- Germany

- /

- Capital Markets

- /

- XTRA:MLP

Discovering Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi And 2 Other Hidden Small Caps With Strong Foundations

Reviewed by Simply Wall St

In a global market environment characterized by mixed economic signals and fluctuating indices, small-cap stocks have faced notable challenges, with the Russell 2000 Index underperforming compared to its larger counterparts. As central banks globally adjust interest rates to navigate economic uncertainties, investors are increasingly seeking out small-cap companies that demonstrate strong fundamentals and resilience in this shifting landscape. Identifying stocks with solid foundations is crucial for navigating such volatile conditions, providing potential opportunities amid broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Nitto Fuji Flour MillingLtd | 0.86% | 6.39% | 4.69% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi (IBSE:AVPGY)

Simply Wall St Value Rating: ★★★★★★

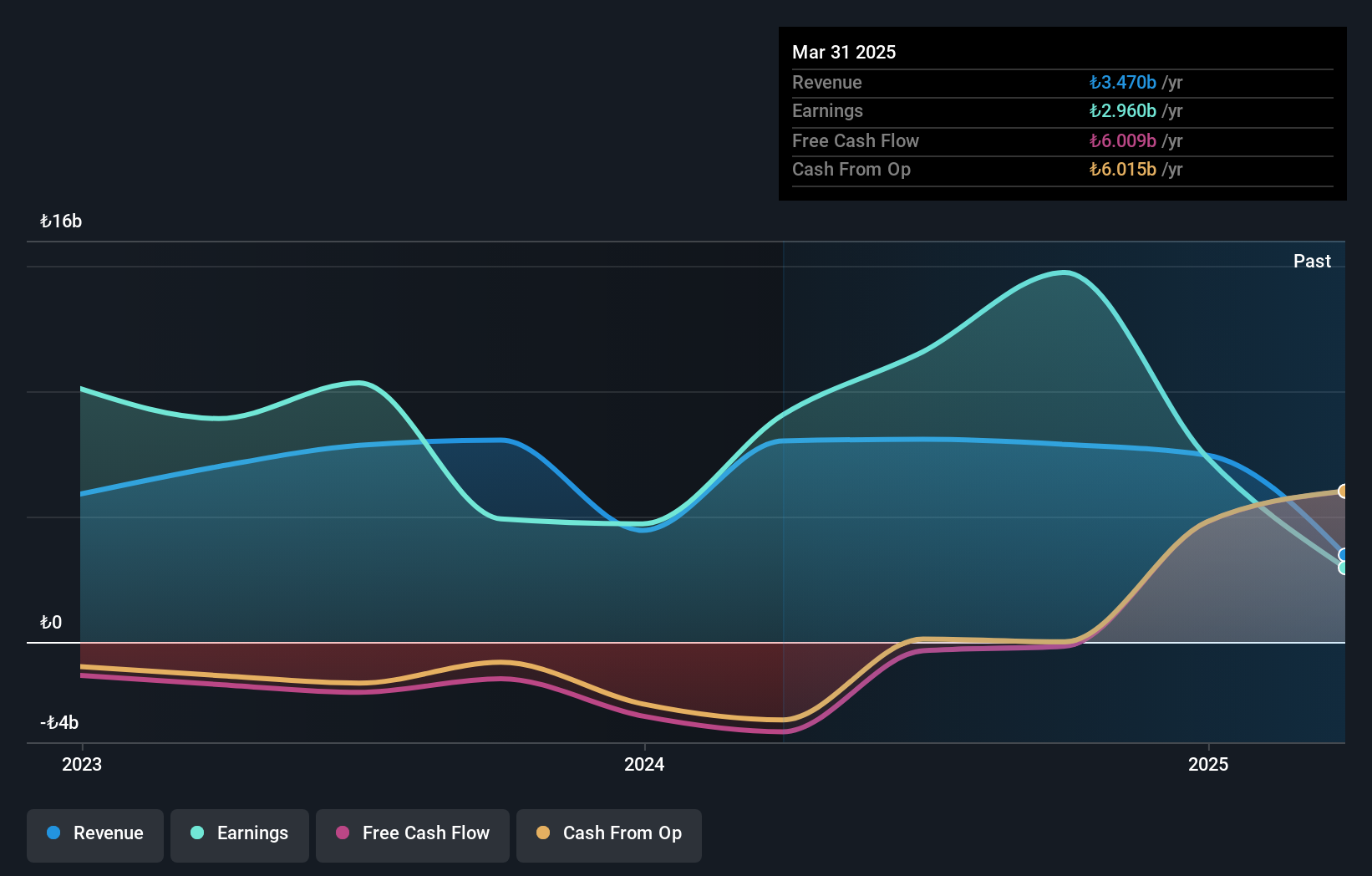

Overview: Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi operates in Turkey, focusing on real estate development, leasing, and business administration activities, with a market capitalization of TRY21.88 billion.

Operations: Avrupakent generates revenue primarily from its Residential and Office Project segment, contributing TRY788.23 million, and Rental Offices and Shopping Centers segment, adding TRY1.24 billion. The company's market capitalization stands at TRY21.88 billion.

Avrupakent Gayrimenkul Yatirim Ortakligi Anonim Sirketi, a small player in the real estate investment sector, has shown remarkable financial resilience. Its price-to-earnings ratio of 1.8x is significantly lower than the TR market average of 16.3x, suggesting potential undervaluation. The company is debt-free, eliminating concerns over interest payments and showcasing robust earnings growth of 150% over the past year—far outpacing the REITs industry average of -50%. Recent reports highlight a turnaround with third-quarter net income at TRY 75.88 million compared to a loss last year, alongside nine-month sales reaching TRY 5.59 billion from TRY 3.20 billion previously.

IG Port (TSE:3791)

Simply Wall St Value Rating: ★★★★★★

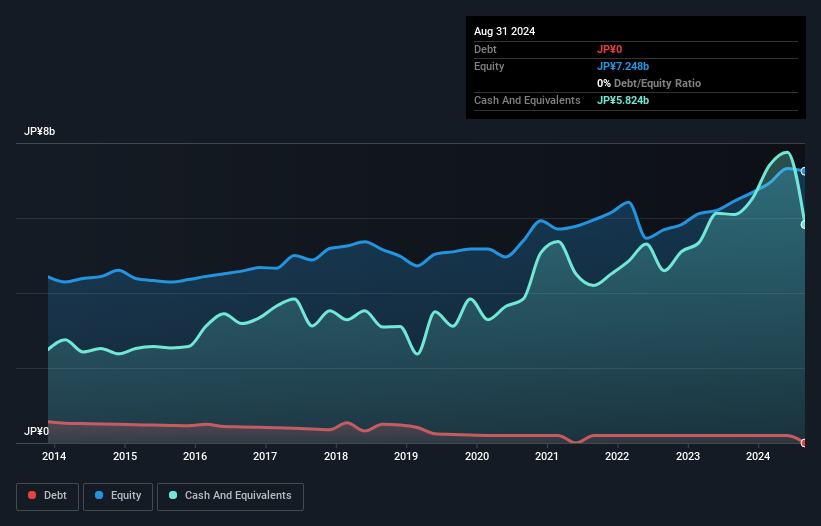

Overview: IG Port, Inc., along with its subsidiaries, is an animation production company serving both Japanese and international markets with a market cap of ¥50.45 billion.

Operations: IG Port generates revenue primarily through animation production, with a market cap of ¥50.45 billion. The company's financial performance is influenced by its cost structure and operational efficiencies, impacting its net profit margin.

IG Port, a nimble player in the entertainment sector, recently joined the S&P Global BMI Index, marking a notable milestone. This company boasts impressive earnings growth of 23.7% over the past year, outpacing the industry average of -7%. With no debt on its books and a history of reducing its debt-to-equity ratio from 4.5% five years ago to zero today, financial stability seems strong. The firm is also free cash flow positive with US$1.83 million recorded recently and has high-quality earnings that enhance investor confidence despite recent share price volatility.

- Delve into the full analysis health report here for a deeper understanding of IG Port.

Gain insights into IG Port's historical performance by reviewing our past performance report.

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★☆

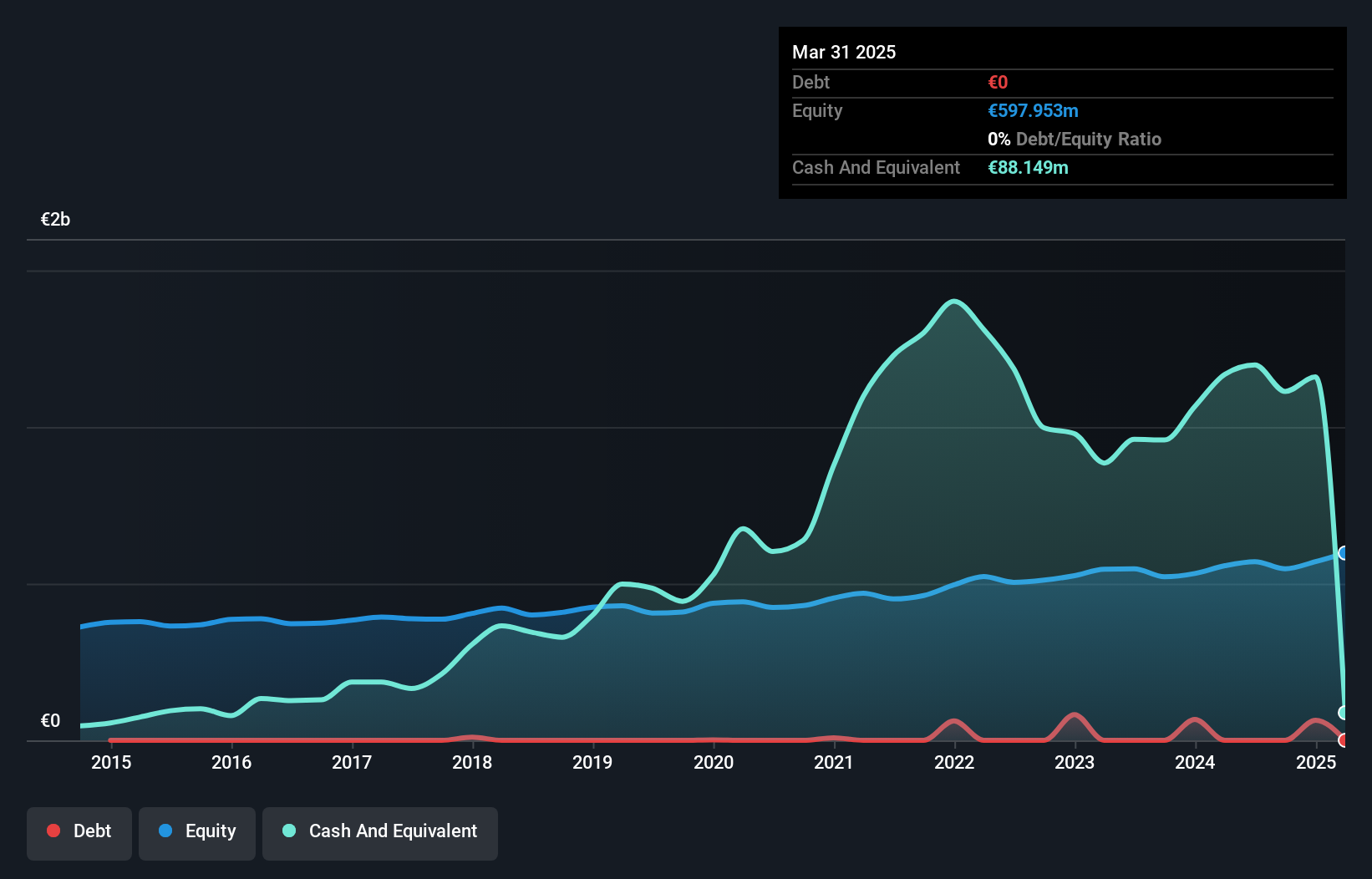

Overview: MLP SE, with a market cap of €649.23 million, operates in Germany offering financial services to private, corporate, and institutional clients through its subsidiaries.

Operations: MLP SE generates revenue primarily from Financial Consulting (€436.56 million), FERI (€253.38 million), and Banking (€216.22 million) segments, with additional contributions from DOMCURA and Deutschland.Immobilien.

MLP is capturing attention with its robust financial health and promising growth trajectory. Trading at 47% below its estimated fair value, this company offers potential upside for investors. In the past year, MLP's earnings surged by 30%, outpacing the Capital Markets industry average of 11.6%. The firm remains debt-free, eliminating concerns over interest payments and enhancing financial flexibility. Recent announcements reveal impressive figures: Q3 sales hit €245 million compared to €205 million last year, while net income rose to €10 million from €7 million previously. With a raised EBIT forecast between €85-95 million for 2024, MLP seems poised for continued success in the coming years.

- Click here and access our complete health analysis report to understand the dynamics of MLP.

Review our historical performance report to gain insights into MLP's's past performance.

Seize The Opportunity

- Navigate through the entire inventory of 4507 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MLP

MLP

Provides financial services to private, corporate, and institutional clients in Germany.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives