- Germany

- /

- Medical Equipment

- /

- XTRA:EUZ

The total return for Eckert & Ziegler Strahlen- und Medizintechnik (ETR:EUZ) investors has risen faster than earnings growth over the last five years

Eckert & Ziegler Strahlen- und Medizintechnik AG (ETR:EUZ) shareholders might be concerned after seeing the share price drop 26% in the last quarter. But over five years returns have been remarkably great. To be precise, the stock price is 326% higher than it was five years ago, a wonderful performance by any measure. So it might be that some shareholders are taking profits after good performance. Only time will tell if there is still too much optimism currently reflected in the share price.

In light of the stock dropping 11% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

View our latest analysis for Eckert & Ziegler Strahlen- und Medizintechnik

SWOT Analysis for Eckert & Ziegler Strahlen- und Medizintechnik

- Earnings growth over the past year exceeded the industry.

- Debt is not viewed as a risk.

- Earnings growth over the past year is below its 5-year average.

- Dividend is low compared to the top 25% of dividend payers in the Medical Equipment market.

- Expensive based on P/E ratio and estimated fair value.

- Annual earnings are forecast to grow faster than the German market.

- Dividends are not covered by cash flow.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

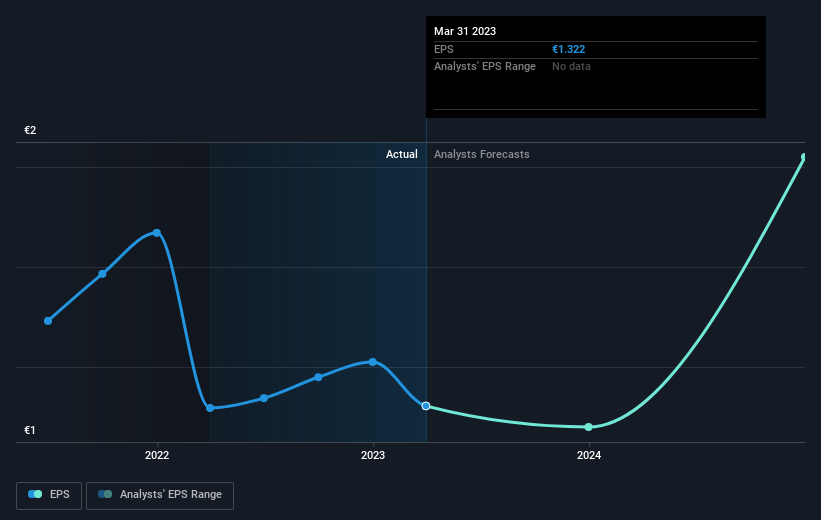

Over half a decade, Eckert & Ziegler Strahlen- und Medizintechnik managed to grow its earnings per share at 21% a year. This EPS growth is lower than the 34% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Eckert & Ziegler Strahlen- und Medizintechnik's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Eckert & Ziegler Strahlen- und Medizintechnik the TSR over the last 5 years was 344%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While it's certainly disappointing to see that Eckert & Ziegler Strahlen- und Medizintechnik shares lost 3.8% throughout the year, that wasn't as bad as the market loss of 4.7%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 35% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Eckert & Ziegler Strahlen- und Medizintechnik has 1 warning sign we think you should be aware of.

We will like Eckert & Ziegler Strahlen- und Medizintechnik better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Eckert & Ziegler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:EUZ

Eckert & Ziegler

Manufactures and sells isotope technology components worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives