- Germany

- /

- Healthcare Services

- /

- XTRA:RHK

Discovering Three Undiscovered Gems in Germany

Reviewed by Simply Wall St

As the European Central Bank's recent interest rate cut has given a boost to the German market, Germany’s DAX index saw a notable rise of 2.17%, reflecting renewed investor optimism. Amidst this positive market sentiment, it is an opportune time to explore some lesser-known small-cap stocks that could offer unique growth opportunities. Identifying strong small-cap stocks often involves looking for companies with solid fundamentals, innovative products or services, and potential for expansion in their respective markets. In this article, we will highlight three such undiscovered gems in Germany that may be worth your attention.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

M1 Kliniken (XTRA:M12)

Simply Wall St Value Rating: ★★★★★★

Overview: M1 Kliniken AG, with a market cap of €333.99 million, operates in the field of aesthetic medicine and plastic surgery services across several countries including Germany, Austria, the Netherlands, Switzerland, the United Kingdom, Croatia, Hungary, Bulgaria, Romania, and Australia.

Operations: M1 Kliniken AG generates revenue primarily from providing aesthetic medicine and plastic surgery services across multiple countries. The company has a market cap of €333.99 million.

M1 Kliniken, a small cap healthcare player in Germany, has shown impressive earnings growth of 163.7% over the past year, outpacing the industry average of 30.9%. The company reported half-year sales of €167.74 million and net income of €9.9 million, up from €3.42 million last year. Basic earnings per share rose to €0.53 from €0.17 a year ago, reflecting robust performance despite recent share price volatility and no debt burden since five years ago when its debt to equity ratio was 0.2%.

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Value Rating: ★★★★★★

Overview: Mensch und Maschine Software SE offers CAD/CAM/CAE, product data management, and building information modeling/management solutions in Germany and internationally, with a market cap of €956.70 million.

Operations: Mensch und Maschine Software SE generates revenue primarily from its M+M Software segment (€107.71 million) and M+M Digitization segment (€216.19 million). The company's net profit margin is a key financial metric to consider.

Mensch und Maschine (MUM) has shown solid performance with a debt to equity ratio dropping from 42.8% to 15.5% over five years, and earnings growing by 7.6% in the past year, outpacing the software industry’s -4.4%. Trading at nearly 40% below its estimated fair value, MUM's interest payments are well covered by EBIT (247x). Recent results show Q2 sales of €75.1 million and net income of €7.34 million, indicating steady growth and profitability.

RHÖN-KLINIKUM (XTRA:RHK)

Simply Wall St Value Rating: ★★★★★☆

Overview: RHÖN-KLINIKUM Aktiengesellschaft, along with its subsidiaries, provides in-patient, semi-patient, and outpatient healthcare services in Germany and has a market cap of approximately €809.96 million.

Operations: RHÖN-KLINIKUM generates revenue primarily from acute hospitals (€1.45 billion), medical care centres (€23.90 million), and rehabilitation hospitals (€34.70 million).

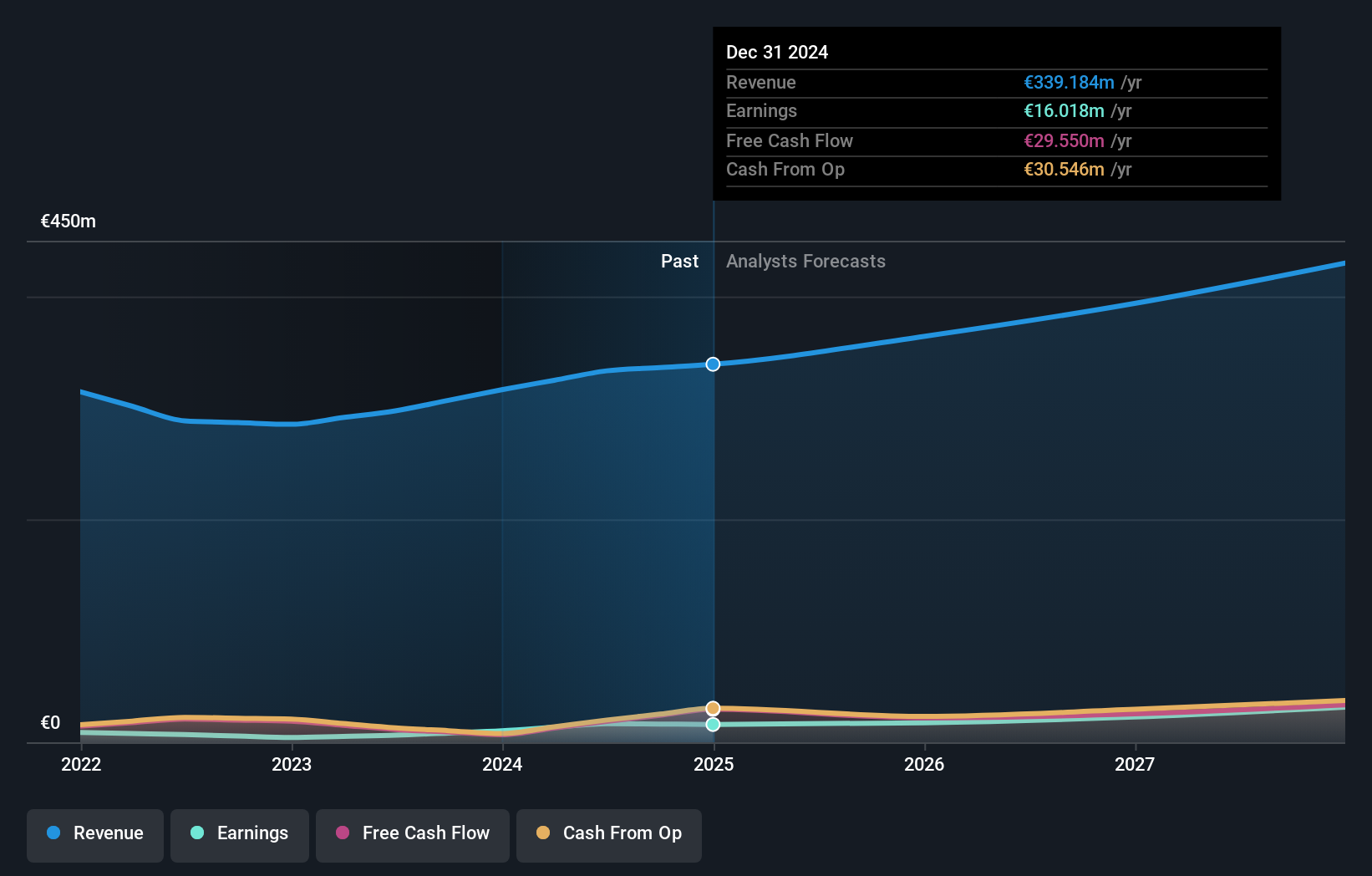

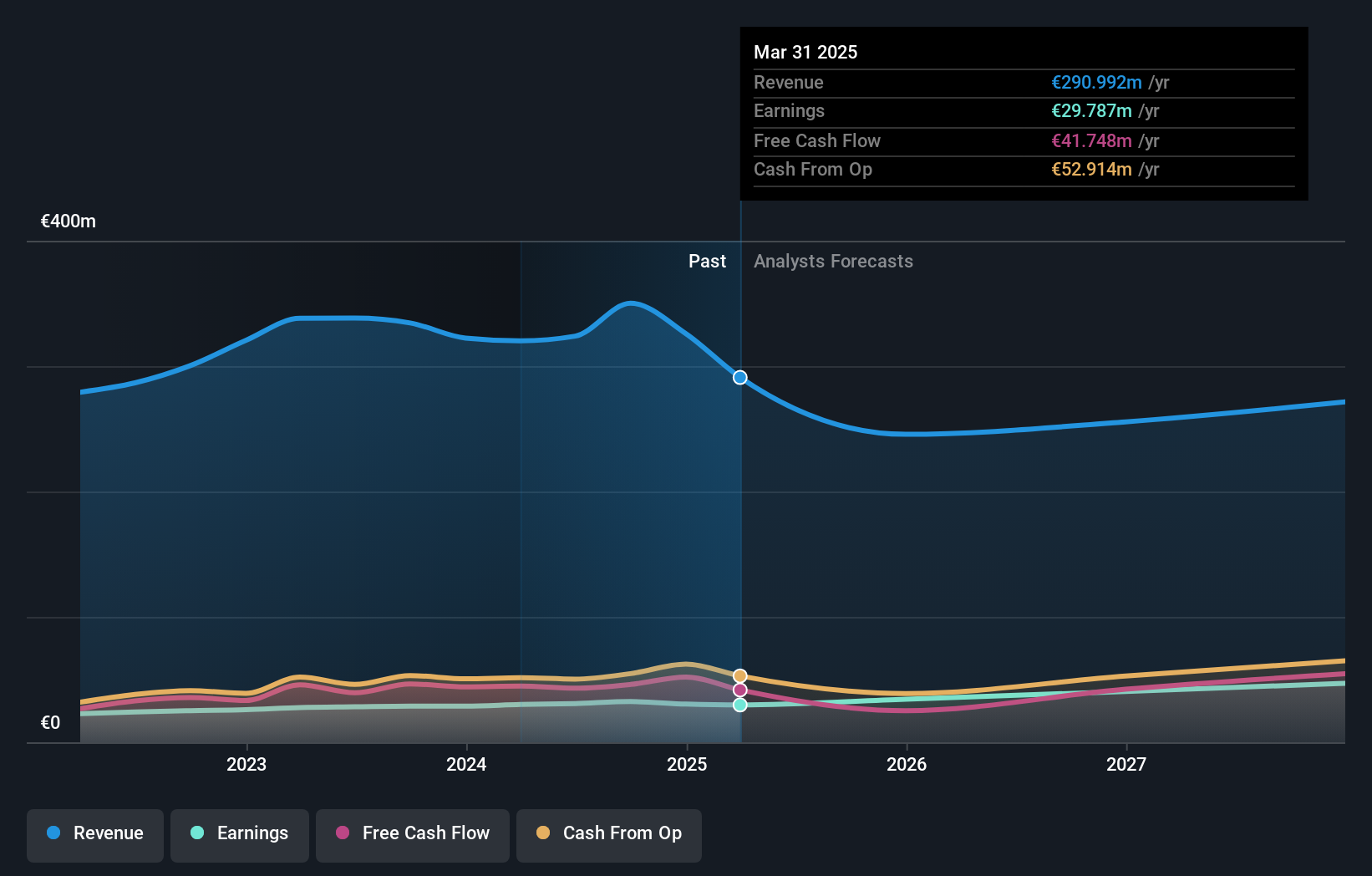

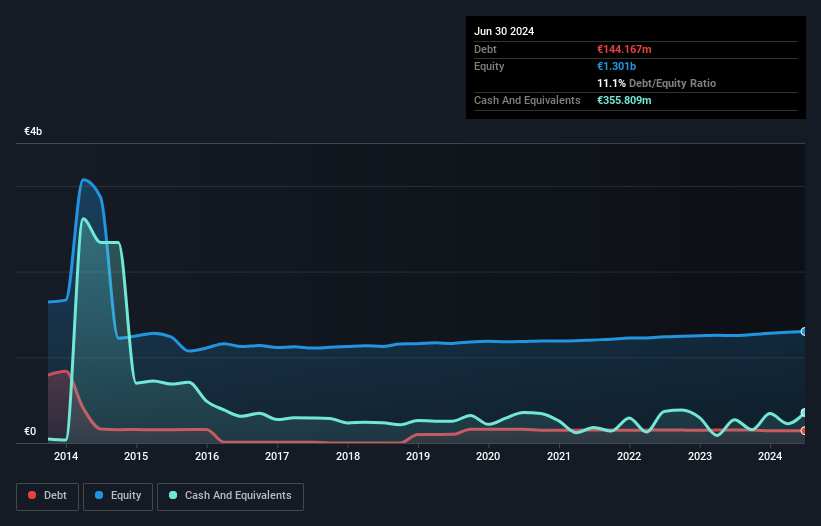

RHÖN-KLINIKUM, a notable player in the healthcare sector, reported second-quarter sales of €392.69 million and net income of €9.01 million. Over the past year, earnings grew by 81.6%, surpassing the industry's 30.9% growth rate. The company's debt-to-equity ratio increased to 11.1% over five years from 8.7%. With a price-to-earnings ratio of 17.4x below the industry average and positive free cash flow, RHÖN-KLINIKUM appears undervalued yet promising within its niche market segment.

- Take a closer look at RHÖN-KLINIKUM's potential here in our health report.

Explore historical data to track RHÖN-KLINIKUM's performance over time in our Past section.

Summing It All Up

- Gain an insight into the universe of 53 German Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RHK

RHÖN-KLINIKUM

Offers in-patient, semi-patient, and outpatient healthcare services in Germany.

Flawless balance sheet with proven track record.