- Germany

- /

- Oil and Gas

- /

- XTRA:CE2

CropEnergies AG (ETR:CE2) Held Back By Insufficient Growth Even After Shares Climb 55%

CropEnergies AG (ETR:CE2) shares have had a really impressive month, gaining 55% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

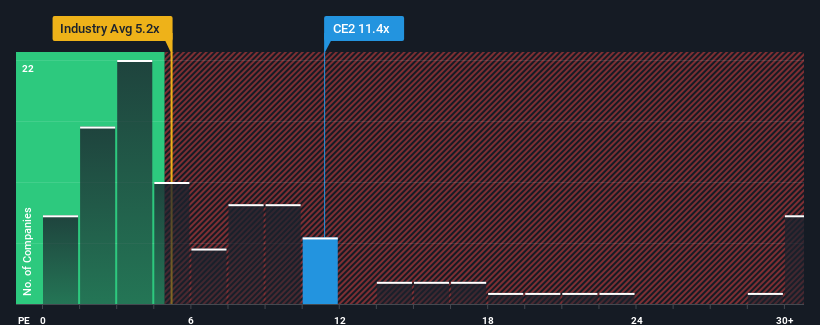

Although its price has surged higher, CropEnergies' price-to-earnings (or "P/E") ratio of 11.4x might still make it look like a buy right now compared to the market in Germany, where around half of the companies have P/E ratios above 17x and even P/E's above 35x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

CropEnergies has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for CropEnergies

Is There Any Growth For CropEnergies?

There's an inherent assumption that a company should underperform the market for P/E ratios like CropEnergies' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 56% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 7.4% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 17% per year as estimated by the dual analysts watching the company. With the market predicted to deliver 13% growth each year, that's a disappointing outcome.

In light of this, it's understandable that CropEnergies' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On CropEnergies' P/E

CropEnergies' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of CropEnergies' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 4 warning signs for CropEnergies (2 don't sit too well with us!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:CE2

CropEnergies

Manufactures and distributes bioethanol, and other biofuels and related products produced from grain or other agricultural raw materials in Germany and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives