- Germany

- /

- Medical Equipment

- /

- XTRA:NN6

The Market Lifts NanoRepro AG (ETR:NN6) Shares 28% But It Can Do More

NanoRepro AG (ETR:NN6) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

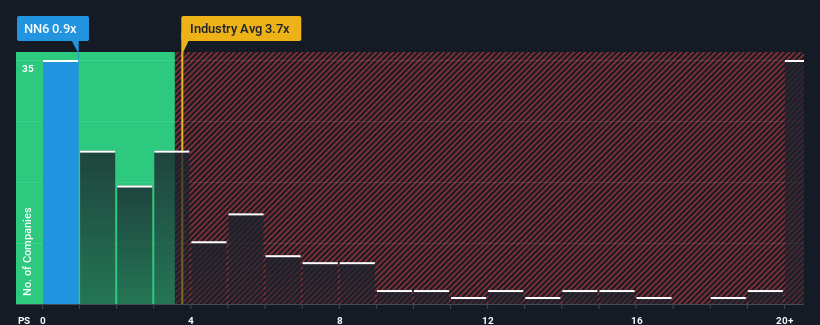

In spite of the firm bounce in price, considering around half the companies operating in Germany's Medical Equipment industry have price-to-sales ratios (or "P/S") above 2.3x, you may still consider NanoRepro as an solid investment opportunity with its 0.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for NanoRepro

What Does NanoRepro's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at NanoRepro over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on NanoRepro will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for NanoRepro, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is NanoRepro's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like NanoRepro's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 76% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 5.4% shows it's noticeably more attractive.

With this information, we find it odd that NanoRepro is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does NanoRepro's P/S Mean For Investors?

The latest share price surge wasn't enough to lift NanoRepro's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see NanoRepro currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

You always need to take note of risks, for example - NanoRepro has 3 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NanoRepro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NN6

NanoRepro

Develops, manufactures, and distributes rapid diagnostic tests and food supplements for home and professional use in Germany and internationally.

Flawless balance sheet slight.