- Germany

- /

- Oil and Gas

- /

- XTRA:VH2

Friedrich Vorwerk Group SE's (ETR:VH2) 29% Jump Shows Its Popularity With Investors

Friedrich Vorwerk Group SE (ETR:VH2) shares have continued their recent momentum with a 29% gain in the last month alone. The last month tops off a massive increase of 282% in the last year.

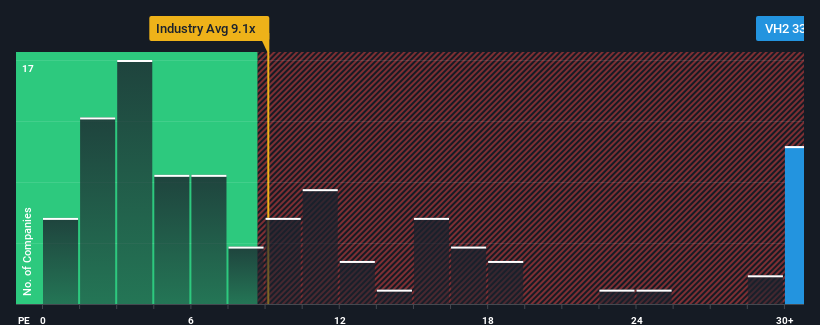

Since its price has surged higher, given close to half the companies in Germany have price-to-earnings ratios (or "P/E's") below 18x, you may consider Friedrich Vorwerk Group as a stock to avoid entirely with its 33.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

We check all companies for important risks. See what we found for Friedrich Vorwerk Group in our free report.Recent times have been advantageous for Friedrich Vorwerk Group as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Friedrich Vorwerk Group

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Friedrich Vorwerk Group would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 252% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 31% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 21% per annum during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 16% per annum growth forecast for the broader market.

In light of this, it's understandable that Friedrich Vorwerk Group's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has got Friedrich Vorwerk Group's P/E rushing to great heights as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Friedrich Vorwerk Group's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Friedrich Vorwerk Group with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:VH2

Friedrich Vorwerk Group

Provides various solutions for transformation and transportation of energy in Germany and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success