- Germany

- /

- Capital Markets

- /

- XTRA:MPCK

Jiangsu Tianmu Lake TourismLtd And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating indices and mixed economic signals, investors are increasingly turning their attention to dividend stocks for potential stability and income. In this context, understanding what makes a strong dividend stock is crucial; typically, these are companies with consistent earnings, robust cash flow, and a commitment to returning value to shareholders—qualities that can be particularly appealing amid today's uncertain market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.87% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.92% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Globeride (TSE:7990) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.39% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.11% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

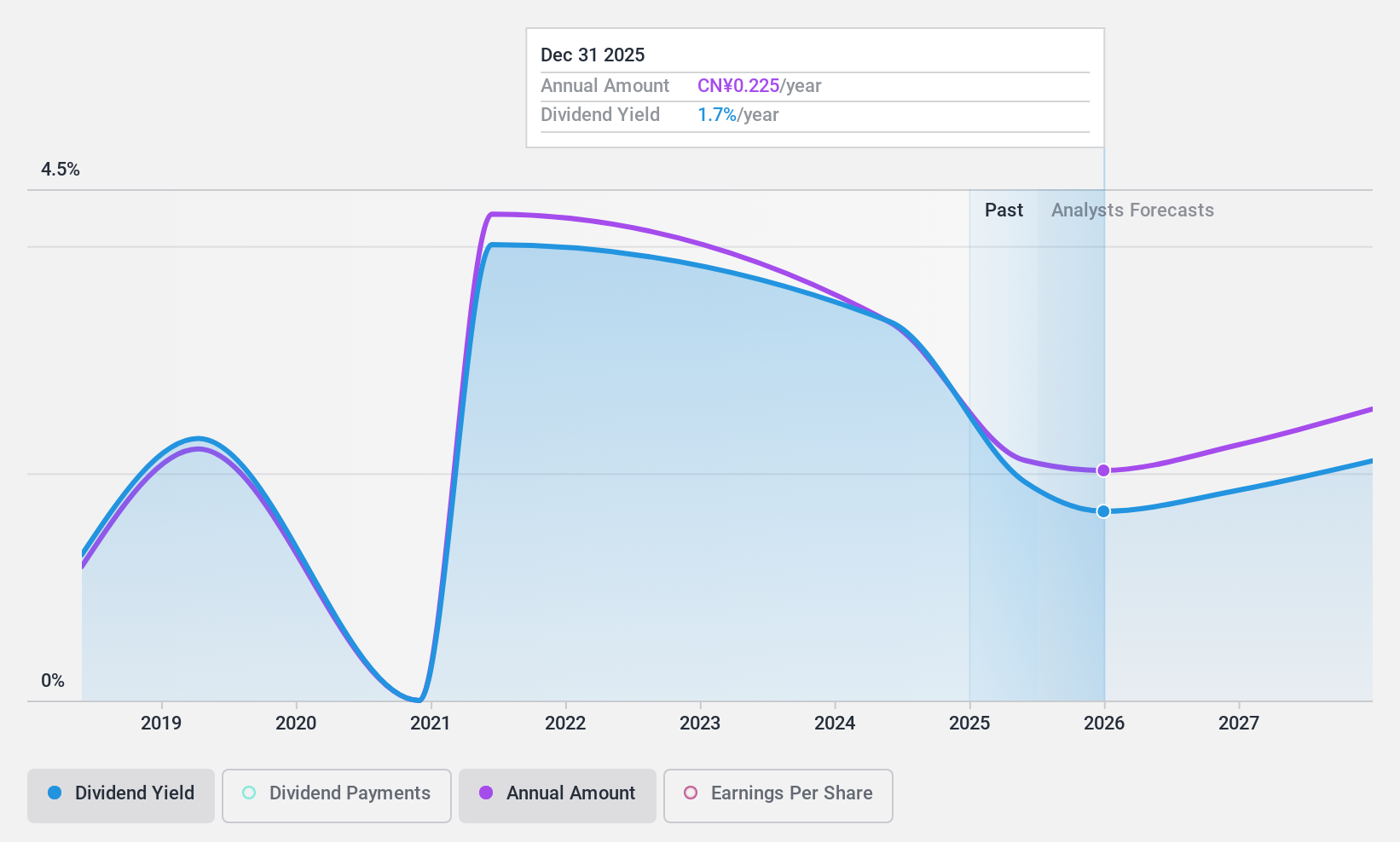

Jiangsu Tianmu Lake TourismLtd (SHSE:603136)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Tianmu Lake Tourism Co., Ltd. operates a tourism resort in China and has a market cap of CN¥3.21 billion.

Operations: Jiangsu Tianmu Lake Tourism Co., Ltd. generates revenue from operating a tourism resort in China.

Dividend Yield: 3.1%

Jiangsu Tianmu Lake Tourism Ltd. has shown a commitment to dividend payments, with its current payout ratio of 87.3% covered by earnings and a cash payout ratio of 68.8%. However, the company has only paid dividends for six years, and these have been volatile during this period. Recent earnings reports indicate declining revenue and net income compared to last year, which could impact future dividend sustainability despite being in the top 25% yield bracket in China at 3.11%.

- Click here and access our complete dividend analysis report to understand the dynamics of Jiangsu Tianmu Lake TourismLtd.

- The analysis detailed in our Jiangsu Tianmu Lake TourismLtd valuation report hints at an deflated share price compared to its estimated value.

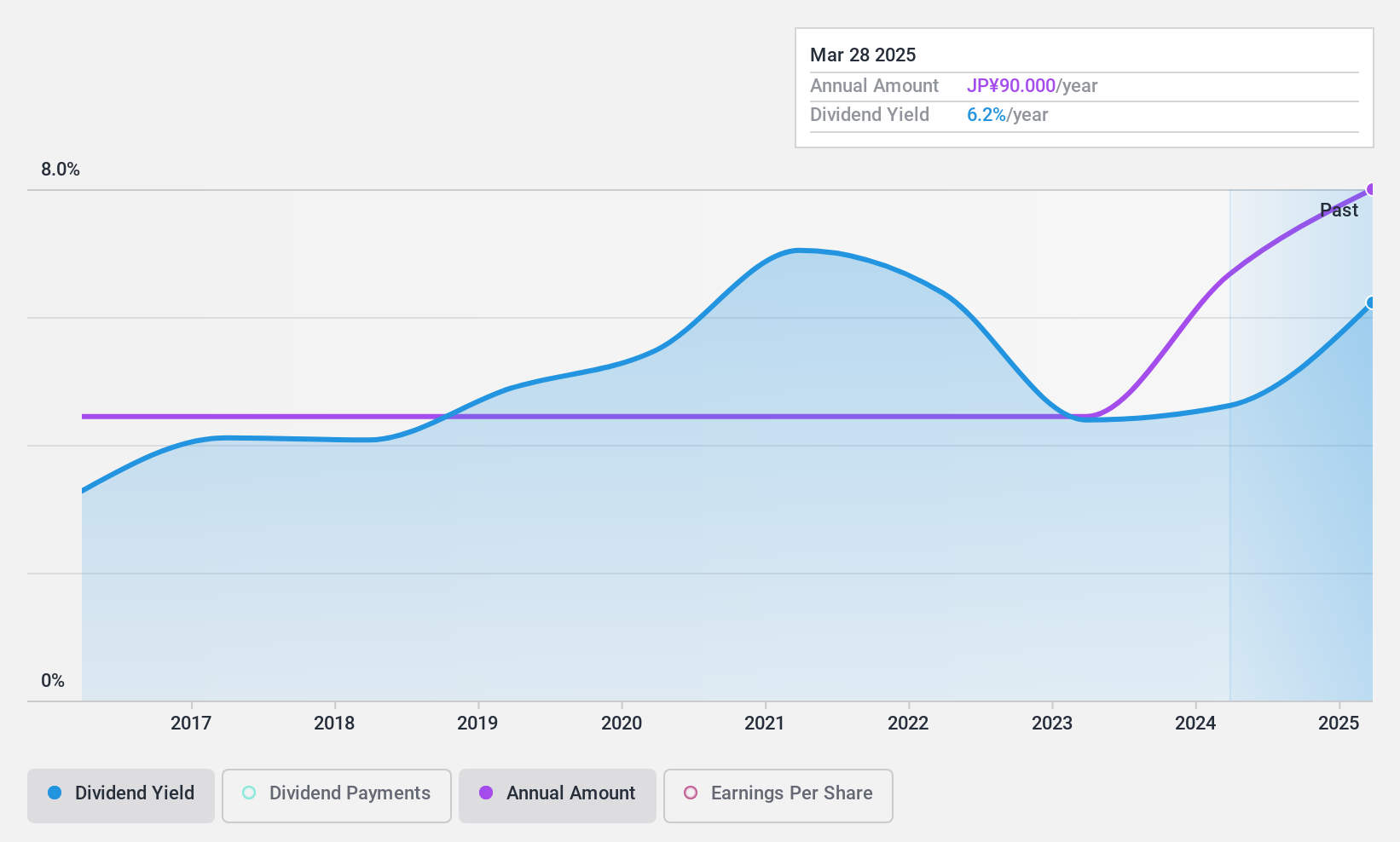

Mamiya-OP (TSE:7991)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mamiya-OP Co., Ltd. is a company that manufactures and sells electronic and sports equipment both in Japan and internationally, with a market cap of ¥15.67 billion.

Operations: Mamiya-OP Co., Ltd.'s revenue primarily comes from its Electronic Equipment Business, generating ¥25.77 billion, and its Sports Business, contributing ¥4.64 billion, with an additional ¥156.07 million from its Real Estate Business.

Dividend Yield: 4.9%

Mamiya-OP's dividend payments have been volatile and unreliable over the past decade, despite an overall increase. However, its dividends are well-covered by earnings and cash flows, with low payout ratios of 14.3% and 45.2%, respectively. The stock trades significantly below its estimated fair value, offering a dividend yield of 4.94%, placing it in the top quartile in Japan's market. Recent substantial profit growth may enhance future dividend stability but shareholder dilution remains a concern.

- Take a closer look at Mamiya-OP's potential here in our dividend report.

- According our valuation report, there's an indication that Mamiya-OP's share price might be on the cheaper side.

MPC Münchmeyer Petersen Capital (XTRA:MPCK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG is a publicly owned investment manager with a market cap of approximately €199.15 million.

Operations: MPC Münchmeyer Petersen Capital AG generates its revenue primarily from Management Services (€33.76 million) and Transaction Services (€7.26 million).

Dividend Yield: 5%

MPC Münchmeyer Petersen Capital's dividends have grown but are relatively new, with only three years of payments. The dividend yield stands at 5%, placing it among the top 25% in Germany. Dividends are well-covered by earnings and cash flows, with payout ratios of 54.8% and 28.7%, respectively. Despite trading at a discount to its fair value, the company has an unstable dividend track record due to its short history of payments and large one-off items impacting results.

- Get an in-depth perspective on MPC Münchmeyer Petersen Capital's performance by reading our dividend report here.

- Our valuation report here indicates MPC Münchmeyer Petersen Capital may be undervalued.

Turning Ideas Into Actions

- Access the full spectrum of 1928 Top Dividend Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MPCK

Excellent balance sheet, good value and pays a dividend.