- Germany

- /

- Capital Markets

- /

- DB:RTML

Despite shrinking by €4.6m in the past week, CAMERIT (FRA:RTML) shareholders are still up 34% over 3 years

No-one enjoys it when they lose money on a stock. But it can difficult to make money in a declining market. While the CAMERIT AG (FRA:RTML) share price is down 59% in the last three years, the total return to shareholders (which includes dividends) was 34%. That's better than the market which declined 6.2% over the last three years. On top of that, the share price is down 69% in the last week.

If the past week is anything to go by, investor sentiment for CAMERIT isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for CAMERIT

CAMERIT recorded just €66,548 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. We can't help wondering why it's publicly listed so early in its journey. Are venture capitalists not interested? As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. Investors will be hoping that CAMERIT can make progress and gain better traction for the business, before it runs low on cash.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. It certainly is a dangerous place to invest, as CAMERIT investors might realise.

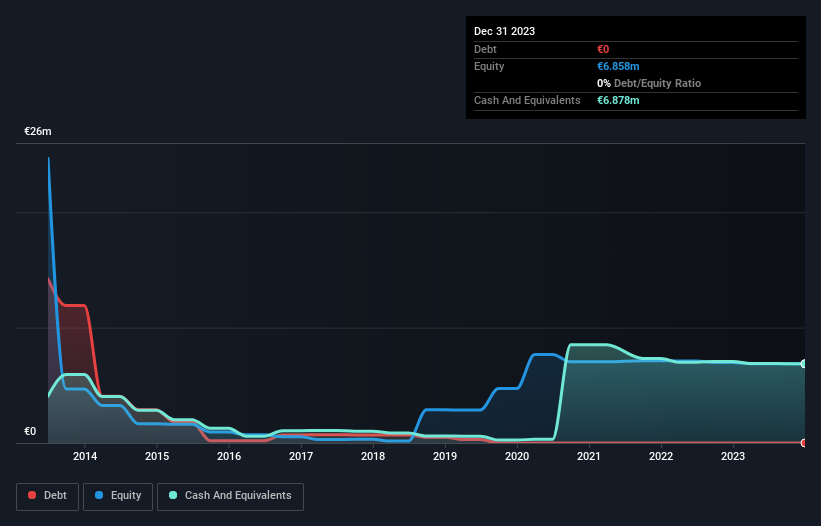

CAMERIT has plenty of cash in the bank, with cash in excess of all liabilities sitting at €6.8m, when it last reported (December 2023). That allows management to focus on growing the business, and not worry too much about raising capital. But with the share price diving 17% per year, over 3 years , it could be that the price was previously too hyped up. The image below shows how CAMERIT's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

Of course, the truth is that it is hard to value companies without much revenue or profit. Would it bother you if insiders were selling the stock? I would feel more nervous about the company if that were so. You can click here to see if there are insiders selling.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between CAMERIT's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that CAMERIT's TSR, at 34% is higher than its share price return of -59%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We're pleased to report that CAMERIT shareholders have received a total shareholder return of 57% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 36% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for CAMERIT you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:RTML

CAMERIT

Hesse Newman Capital AG provides financial investment services in Germany.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives