- Germany

- /

- Oil and Gas

- /

- XTRA:ETG

ITAB Shop Concept And 2 European Small Caps With Promising Potential

Reviewed by Simply Wall St

As European markets navigate the turbulence of escalating trade tensions and shifting economic indicators, investors are increasingly looking toward small-cap stocks for potential opportunities. In this environment, identifying companies that demonstrate resilience and innovation can be key to uncovering promising investment prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Value Rating: ★★★★★★

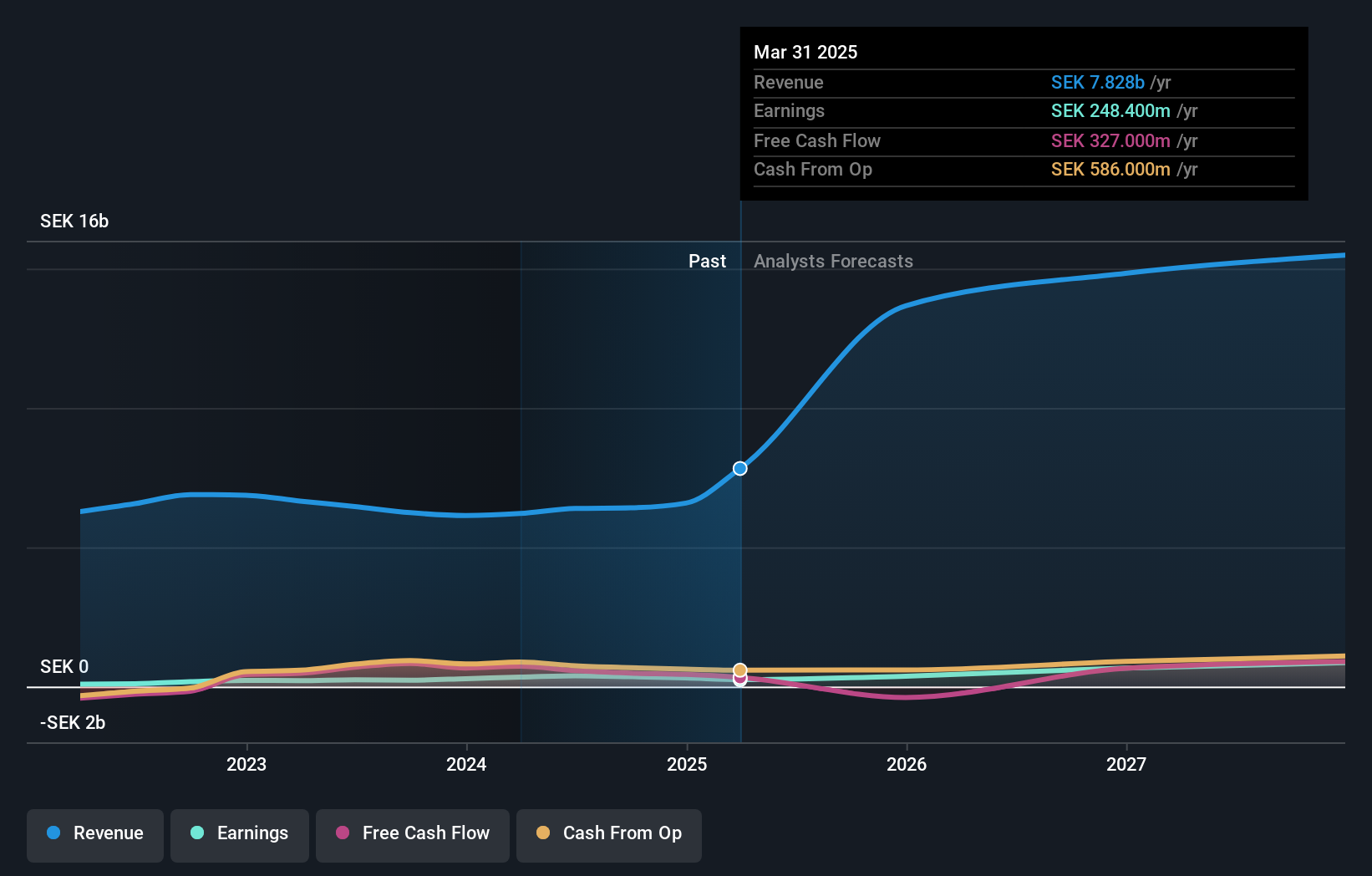

Overview: ITAB Shop Concept AB (publ) specializes in offering store design solutions, customized concept fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical retail environments with a market cap of approximately SEK5.48 billion.

Operations: The company's primary revenue stream is derived from its Furniture & Fixtures segment, generating SEK6.59 billion.

ITAB Shop Concept, a nimble player in the retail solutions sector, has seen its earnings grow by 10.2% over the past year, outpacing the industry average of -6%. The company is trading at an attractive valuation, 71% below estimated fair value. ITAB's debt situation appears robust with interest payments well-covered by EBIT at a ratio of 17.8 times and more cash than total debt. Recent contracts with major European retailers like ASDA and a DIY chain in Italy underscore its market traction, though no dividends are planned as profits are reinvested to fortify financial health amidst acquisition integration challenges.

Zinzino (OM:ZZ B)

Simply Wall St Value Rating: ★★★★★★

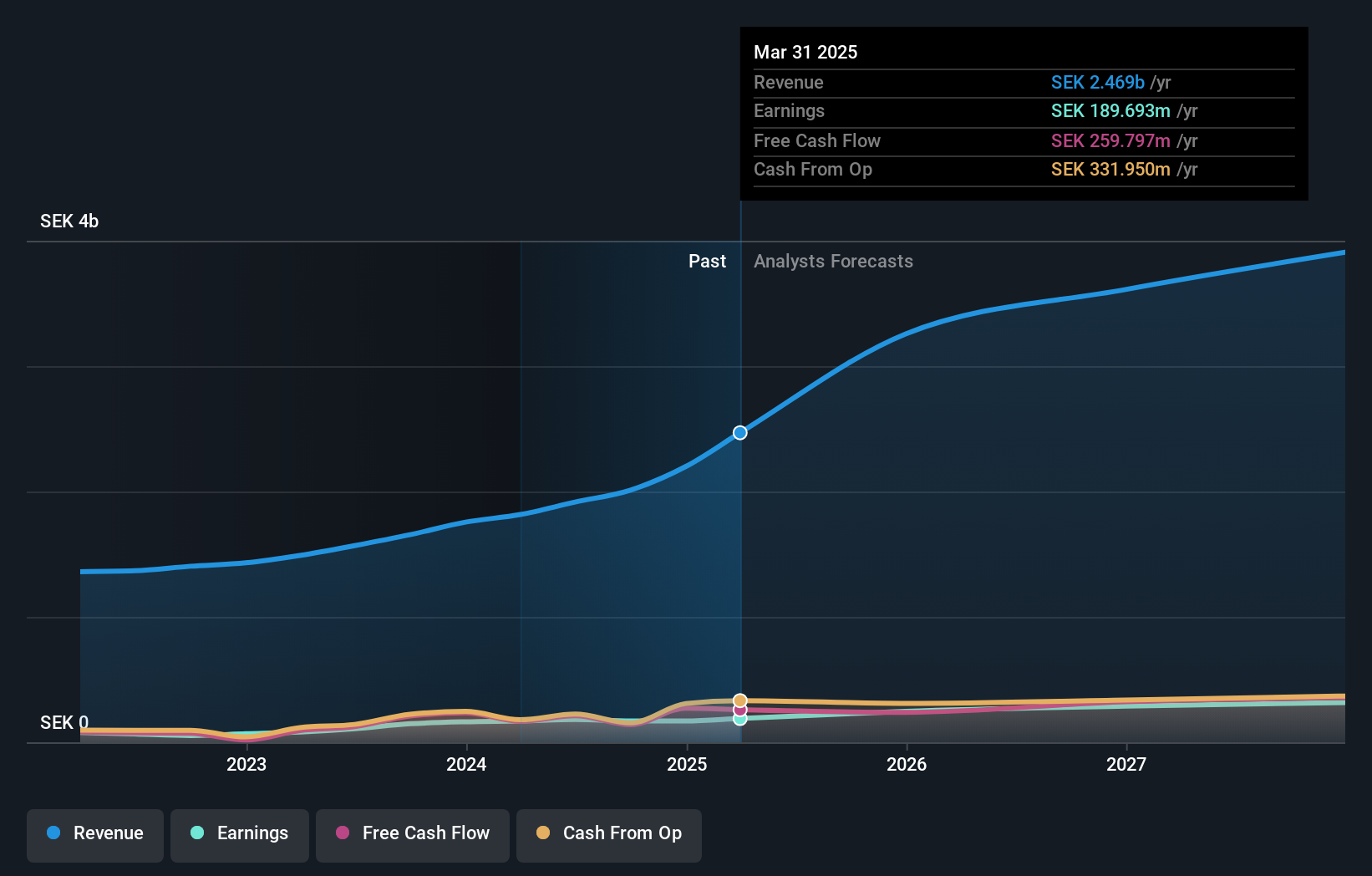

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products both in Sweden and internationally, with a market capitalization of SEK5.31 billion.

Operations: Zinzino generates revenue primarily from its Zinzino (Incl. VMA Life) segment, which contributed SEK2.11 billion, while the Faun segment added SEK182.15 million. The company experienced a deduction of SEK79.75 million due to group eliminations in its financial reporting.

Zinzino, a vibrant player in the retail distributors sector, has been making waves with its impressive revenue surge. The company's sales for March 2025 reached SEK 275 million, a significant leap from SEK 160 million the previous year. This growth aligns with Zinzino's strategic expansion into New Zealand, tapping into Oceania's thriving e-commerce scene. Despite facing slight pressure on net income in Q4 2024 at SEK 43 million compared to SEK 44 million previously, Zinzino remains debt-free and is trading at an attractive discount of approximately 45% below estimated fair value. With earnings forecasted to grow annually by over 11%, Zinzino seems poised for continued momentum.

- Click to explore a detailed breakdown of our findings in Zinzino's health report.

Understand Zinzino's track record by examining our Past report.

EnviTec Biogas (XTRA:ETG)

Simply Wall St Value Rating: ★★★★★☆

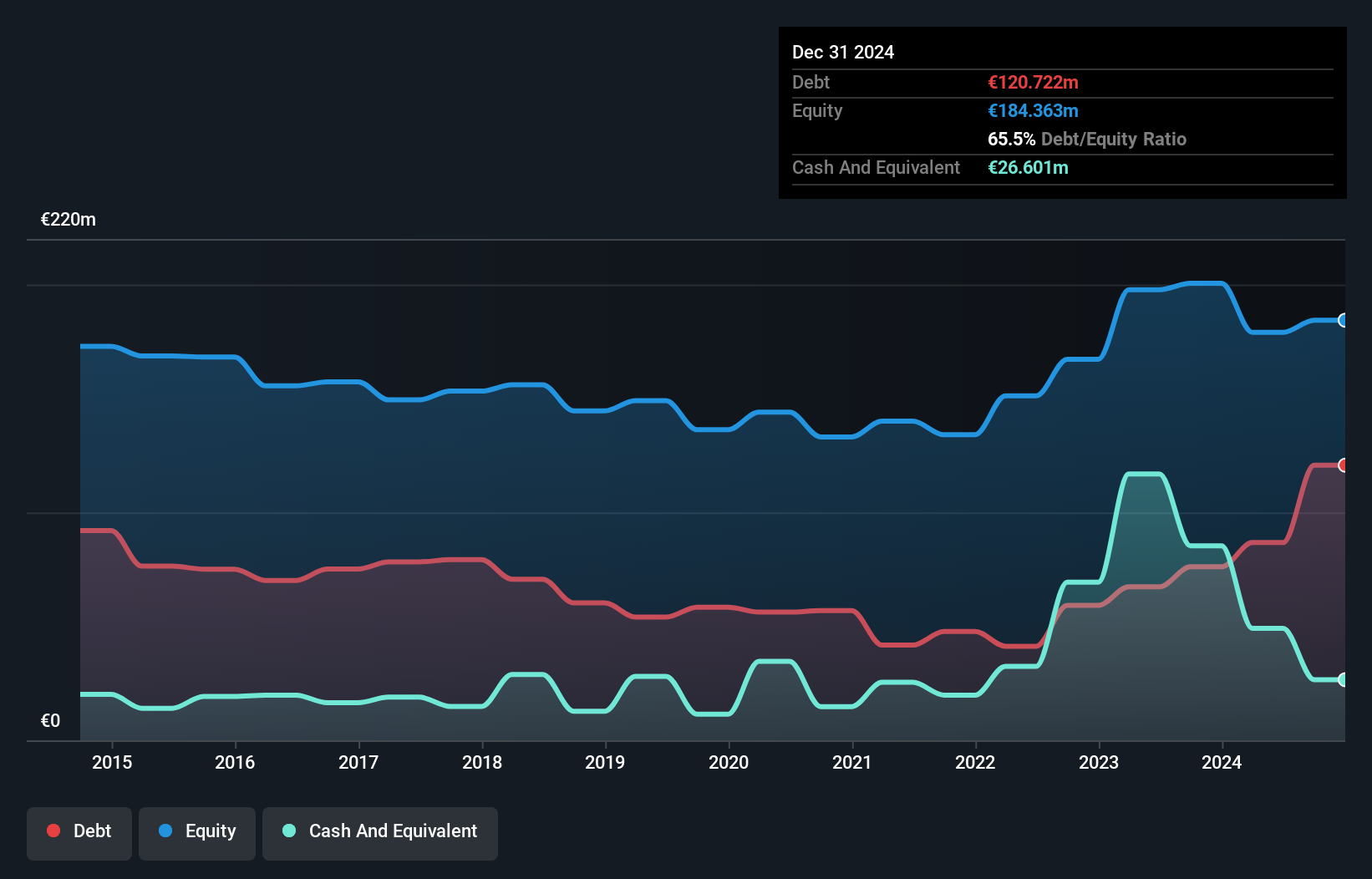

Overview: EnviTec Biogas AG is engaged in the manufacturing and operation of biogas and biomethane plants across various countries including Germany, Italy, and the United States, with a market capitalization of €533.12 million.

Operations: EnviTec Biogas AG generates revenue primarily through the manufacturing and operation of biogas and biomethane plants. The company's financial performance is influenced by its ability to manage costs associated with plant operations across multiple countries.

EnviTec Biogas, a small player in the renewable energy sector, is trading at 56.6% below its estimated fair value, suggesting potential for appreciation. Despite facing a challenging year with earnings growth at -16.5%, it still outperformed the broader Oil and Gas industry average of -26.3%. The company's debt to equity ratio has climbed from 36.3% to 48.5% over five years, indicating increased leverage but remains within manageable levels with a satisfactory net debt to equity ratio of 21%. With high-quality past earnings and robust interest coverage, EnviTec appears well-positioned for future opportunities in biogas production amidst growing environmental concerns.

- Delve into the full analysis health report here for a deeper understanding of EnviTec Biogas.

Gain insights into EnviTec Biogas' historical performance by reviewing our past performance report.

Where To Now?

- Access the full spectrum of 351 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnviTec Biogas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ETG

EnviTec Biogas

Manufactures and operates biogas and biomethane plants in Germany, Italy, Great Britain, the Czechia Republic, France, Denmark, the United States, China, Greece, Estonia, and internationally.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives