- Germany

- /

- Medical Equipment

- /

- XTRA:EUZ

Why We Think Eckert & Ziegler SE's (ETR:EUZ) CEO Compensation Is Not Excessive At All

Key Insights

- Eckert & Ziegler's Annual General Meeting to take place on 26th of June

- Total pay for CEO Harald Hasselmann includes €312.0k salary

- The total compensation is 51% less than the average for the industry

- Eckert & Ziegler's three-year loss to shareholders was 52% while its EPS grew by 3.7% over the past three years

Performance at Eckert & Ziegler SE (ETR:EUZ) has been rather uninspiring recently and shareholders may be wondering how CEO Harald Hasselmann plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 26th of June. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We think CEO compensation looks appropriate given the data we have put together.

View our latest analysis for Eckert & Ziegler

Comparing Eckert & Ziegler SE's CEO Compensation With The Industry

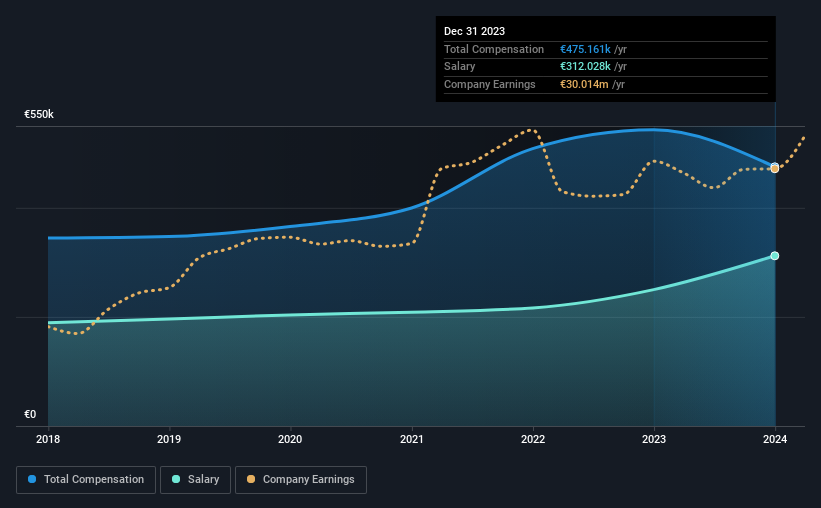

At the time of writing, our data shows that Eckert & Ziegler SE has a market capitalization of €918m, and reported total annual CEO compensation of €475k for the year to December 2023. We note that's a decrease of 13% compared to last year. Notably, the salary which is €312.0k, represents most of the total compensation being paid.

On comparing similar companies from the German Medical Equipment industry with market caps ranging from €372m to €1.5b, we found that the median CEO total compensation was €962k. Accordingly, Eckert & Ziegler pays its CEO under the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €312k | €250k | 66% |

| Other | €163k | €293k | 34% |

| Total Compensation | €475k | €543k | 100% |

Speaking on an industry level, nearly 36% of total compensation represents salary, while the remainder of 64% is other remuneration. Eckert & Ziegler is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Eckert & Ziegler SE's Growth

Eckert & Ziegler SE's earnings per share (EPS) grew 3.7% per year over the last three years. Its revenue is up 11% over the last year.

We would argue that the modest growth in revenue is a notable positive. And the improvement in EPSis modest but respectable. Although we'll stop short of calling the stock a top performer, we think the company has potential. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Eckert & Ziegler SE Been A Good Investment?

Few Eckert & Ziegler SE shareholders would feel satisfied with the return of -52% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The fact that shareholders are sitting on a loss is certainly disheartening. Perhaps the poor price performance may have something to do with the the fact that earnings per share growth has not been performing as strongly either. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

So you may want to check if insiders are buying Eckert & Ziegler shares with their own money (free access).

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Eckert & Ziegler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EUZ

Eckert & Ziegler

Manufactures and sells isotope technology components worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives