- Norway

- /

- Energy Services

- /

- OB:SEA1

Discover 3 European Dividend Stocks With Yields Up To 18.8%

Reviewed by Simply Wall St

As European markets navigate a complex landscape of mixed stock index performances and cautious monetary policy decisions, investors are increasingly focused on strategies that can provide stability and income. In this environment, dividend stocks stand out as an attractive option for those seeking reliable returns, offering the potential for steady cash flow amid economic uncertainties.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.45% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.43% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.16% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.66% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.58% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.89% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.86% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.43% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.73% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.54% | ★★★★★☆ |

Click here to see the full list of 231 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Equinor (OB:EQNR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Equinor ASA is an energy company involved in the exploration, production, transportation, refining, and marketing of petroleum and other forms of energy both in Norway and internationally, with a market cap of NOK642.22 billion.

Operations: Equinor ASA generates its revenue from several segments, including Exploration & Production Norway ($35.05 billion), Marketing, Midstream & Processing ($105.57 billion), Exploration & Production USA ($4.14 billion), Exploration & Production International excluding the USA ($5.83 billion), and Renewables ($0.10 billion).

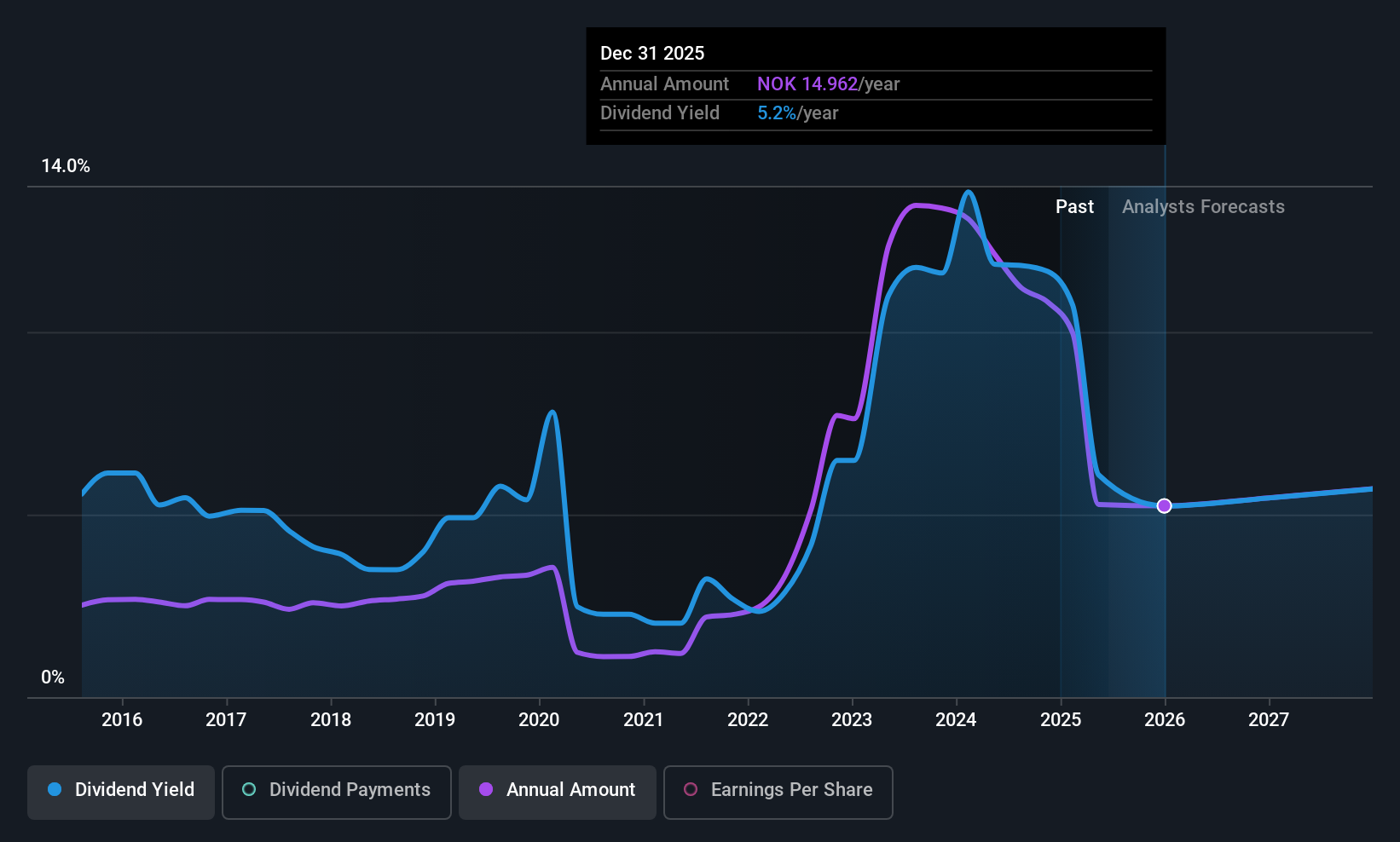

Dividend Yield: 5.8%

Equinor has demonstrated a commitment to dividends, with recent affirmations of a US$0.37 per share payout for the first two quarters of 2025. The dividend is well-covered by both earnings and cash flows, maintaining payout ratios around 48% and 49.7%, respectively. However, despite past increases in dividend payments over the last decade, Equinor's dividends have been volatile and unreliable at times. Additionally, its current yield of 5.78% is below Norway's top quartile dividend payers' average.

- Click here to discover the nuances of Equinor with our detailed analytical dividend report.

- The analysis detailed in our Equinor valuation report hints at an deflated share price compared to its estimated value.

Sea1 Offshore (OB:SEA1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sea1 Offshore Inc., along with its subsidiaries, owns and operates offshore support vessels for the offshore energy service industry, with a market cap of NOK3.53 billion.

Operations: Sea1 Offshore Inc. generates revenue from its operations through several segments, including Subsea Vessels at $132.12 million, Anchor Handling Tug Supply Vessels at $106.57 million, Platform Supply Vessels (PSV) at $23.90 million, and Fast Crew & Oil Spill Recovery Vessels at $13.05 million.

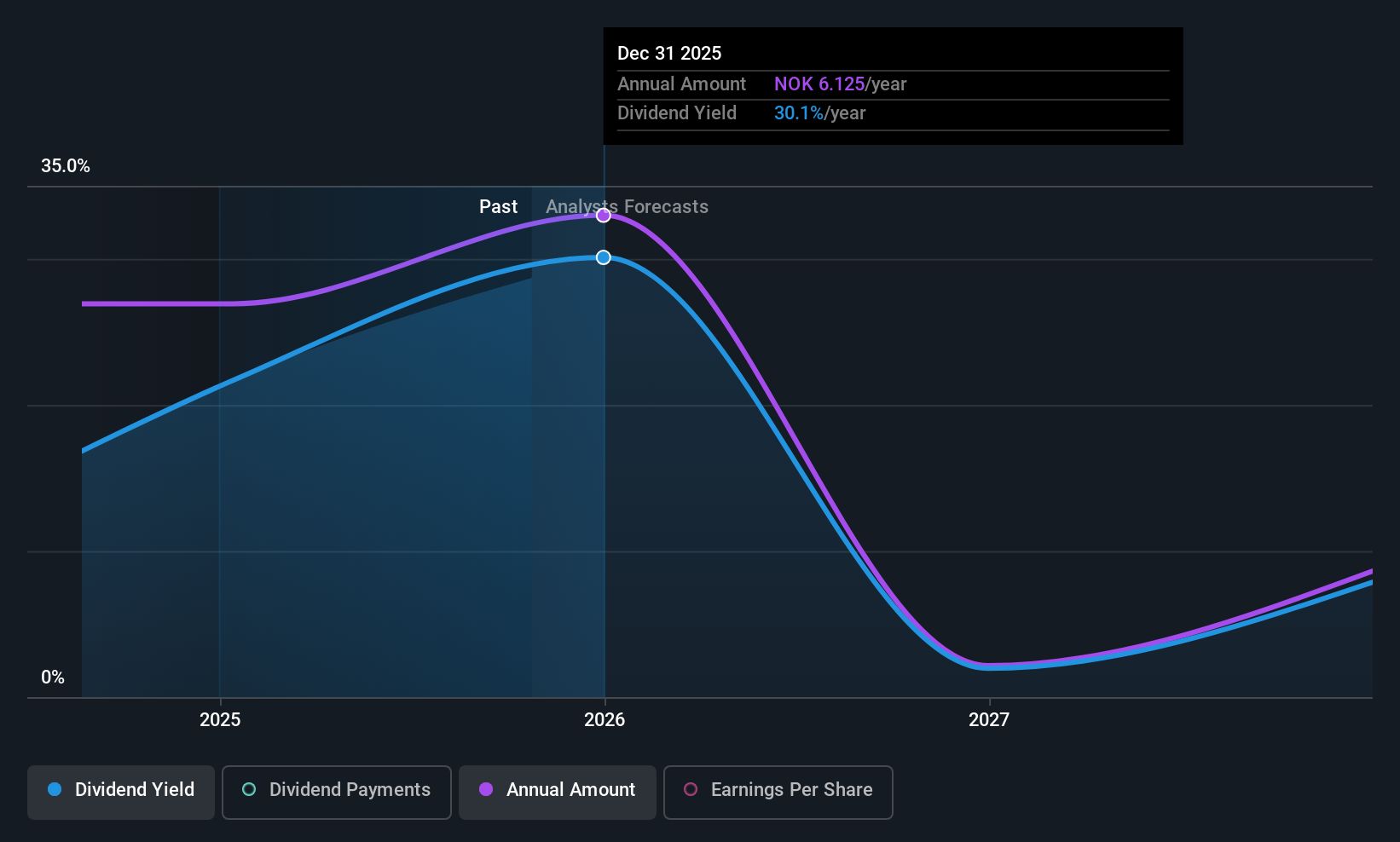

Dividend Yield: 18.8%

Sea1 Offshore's dividend yield of 18.81% ranks it among the top 25% of Norwegian dividend payers, though its reliability is questionable due to recent volatility and a short payment history. Despite trading at a significant discount to estimated fair value and having dividends covered by earnings (payout ratio: 39.9%) and cash flows (cash payout ratio: 78.4%), the company faces challenges with declining earnings, reduced profit margins, and substantial debt levels impacting financial stability.

- Dive into the specifics of Sea1 Offshore here with our thorough dividend report.

- Upon reviewing our latest valuation report, Sea1 Offshore's share price might be too pessimistic.

Deutsche Rohstoff (XTRA:DR0)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Deutsche Rohstoff AG, with a market cap of €215.26 million, is involved in the exploration and production of crude oil and natural gas across the United States, Australia, Western Europe, and South Korea.

Operations: Deutsche Rohstoff AG generates its revenue from the exploration and production of crude oil and natural gas in regions including the United States, Australia, Western Europe, and South Korea.

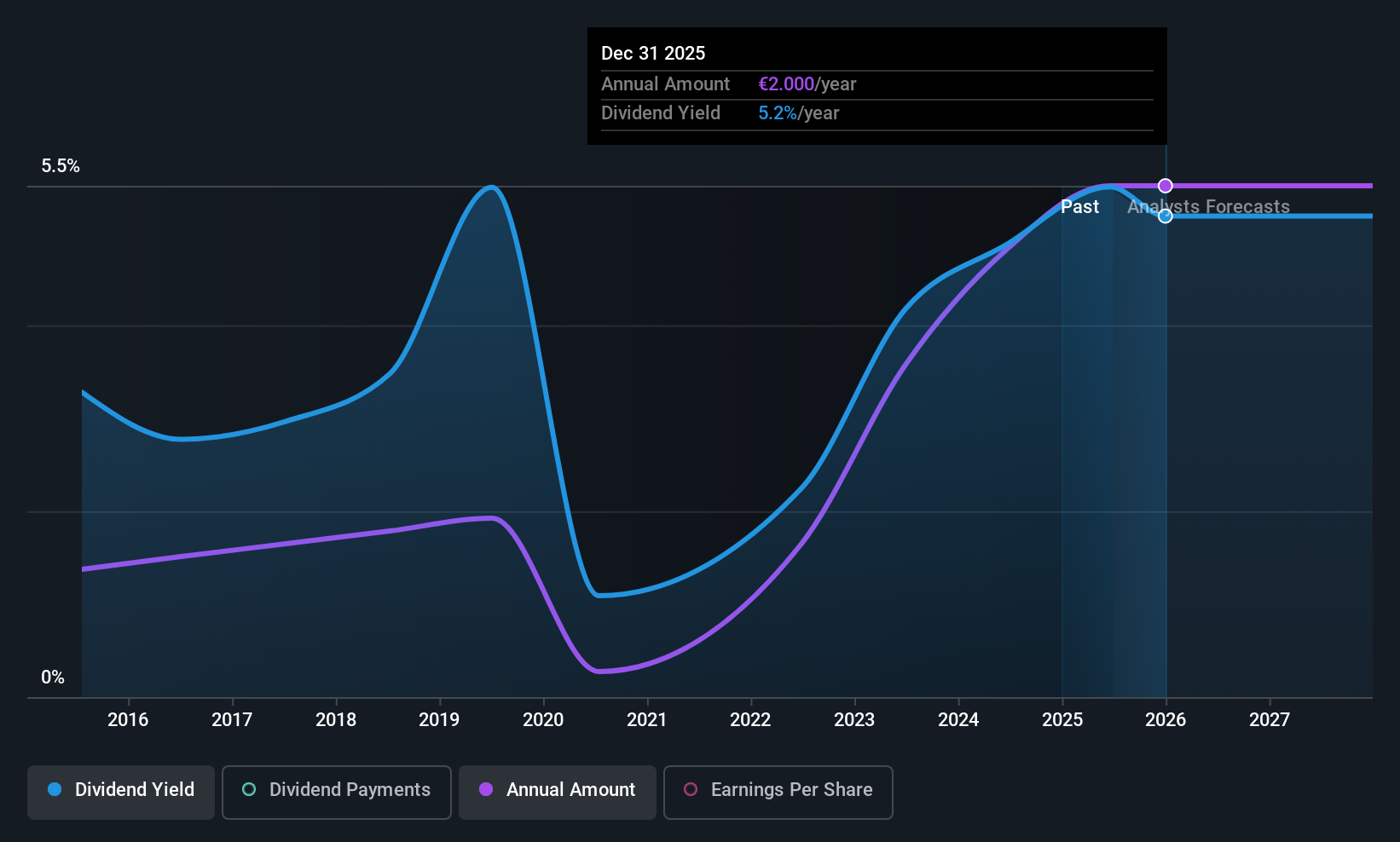

Dividend Yield: 4.5%

Deutsche Rohstoff's dividends are well-covered by earnings and cash flows, with payout ratios of 23.5% and 43.9%, respectively, but its dividend history is volatile. Recent earnings guidance anticipates revenue between €170 million and €190 million for 2025, yet profit margins have declined significantly from the previous year. The company was recently dropped from the S&P Global BMI Index, reflecting potential concerns about future performance amidst a forecasted decline in earnings over the next three years.

- Take a closer look at Deutsche Rohstoff's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Deutsche Rohstoff is priced lower than what may be justified by its financials.

Make It Happen

- Unlock our comprehensive list of 231 Top European Dividend Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SEA1

Sea1 Offshore

Owns and operates offshore support vessels for the offshore energy service industry.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives