- Germany

- /

- Capital Markets

- /

- XTRA:MPCK

Top 3 European Dividend Stocks To Consider

Reviewed by Simply Wall St

Amid recent fluctuations in global markets, the European stock landscape has seen a downturn, with major indexes like France's CAC 40 and Germany's DAX experiencing notable declines. Despite these challenges, resilient economic indicators in the Eurozone suggest potential opportunities for investors seeking stability through dividend stocks. In such an environment, a good dividend stock is often characterized by its ability to provide consistent returns even when market conditions are volatile.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.33% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.73% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 7.20% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.10% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.14% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.67% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.77% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.59% | ★★★★★☆ |

Click here to see the full list of 221 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Holcim (SWX:HOLN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Holcim AG, along with its subsidiaries, offers building materials and solutions globally and has a market cap of CHF36.93 billion.

Operations: Holcim AG generates revenue from its building materials and solutions business worldwide, with a segment adjustment of CHF28.83 billion and corporate/eliminations of CHF-2.60 billion.

Dividend Yield: 4.6%

Holcim's dividend is appealing, with a 4.63% yield placing it in the top quartile of Swiss dividend payers. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 54.2% and 50.5%, respectively, indicating sustainability. Despite recent share price volatility, Holcim has consistently increased its dividends over the past decade. Recent strategic initiatives include a significant investment in sustainable cement production in Greece and innovative carbon capture technology partnerships, enhancing long-term growth prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of Holcim.

- Insights from our recent valuation report point to the potential undervaluation of Holcim shares in the market.

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG, with a market cap of CHF1.16 billion, operates cogwheel railway and winter sports facilities in the Jungfrau region of Switzerland through its subsidiaries.

Operations: Jungfraubahn Holding AG generates revenue from several segments, including CHF42.04 million from Winter Sports, CHF56.13 million from Experience Mountains, and CHF191.97 million from Jungfraujoch - TOP of Europe.

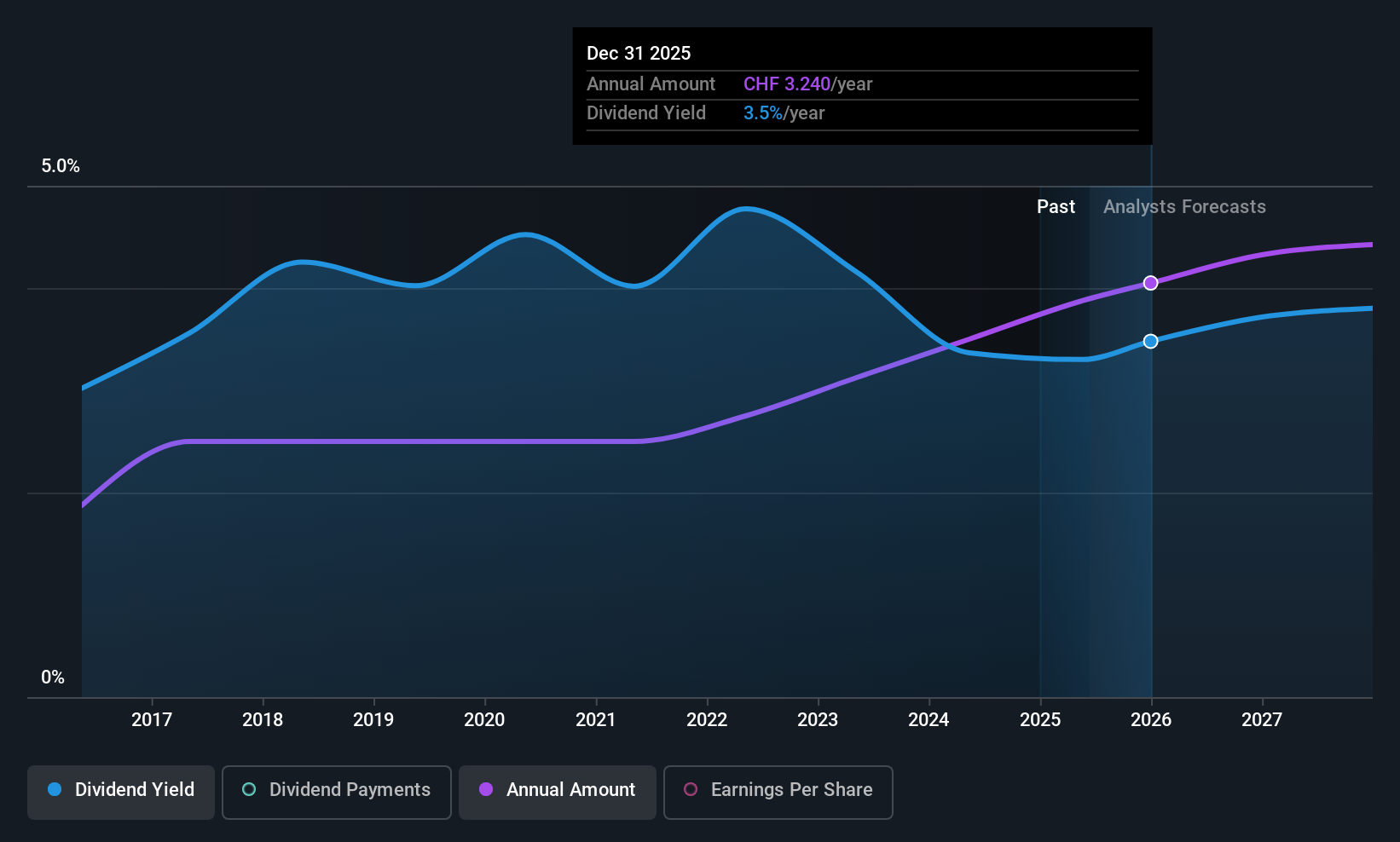

Dividend Yield: 3.6%

Jungfraubahn Holding's dividend yield of 3.61% falls short of the top Swiss payers, but its payout ratios of 56% for earnings and 51.7% for cash flows suggest coverage is sustainable. Despite a history of volatility and unreliability over the past decade, dividends have shown some growth during this period. The stock's price-to-earnings ratio at 15.6x is attractive compared to the broader Swiss market, potentially offering value for investors seeking stable returns.

- Click to explore a detailed breakdown of our findings in Jungfraubahn Holding's dividend report.

- In light of our recent valuation report, it seems possible that Jungfraubahn Holding is trading beyond its estimated value.

MPC Münchmeyer Petersen Capital (XTRA:MPCK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager with a market cap of €175.89 million.

Operations: MPC Münchmeyer Petersen Capital AG generates revenue primarily from Management Services (€36.22 million), Transaction Services (€6.84 million), and Miscellaneous activities (€2.16 million).

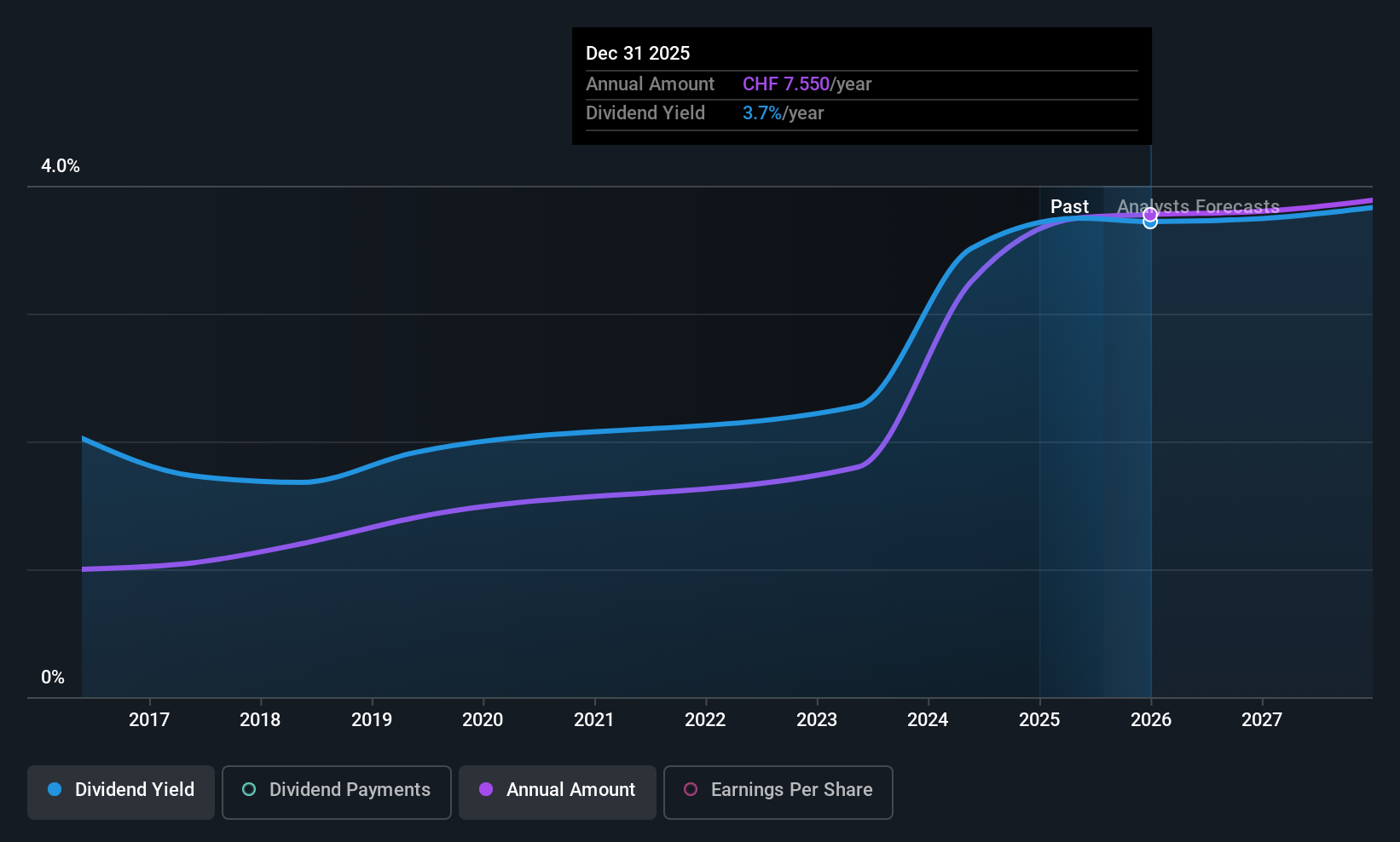

Dividend Yield: 5.4%

MPC Münchmeyer Petersen Capital's dividend yield of 5.41% ranks in the top 25% of German payers, supported by sustainable payout ratios—56.6% from earnings and 64.6% from cash flows. Although dividends have grown steadily, the company has only a three-year history of payments, indicating limited reliability data. Recent Q1 results showed increased sales (EUR 11.79 million) and net income (EUR 6.41 million), aligning with confirmed revenue guidance for 2025 between EUR 43 million and EUR 47 million.

- Click here to discover the nuances of MPC Münchmeyer Petersen Capital with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that MPC Münchmeyer Petersen Capital is priced lower than what may be justified by its financials.

Summing It All Up

- Click here to access our complete index of 221 Top European Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MPCK

Undervalued with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026