Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Carl Zeiss Meditec AG (ETR:AFX) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Carl Zeiss Meditec

How Much Debt Does Carl Zeiss Meditec Carry?

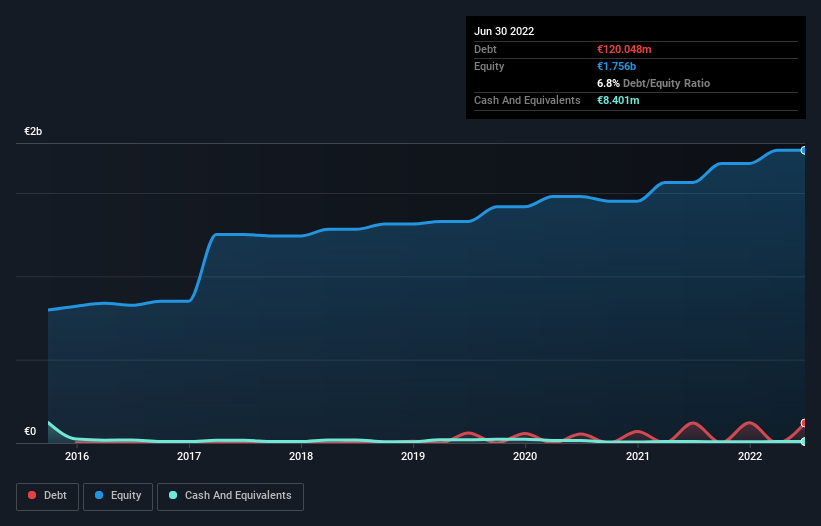

The chart below, which you can click on for greater detail, shows that Carl Zeiss Meditec had €120.0m in debt in March 2022; about the same as the year before. However, it does have €8.40m in cash offsetting this, leading to net debt of about €111.6m.

How Strong Is Carl Zeiss Meditec's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Carl Zeiss Meditec had liabilities of €499.3m due within 12 months and liabilities of €270.7m due beyond that. Offsetting this, it had €8.40m in cash and €1.30b in receivables that were due within 12 months. So it can boast €536.5m more liquid assets than total liabilities.

This short term liquidity is a sign that Carl Zeiss Meditec could probably pay off its debt with ease, as its balance sheet is far from stretched. But either way, Carl Zeiss Meditec has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Carl Zeiss Meditec's net debt is only 0.29 times its EBITDA. And its EBIT easily covers its interest expense, being 164 times the size. So we're pretty relaxed about its super-conservative use of debt. Fortunately, Carl Zeiss Meditec grew its EBIT by 4.6% in the last year, making that debt load look even more manageable. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Carl Zeiss Meditec can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Carl Zeiss Meditec produced sturdy free cash flow equating to 67% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Carl Zeiss Meditec's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its net debt to EBITDA also supports that impression! It's also worth noting that Carl Zeiss Meditec is in the Medical Equipment industry, which is often considered to be quite defensive. Zooming out, Carl Zeiss Meditec seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Carl Zeiss Meditec's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AFX

Carl Zeiss Meditec

Operates as a medical technology company in Germany, rest of Europe, North America, and Asia.

Undervalued with excellent balance sheet.