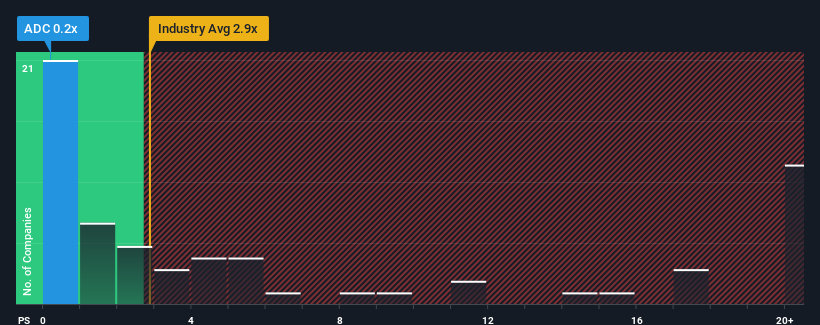

With a price-to-sales (or "P/S") ratio of 0.2x AdCapital AG (FRA:ADC) may be sending very bullish signals at the moment, given that almost half of all the Capital Markets companies in Germany have P/S ratios greater than 2.9x and even P/S higher than 18x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for AdCapital

How Has AdCapital Performed Recently?

It looks like revenue growth has deserted AdCapital recently, which is not something to boast about. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on AdCapital will help you shine a light on its historical performance.How Is AdCapital's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as AdCapital's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 5.6% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to shrink 4.1% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

In light of this, the fact AdCapital's P/S sits below the majority of other companies is peculiar but certainly not shocking. There's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares excessively.

The Bottom Line On AdCapital's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look into numbers has shown it's somewhat unexpected that AdCapital has a lower P/S than the industry average, given its recent three-year revenue performance which was better than anticipated for an industry facing challenges. When we see better than average revenue growth but a lower than average P/S, we must assume that potential risks are what might be placing significant pressure on the P/S ratio. We'd hazard a guess that some investors are concerned about the company's revenue performance tailing off amidst these tough industry conditions. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for AdCapital (1 is a bit unpleasant) you should be aware of.

If these risks are making you reconsider your opinion on AdCapital, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:ADC

AdCapital

An industrial holding company, invests in electrical engineering, metal and plastics processing, machine and tool construction, and automotive businesses in Germany and internationally.

Adequate balance sheet slight.