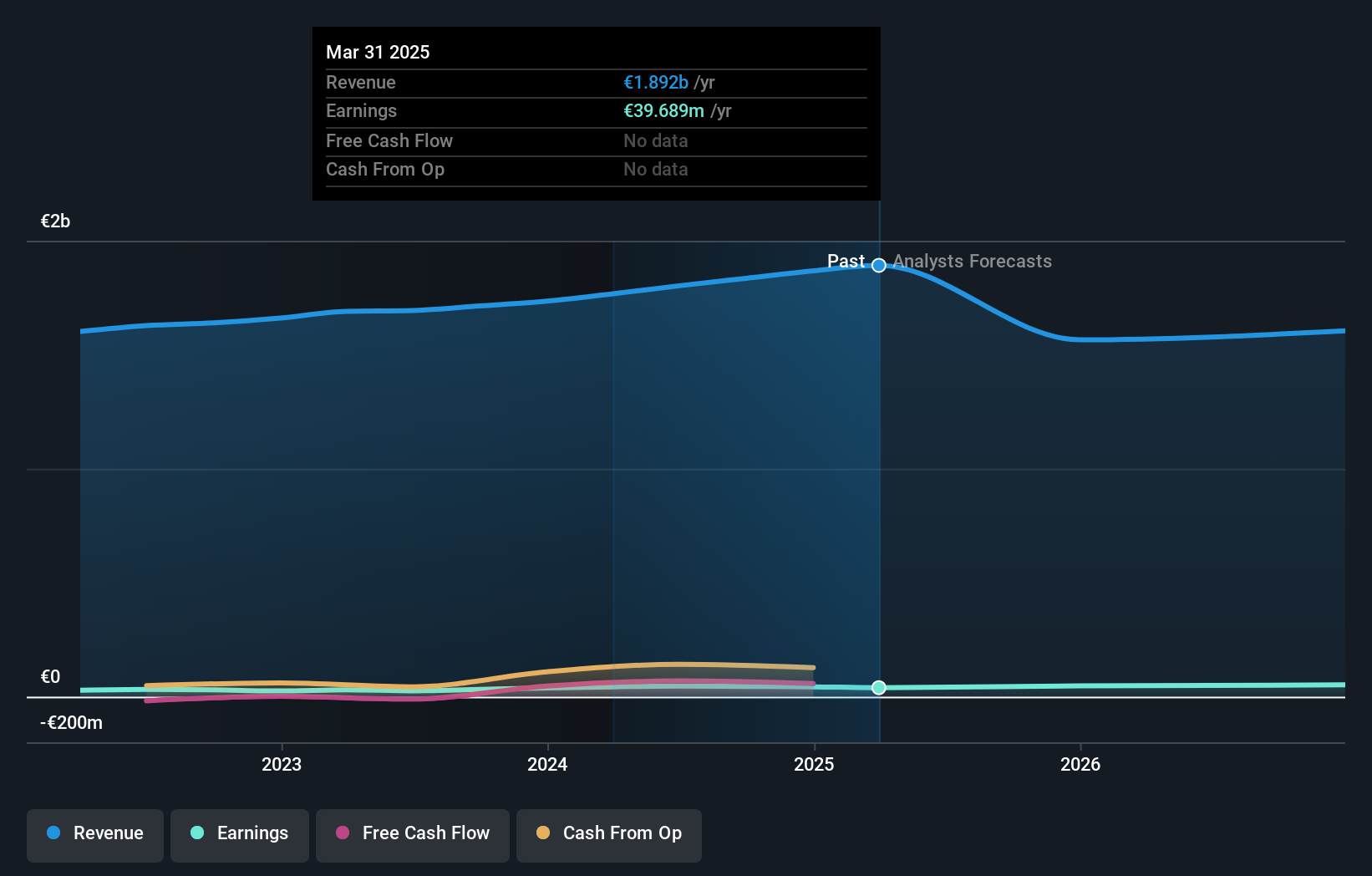

RHÖN-KLINIKUM, a European healthcare provider, has shown promising financial health with its debt-to-equity ratio decreasing from 13.6% to 10.9% over the last five years. The company seems undervalued, trading at 57.8% below estimated fair value, which may attract investors looking for potential upside. Impressively, earnings surged by 40.5% in the past year, outpacing the broader healthcare sector's growth of 31.8%. With more cash on hand than total debt and a strong interest coverage position, RHÖN-KLINIKUM appears well-positioned for sustained profitability and future growth prospects in the industry.

- Navigate through the intricacies of RHÖN-KLINIKUM with our comprehensive health report here.

Assess RHÖN-KLINIKUM's past performance with our detailed historical performance reports.

Taking Advantage

- Investigate our full lineup of 356 European Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CBAV

Clínica Baviera

A medical company, operates a network of ophthalmology clinics in Spain and Europe.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives