- Germany

- /

- Capital Markets

- /

- XTRA:MWB0

Don't Buy mwb fairtrade Wertpapierhandelsbank AG (ETR:MWB) For Its Next Dividend Without Doing These Checks

mwb fairtrade Wertpapierhandelsbank AG (ETR:MWB) is about to trade ex-dividend in the next four days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Thus, you can purchase mwb fairtrade Wertpapierhandelsbank's shares before the 24th of July in order to receive the dividend, which the company will pay on the 26th of July.

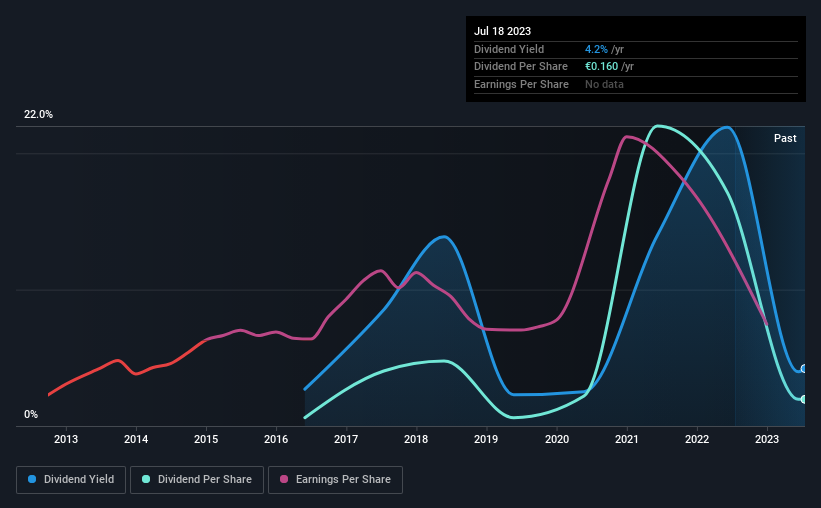

The company's next dividend payment will be €0.16 per share. Last year, in total, the company distributed €0.16 to shareholders. Last year's total dividend payments show that mwb fairtrade Wertpapierhandelsbank has a trailing yield of 4.2% on the current share price of €3.8. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether mwb fairtrade Wertpapierhandelsbank has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for mwb fairtrade Wertpapierhandelsbank

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. It paid out 85% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be worried about the risk of a drop in earnings.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're discomforted by mwb fairtrade Wertpapierhandelsbank's 25% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last seven years, mwb fairtrade Wertpapierhandelsbank has lifted its dividend by approximately 18% a year on average. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. mwb fairtrade Wertpapierhandelsbank is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

Final Takeaway

Should investors buy mwb fairtrade Wertpapierhandelsbank for the upcoming dividend? We're not overly enthused to see mwb fairtrade Wertpapierhandelsbank's earnings in retreat at the same time as the company is paying out more than half of its earnings as dividends to shareholders. All things considered, we're not optimistic about its dividend prospects, and would be inclined to leave it on the shelf for now.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with mwb fairtrade Wertpapierhandelsbank. In terms of investment risks, we've identified 4 warning signs with mwb fairtrade Wertpapierhandelsbank and understanding them should be part of your investment process.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

If you're looking to trade mwb fairtrade Wertpapierhandelsbank, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MWB0

mwb fairtrade Wertpapierhandelsbank

Operates as a securities trading company in Germany.

Slight with mediocre balance sheet.

Market Insights

Community Narratives