- Germany

- /

- Oil and Gas

- /

- XTRA:VBK

German Stocks Trading Below Estimated Value In October 2024

Reviewed by Simply Wall St

In October 2024, Germany's DAX index experienced a notable rise of 1.46%, buoyed by the European Central Bank's decision to cut interest rates for the second consecutive meeting, fueling expectations of further monetary easing. As investors navigate these evolving economic conditions, identifying stocks trading below their estimated value can offer potential opportunities for those seeking to capitalize on market inefficiencies and favorable valuations.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €16.30 | €30.87 | 47.2% |

| init innovation in traffic systems (XTRA:IXX) | €37.50 | €52.32 | 28.3% |

| 2G Energy (XTRA:2GB) | €22.70 | €41.31 | 45% |

| Formycon (XTRA:FYB) | €50.40 | €81.71 | 38.3% |

| CeoTronics (DB:CEK) | €5.40 | €10.11 | 46.6% |

| Friedrich Vorwerk Group (XTRA:VH2) | €29.60 | €46.34 | 36.1% |

| Schweizer Electronic (XTRA:SCE) | €3.72 | €7.19 | 48.3% |

| Your Family Entertainment (DB:RTV) | €2.50 | €4.21 | 40.6% |

| LPKF Laser & Electronics (XTRA:LPK) | €8.74 | €12.46 | 29.8% |

| MTU Aero Engines (XTRA:MTX) | €312.60 | €566.93 | 44.9% |

Here we highlight a subset of our preferred stocks from the screener.

init innovation in traffic systems (XTRA:IXX)

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of approximately €370.36 million.

Operations: The company generates revenue from its Wireless Communications Equipment segment, amounting to €235.67 million.

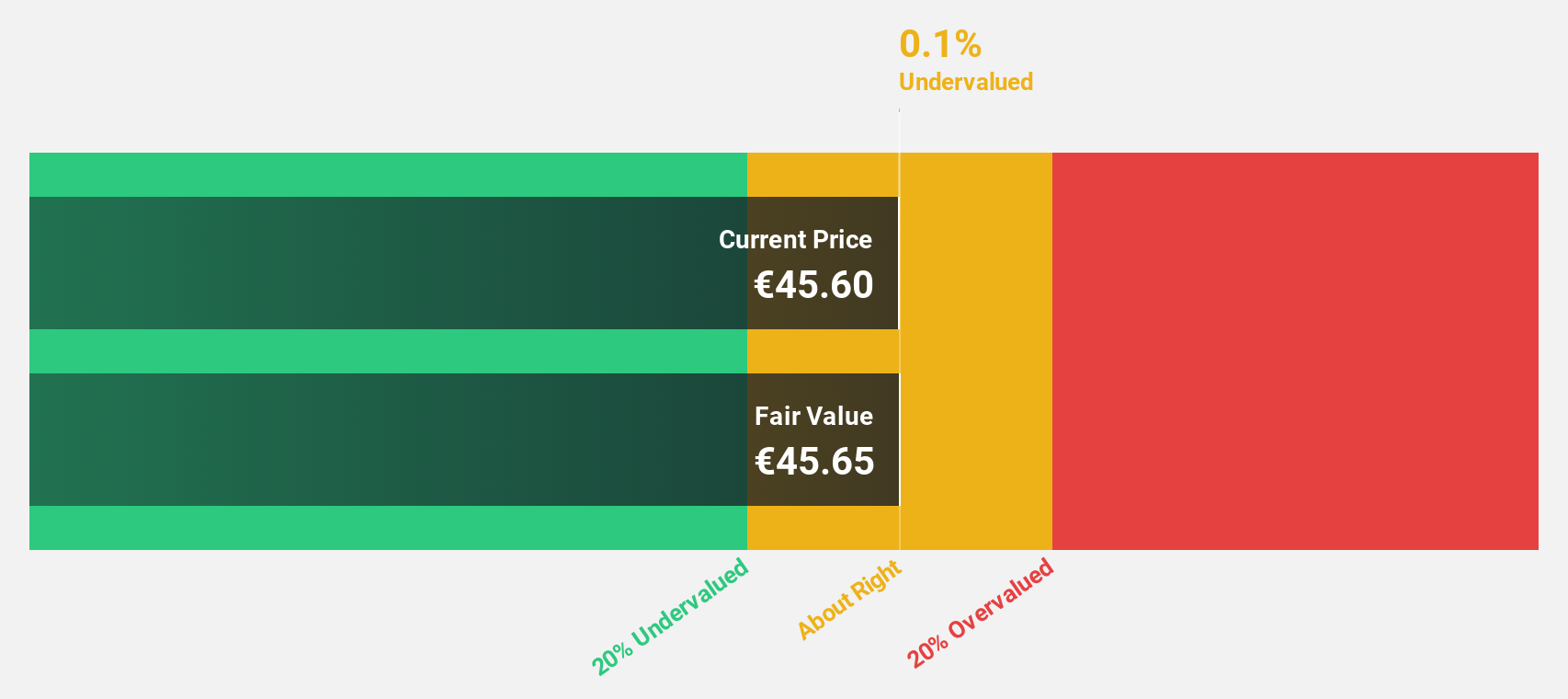

Estimated Discount To Fair Value: 28.3%

init innovation in traffic systems SE is trading at €37.5, significantly below its estimated fair value of €52.32, suggesting it may be undervalued based on cash flows. Despite a decrease in quarterly net income to €2.42 million from €3.03 million the previous year, earnings for the first half improved notably to €4.82 million from €1.34 million year-on-year, reflecting strong revenue growth and potential for future profitability with forecasted annual earnings growth of 21.6%.

- According our earnings growth report, there's an indication that init innovation in traffic systems might be ready to expand.

- Unlock comprehensive insights into our analysis of init innovation in traffic systems stock in this financial health report.

Verbio (XTRA:VBK)

Overview: Verbio SE is involved in the production and distribution of fuels and finished products across Germany, Europe, North America, and internationally, with a market cap of €962.85 million.

Operations: The company's revenue primarily comes from its Biodiesel segment, generating €989.66 million, and its Bioethanol (including Biomethane) segment, contributing €661.38 million.

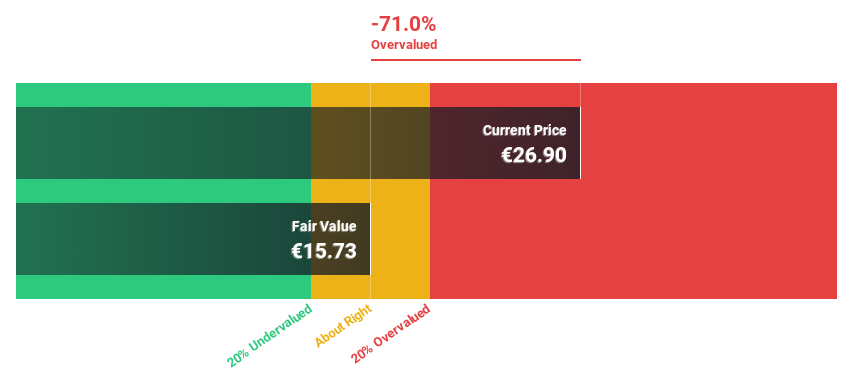

Estimated Discount To Fair Value: 26.4%

Verbio SE is trading at €15.13, below its estimated fair value of €20.55, indicating potential undervaluation based on cash flows. Despite volatile share prices and a significant drop in net income to €19.96 million from €132.02 million last year, earnings are forecasted to grow substantially at 35.1% annually over the next three years, outpacing the German market's growth rate of 20.2%. Revenue growth is also expected to exceed the market average slightly.

- Our growth report here indicates Verbio may be poised for an improving outlook.

- Get an in-depth perspective on Verbio's balance sheet by reading our health report here.

Friedrich Vorwerk Group (XTRA:VH2)

Overview: Friedrich Vorwerk Group SE offers solutions for energy transformation and transportation across Germany and Europe, with a market cap of €592 million.

Operations: The company generates revenue from segments including Electricity (€95.30 million), Natural Gas (€160.89 million), Clean Hydrogen (€28.38 million), and Adjacent Opportunities (€117.28 million).

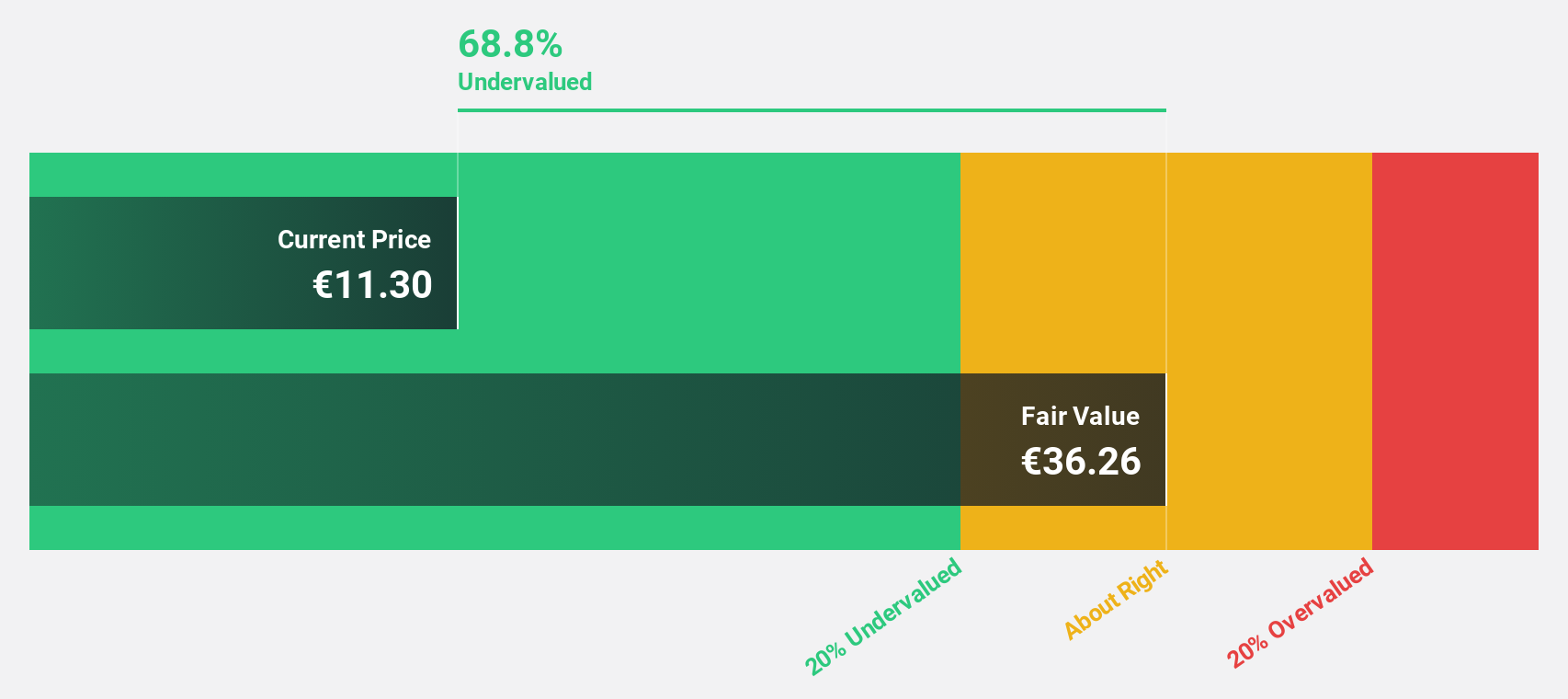

Estimated Discount To Fair Value: 36.1%

Friedrich Vorwerk Group SE is trading at €29.6, significantly below its estimated fair value of €46.34, highlighting potential undervaluation based on cash flows. Recent earnings showed strong growth with net income rising to €7.96 million in Q2 2024 from €2.38 million the previous year. Earnings are projected to grow significantly faster than the German market at 25.7% per year, despite a forecasted low return on equity of 13.8% in three years.

- Our comprehensive growth report raises the possibility that Friedrich Vorwerk Group is poised for substantial financial growth.

- Navigate through the intricacies of Friedrich Vorwerk Group with our comprehensive financial health report here.

Next Steps

- Access the full spectrum of 20 Undervalued German Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VBK

Verbio

Engages in the production and distribution of fuels and finished products in Germany, Europe, North America, and internationally.

Good value with reasonable growth potential.