- Germany

- /

- Oil and Gas

- /

- XTRA:VBK

With EPS Growth And More, VERBIO Vereinigte BioEnergie (ETR:VBK) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like VERBIO Vereinigte BioEnergie (ETR:VBK), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for VERBIO Vereinigte BioEnergie

VERBIO Vereinigte BioEnergie's Improving Profits

In the last three years VERBIO Vereinigte BioEnergie's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, VERBIO Vereinigte BioEnergie's EPS catapulted from €2.68 to €4.69, over the last year. It's not often a company can achieve year-on-year growth of 75%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that VERBIO Vereinigte BioEnergie is growing revenues, and EBIT margins improved by 3.4 percentage points to 21%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

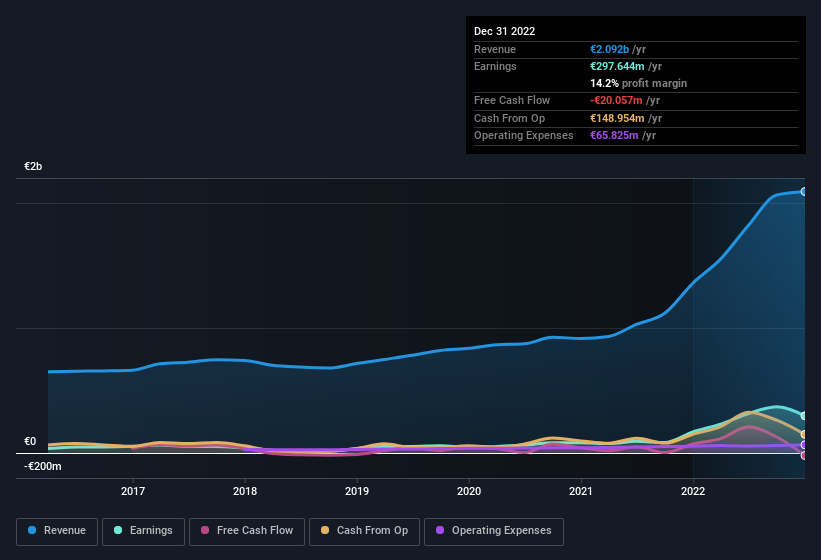

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of VERBIO Vereinigte BioEnergie's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are VERBIO Vereinigte BioEnergie Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that VERBIO Vereinigte BioEnergie insiders own a meaningful share of the business. In fact, they own 58% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. This insider holding amounts to That means they have plenty of their own capital riding on the performance of the business!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like VERBIO Vereinigte BioEnergie with market caps between €1.9b and €6.0b is about €2.2m.

VERBIO Vereinigte BioEnergie offered total compensation worth €1.2m to its CEO in the year to June 2022. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is VERBIO Vereinigte BioEnergie Worth Keeping An Eye On?

VERBIO Vereinigte BioEnergie's earnings per share growth have been climbing higher at an appreciable rate. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so the writing on the wall tells us that VERBIO Vereinigte BioEnergie is worth considering carefully. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for VERBIO Vereinigte BioEnergie that you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:VBK

Verbio

Engages in the production and distribution of fuels and finished products in Germany, Europe, North America, and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.