- Germany

- /

- Healthcare Services

- /

- XTRA:FRE

Fresenius (XTRA:FRE): Exploring Valuation After Steady Gains and Turnaround Moves

Reviewed by Kshitija Bhandaru

See our latest analysis for Fresenius SE KGaA.

Looking beyond this month's climb, Fresenius SE KGaA’s share price has not just trended upward recently but is also building momentum after a period of steady long-term gains. A solid 1-year total shareholder return of 42.3% indicates investors are warming to its growth story.

If recent healthcare moves have you thinking broader, there’s a world of innovation to explore. See the full list of compelling names with our See the full list for free.

But with shares nearing analyst targets and strong recent returns, the big question is whether Fresenius SE KGaA still trades below its true value or if the market has already priced in all future growth potential.

Most Popular Narrative: 23.3% Undervalued

Fresenius SE KGaA’s narrative-driven fair value eclipses the last close, raising eyebrows at a discount premium not recently seen. The stage appears set for a turnaround story, and a closer look at the underlying assumptions could prove revealing.

"What former CEO Mark Schneider blow up to an inefficient giant, will now be cut down by actual CEO Michael Sen and trimmed on efficiency. From formerly 4 segments FMC (dialyses), Helios (private hospitals), Kabi (Generic & Infusions), Vamed (Projects & Digitalization), only 2 remain: Helios and Kabi. The others will be sold, and the proceeds will help to restructure the financial situation."

Curious what explicit financial bets and structural shakeups drive this aggressive valuation target? The answer lies in transformative management moves and projections that diverge from consensus. See how these bold changes alter the company’s future path and flow straight into valuation math. Unlock the full numbers and logic behind the narrative.

Result: Fair Value of $61.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant risks remain, including slower than expected restructuring progress and potential underperformance in the core Helios and Kabi segments, which could challenge the turnaround story.

Find out about the key risks to this Fresenius SE KGaA narrative.

Another View: Market Ratios Paint a Cautious Picture

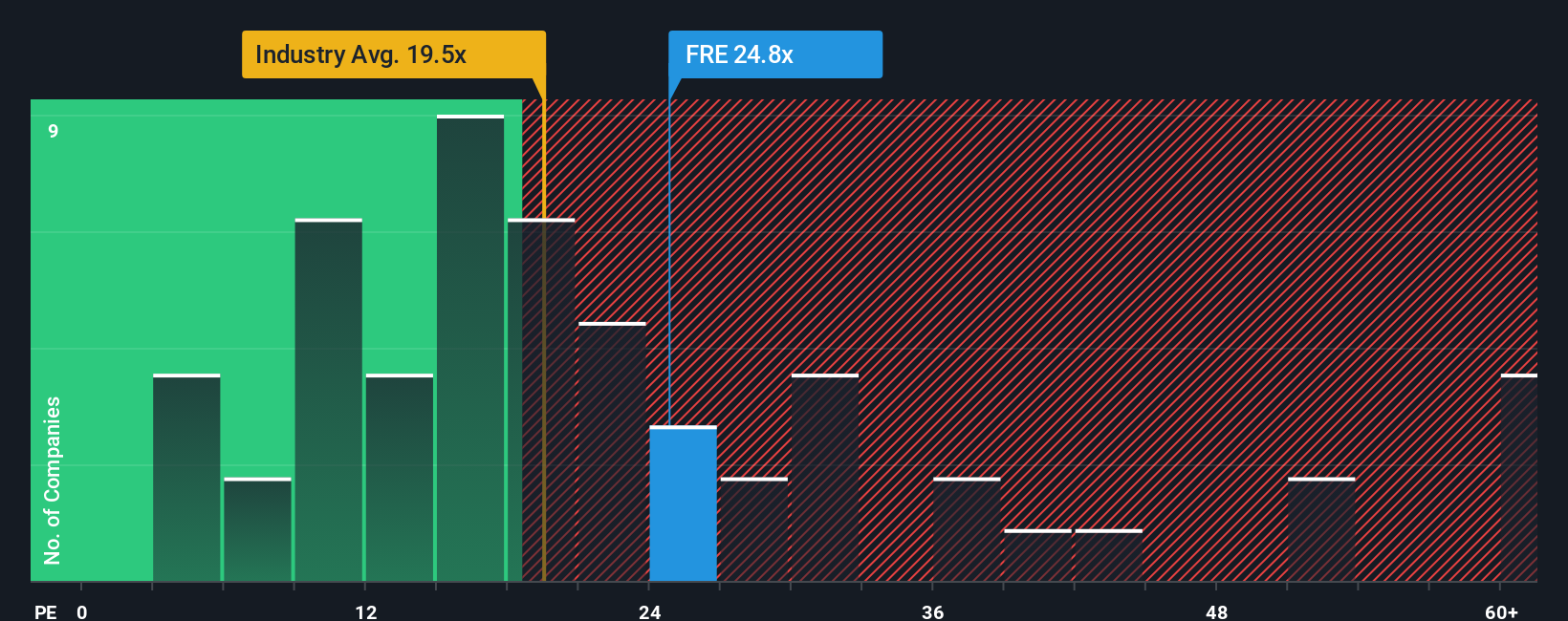

While narrative-based valuation suggests Fresenius SE KGaA is attractively priced, the market’s most widely used measure tells a different story. Its price-to-earnings ratio of 24.6x is higher than the European Healthcare industry average of 19.6x and peers at 24x, yet still below its fair ratio of 30.1x. This gap suggests some opportunity, but also signals the market may be pricing in risk or future uncertainty. Could sentiment shift the valuation, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fresenius SE KGaA Narrative

If you see the numbers differently or would rather chart your own course, you can easily build your own narrative in just a few minutes. Do it your way

A great starting point for your Fresenius SE KGaA research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Unlock your next opportunity with ideas other investors are missing. Use these powerful tools to stay ahead and support strategies that suit your style.

- Jump into high-yield returns with these 19 dividend stocks with yields > 3% that have a proven record of paying investors above 3% and provide attractive steady income streams.

- Capture the AI transformation by screening these 24 AI penny stocks, which are making waves in major markets as they drive innovation across every sector.

- Position yourself for potential upside with these 901 undervalued stocks based on cash flows trading below intrinsic value and waiting for the market to catch up to their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FRE

Fresenius SE KGaA

A health care company, provides products and services for chronically ill patients.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026