- Germany

- /

- Oil and Gas

- /

- XTRA:VH2

Friedrich Vorwerk Group SE (ETR:VH2) Stock Rockets 25% As Investors Are Less Pessimistic Than Expected

Friedrich Vorwerk Group SE (ETR:VH2) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 38% over that time.

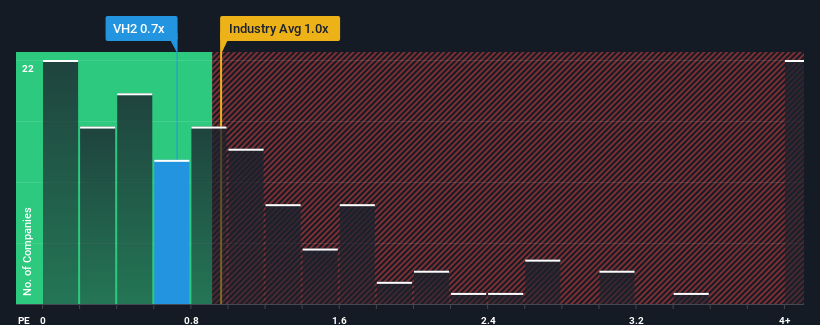

Even after such a large jump in price, it's still not a stretch to say that Friedrich Vorwerk Group's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Oil and Gas industry in Germany, where the median P/S ratio is around 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Friedrich Vorwerk Group

What Does Friedrich Vorwerk Group's P/S Mean For Shareholders?

Recent times haven't been great for Friedrich Vorwerk Group as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Friedrich Vorwerk Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Friedrich Vorwerk Group's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. The latest three year period has also seen an excellent 32% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 5.2% as estimated by the five analysts watching the company. With the industry predicted to deliver 74% growth, that's a disappointing outcome.

With this in consideration, we think it doesn't make sense that Friedrich Vorwerk Group's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Final Word

Friedrich Vorwerk Group's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of Friedrich Vorwerk Group's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Before you settle on your opinion, we've discovered 2 warning signs for Friedrich Vorwerk Group that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:VH2

Friedrich Vorwerk Group

Provides various solutions for transformation and transportation of energy in Germany and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success