- Germany

- /

- Healthtech

- /

- XTRA:M3V

MeVis Medical Solutions AG's (ETR:M3V) Has Had A Decent Run On The Stock market: Are Fundamentals In The Driver's Seat?

MeVis Medical Solutions' (ETR:M3V) stock up by 3.2% over the past month. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on MeVis Medical Solutions' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for MeVis Medical Solutions

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for MeVis Medical Solutions is:

32% = €5.7m ÷ €18m (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. That means that for every €1 worth of shareholders' equity, the company generated €0.32 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

MeVis Medical Solutions' Earnings Growth And 32% ROE

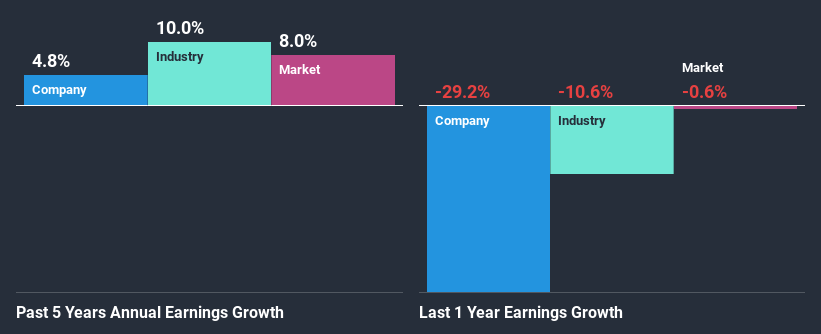

To begin with, MeVis Medical Solutions has a pretty high ROE which is interesting. Second, a comparison with the average ROE reported by the industry of 12% also doesn't go unnoticed by us. However, for some reason, the higher returns aren't reflected in MeVis Medical Solutions' meagre five year net income growth average of 4.8%. This is generally not the case as when a company has a high rate of return it should usually also have a high earnings growth rate. Such a scenario is likely to take place when a company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

Next, on comparing with the industry net income growth, we found that MeVis Medical Solutions' reported growth was lower than the industry growth of 8.1% in the same period, which is not something we like to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about MeVis Medical Solutions''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is MeVis Medical Solutions Using Its Retained Earnings Effectively?

MeVis Medical Solutions doesn't pay any dividend, meaning that potentially all of its profits are being reinvested in the business. However, there's only been very little earnings growth to show for it. So there could be some other explanation in that regard. For instance, the company's business may be deteriorating.

Summary

In total, it does look like MeVis Medical Solutions has some positive aspects to its business. Although, we are disappointed to see a lack of growth in earnings even in spite of a high ROE and and a high reinvestment rate. We believe that there might be some outside factors that could be having a negative impact on the business. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. To know the 2 risks we have identified for MeVis Medical Solutions visit our risks dashboard for free.

If you’re looking to trade MeVis Medical Solutions, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:M3V

MeVis Medical Solutions

Develops, markets, and sells software for recording, analyzing, and evaluating image data to manufacturers of medical devices, providers of medical IT platforms, and clinical end customers in the United States and Europe.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives