- Germany

- /

- Medical Equipment

- /

- XTRA:AAQ1

One Analyst Just Shaved Their aap Implantate AG (ETR:AAQ1) Forecasts Dramatically

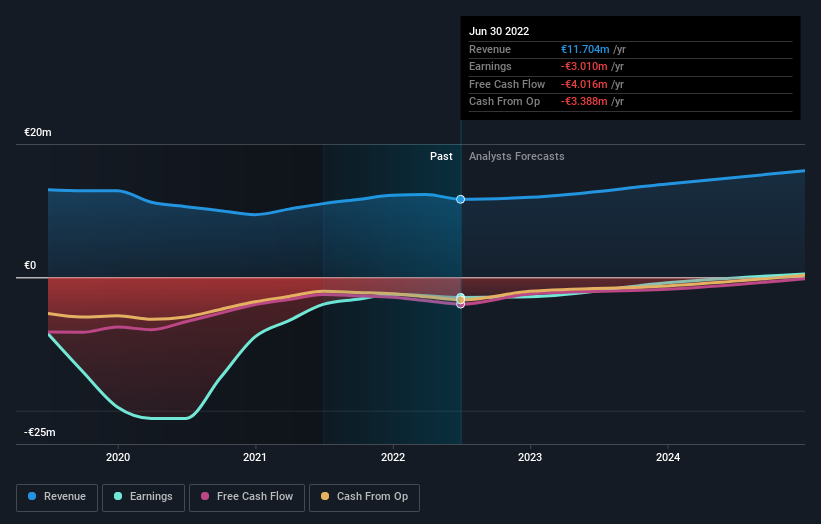

The latest analyst coverage could presage a bad day for aap Implantate AG (ETR:AAQ1), with the covering analyst making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analyst seeing grey clouds on the horizon.

Following the downgrade, the latest consensus from aap Implantate's one analyst is for revenues of €12m in 2022, which would reflect a modest 2.5% improvement in sales compared to the last 12 months. Losses are presumed to reduce, shrinking 19% from last year to €0.49. Yet prior to the latest estimates, the analyst had been forecasting revenues of €14m and losses of €0.42 per share in 2022. Ergo, there's been a clear change in sentiment, with the analyst administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

See our latest analysis for aap Implantate

The consensus price target fell 32% to €2.70, implicitly signalling that lower earnings per share are a leading indicator for aap Implantate's valuation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. For example, we noticed that aap Implantate's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 2.5% growth to the end of 2022 on an annualised basis. That is well above its historical decline of 2.0% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 7.4% annually for the foreseeable future. So although aap Implantate's revenue growth is expected to improve, it is still expected to grow slower than the industry.

The Bottom Line

The most important thing to take away is that the analyst increased their loss per share estimates for this year. Unfortunately the analyst also downgraded their revenue estimates, and industry data suggests that aap Implantate's revenues are expected to grow slower than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

As you can see, the covering analyst clearly isn't bullish, and there might be good reason for that. We've identified some potential issues with aap Implantate's financials, such as major dilution from new stock issuance in the past year. For more information, you can click here to discover this and the 3 other concerns we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AAQ1

aap Implantate

Develops, manufactures, and markets trauma products for orthopedics.

Slight with weak fundamentals.

Market Insights

Community Narratives