- Germany

- /

- Healthcare Services

- /

- XTRA:MAK

A Piece Of The Puzzle Missing From Maternus-Kliniken Aktiengesellschaft's (ETR:MAK) Share Price

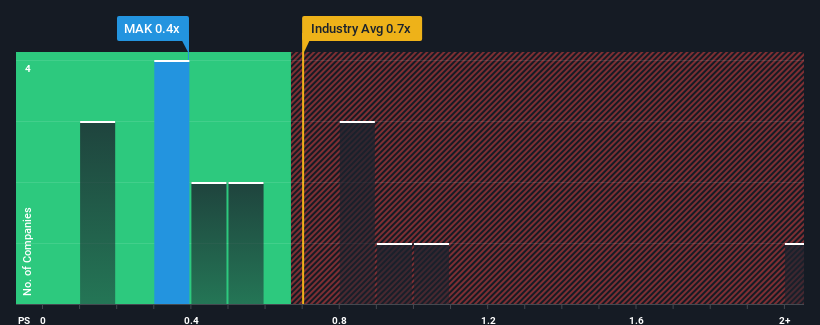

It's not a stretch to say that Maternus-Kliniken Aktiengesellschaft's (ETR:MAK) price-to-sales (or "P/S") ratio of 0.4x seems quite "middle-of-the-road" for Healthcare companies in Germany, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Maternus-Kliniken

How Has Maternus-Kliniken Performed Recently?

As an illustration, revenue has deteriorated at Maternus-Kliniken over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Maternus-Kliniken, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Maternus-Kliniken's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.7%. The last three years don't look nice either as the company has shrunk revenue by 13% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to shrink 21% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

In light of this, the fact Maternus-Kliniken's P/S sits in line with the majority of other companies is unanticipated but certainly not shocking. Even if the company's recent growth rates continue outperforming the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. It's conceivable that the P/S falls to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From Maternus-Kliniken's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Maternus-Kliniken currently trades on a slightly lower than expected P/S if you consider its recent three-year revenues aren't as bad as the forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from matching this more attractive performance. Perhaps investors have reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. While the chance of a downward share price shock is quite unlikely, there does seem to be something concerning shareholders as the relative performance would usually justify a higher price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Maternus-Kliniken (at least 2 which can't be ignored), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MAK

Maternus-Kliniken

Operates retirement and nursing homes, rehabilitation clinics, and various service companies that operate in the field of geriatric care and rehabilitation medicine.

Good value low.