As European inflation nears the central bank’s target, Germany's DAX has reached a fresh peak, reflecting a positive sentiment in the market. This economic backdrop provides an opportune moment to explore dividend stocks that offer both stability and income potential. In this context, identifying strong dividend stocks involves looking for companies with robust financial health and consistent payout histories, especially as inflation trends stabilize.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 4.87% | ★★★★★★ |

| MLP (XTRA:MLP) | 5.29% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.71% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.14% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.83% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.35% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 7.33% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.40% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.76% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.28% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top German Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Mercedes-Benz Group (XTRA:MBG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mercedes-Benz Group AG operates as an automotive company in Germany and internationally, with a market cap of €57.65 billion.

Operations: Mercedes-Benz Group AG generates revenue from three main segments: Mercedes-Benz Cars (€109.58 billion), Mercedes-Benz Vans (€20.22 billion), and Mercedes-Benz Mobility (€26.78 billion).

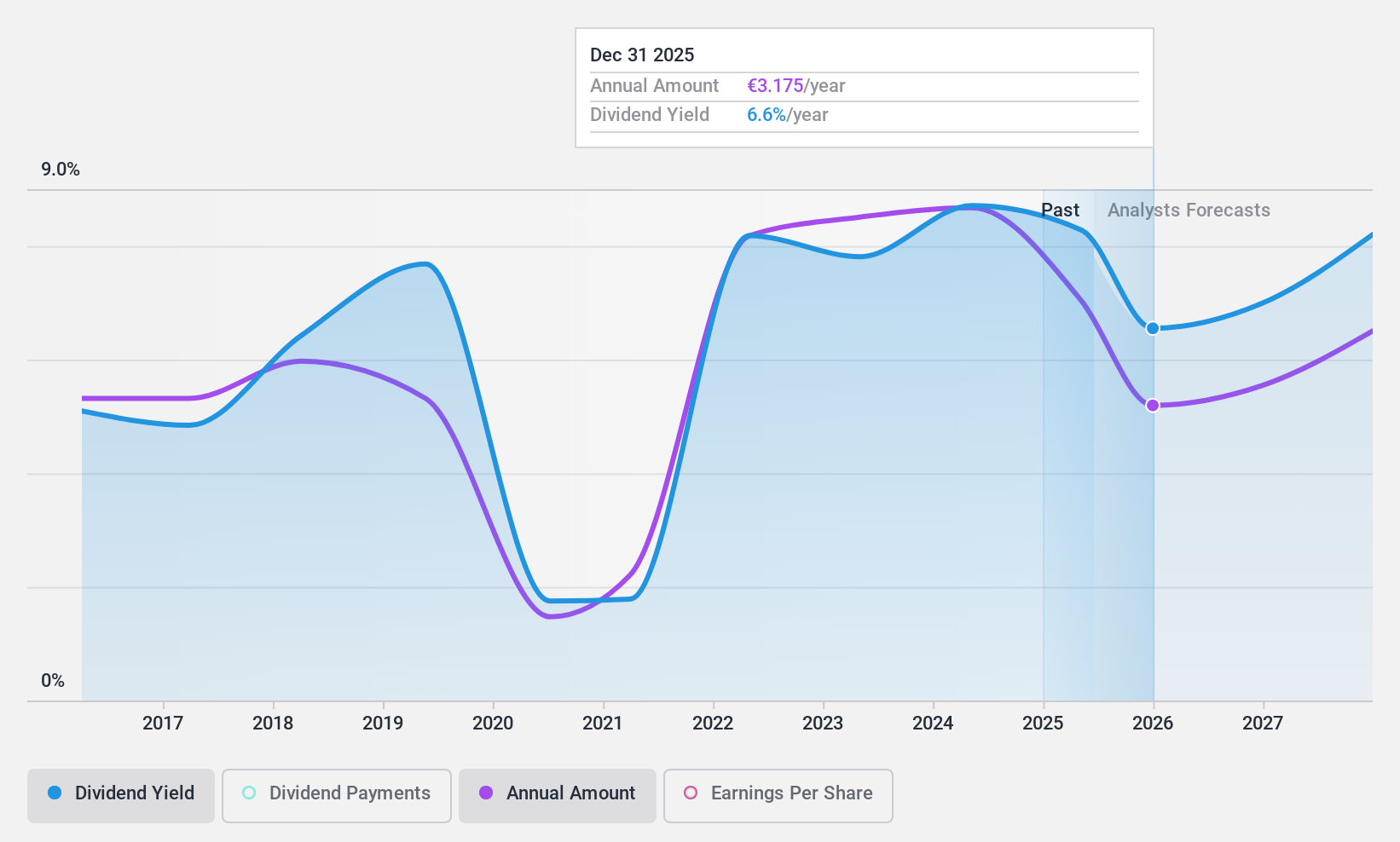

Dividend Yield: 8.8%

Mercedes-Benz Group AG, despite recent earnings declines, maintains a strong dividend profile with a payout ratio of 43.3% and cash payout ratio of 80.9%, indicating dividends are well-covered by both earnings and cash flows. However, its dividend history has been volatile over the past decade. The stock is trading at 64.7% below its estimated fair value and offers an attractive yield in the top 25% of German market payers at 8.83%.

- Click here to discover the nuances of Mercedes-Benz Group with our detailed analytical dividend report.

- Our valuation report here indicates Mercedes-Benz Group may be undervalued.

MPC Münchmeyer Petersen Capital (XTRA:MPCK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager with a market cap of €156.50 million.

Operations: MPC Münchmeyer Petersen Capital AG generates revenue primarily from Management Services (€33.76 million), Transaction Services (€7.26 million), and Miscellaneous sources (€1.03 million).

Dividend Yield: 6.1%

MPC Münchmeyer Petersen Capital AG's recent earnings report shows a significant improvement, with net income rising to €9.7 million from €5.75 million year-over-year. The company offers a dividend yield in the top 25% of German payers and maintains good value compared to peers. Despite only three years of dividend history, payments are well-covered by both earnings (54.8%) and cash flows (28.7%). However, its share price has been highly volatile recently, and dividends have yet to establish long-term stability.

- Get an in-depth perspective on MPC Münchmeyer Petersen Capital's performance by reading our dividend report here.

- The valuation report we've compiled suggests that MPC Münchmeyer Petersen Capital's current price could be quite moderate.

Logwin (XTRA:TGHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Logwin AG offers logistics and transport solutions across Germany, Austria, other European countries, Asia/Pacific, and globally with a market cap of €737.08 million.

Operations: Logwin AG generates revenue primarily through its Solutions segment (€275.78 million) and Air + Ocean segment (€954.25 million).

Dividend Yield: 5.5%

Logwin AG's dividend is well-covered by earnings with a payout ratio of 57% and cash flows with a cash payout ratio of 59.4%. Despite only seven years of dividend history, payments have been stable. However, recent earnings showed a decline, with net income dropping to €31.86 million from €40.49 million year-over-year for the half-year ended June 30, 2024. The stock trades at a discount to its estimated fair value but lacks long-term dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Logwin.

- Our valuation report unveils the possibility Logwin's shares may be trading at a discount.

Make It Happen

- Explore the 32 names from our Top German Dividend Stocks screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MBG

Mercedes-Benz Group

Operates as an automotive company in Germany and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives