- Germany

- /

- Capital Markets

- /

- XTRA:MWB0

mwb fairtrade Wertpapierhandelsbank AG (ETR:MWB) Soars 26% But It's A Story Of Risk Vs Reward

Those holding mwb fairtrade Wertpapierhandelsbank AG (ETR:MWB) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 60% share price drop in the last twelve months.

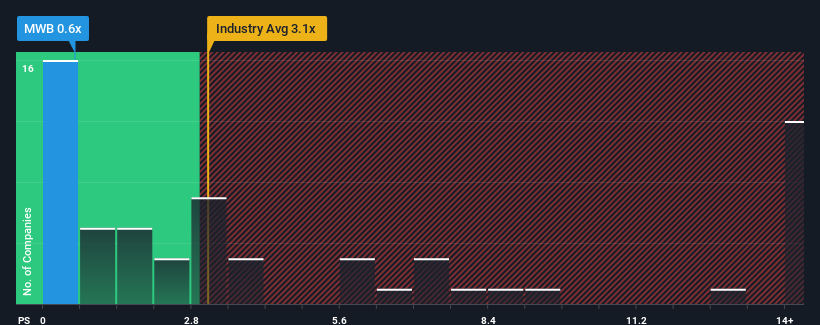

Although its price has surged higher, mwb fairtrade Wertpapierhandelsbank may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Capital Markets industry in Germany have P/S ratios greater than 3.1x and even P/S higher than 9x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for mwb fairtrade Wertpapierhandelsbank

What Does mwb fairtrade Wertpapierhandelsbank's P/S Mean For Shareholders?

For example, consider that mwb fairtrade Wertpapierhandelsbank's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on mwb fairtrade Wertpapierhandelsbank will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for mwb fairtrade Wertpapierhandelsbank, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is mwb fairtrade Wertpapierhandelsbank's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as mwb fairtrade Wertpapierhandelsbank's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 3.7% shows it's a great look while it lasts.

With this information, we find it very odd that mwb fairtrade Wertpapierhandelsbank is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

mwb fairtrade Wertpapierhandelsbank's recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at the figures, it's surprising to see mwb fairtrade Wertpapierhandelsbank currently trades on a much lower than expected P/S since its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

You always need to take note of risks, for example - mwb fairtrade Wertpapierhandelsbank has 3 warning signs we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MWB0

mwb fairtrade Wertpapierhandelsbank

Operates as a securities trading company in Germany.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives