As global markets navigate a landscape marked by geopolitical tensions and economic uncertainties, investors are increasingly focused on the stability and income potential offered by dividend stocks. In this environment, companies that consistently provide reliable dividends can be appealing for their ability to offer a steady income stream amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.73% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.00% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.79% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.23% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 2012 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

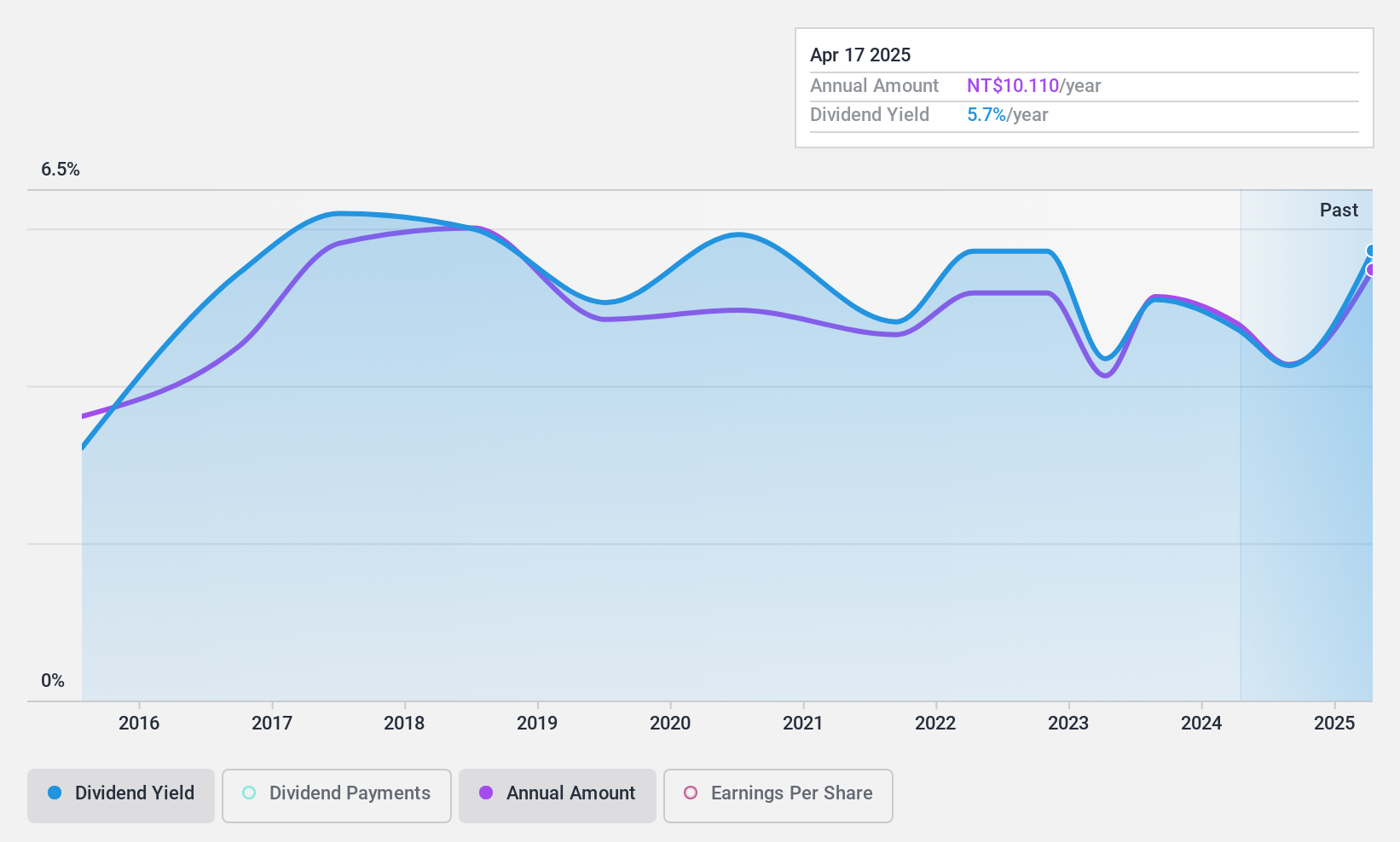

ADDCN Technology (TPEX:5287)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ADDCN Technology Co., Ltd, along with its subsidiaries, operates online trading platforms in Taiwan and internationally, with a market cap of NT$11.31 billion.

Operations: ADDCN Technology Co., Ltd generates revenue primarily from its portal segment, amounting to NT$2.24 billion.

Dividend Yield: 4.2%

ADDCN Technology's dividend payments have been volatile over the past decade, with a payout ratio of 73.5% covered by earnings and a cash payout ratio of 65.5% covered by cash flows, indicating sustainability despite past instability. Trading at good value relative to peers and industry, the stock is priced 7.3% below its estimated fair value. Its dividend yield of 4.18% is slightly below the top quartile in Taiwan's market but has seen growth over ten years.

- Delve into the full analysis dividend report here for a deeper understanding of ADDCN Technology.

- Our expertly prepared valuation report ADDCN Technology implies its share price may be lower than expected.

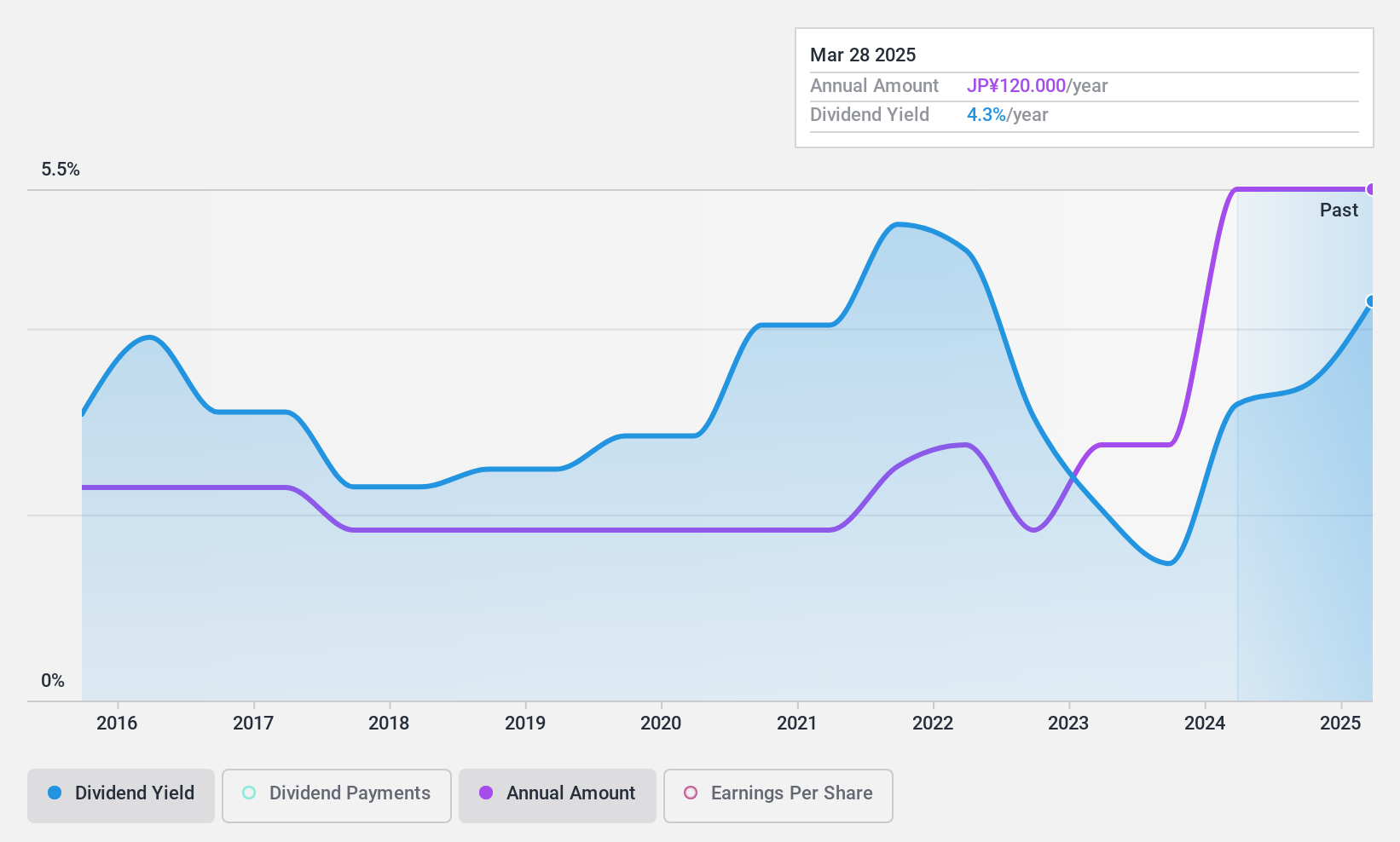

Daikoku Denki (TSE:6430)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Daikoku Denki Co., Ltd. specializes in the development, production, and sale of computer and information system equipment for pachinko halls in Japan, with a market cap of ¥39.59 billion.

Operations: Daikoku Denki Co., Ltd. generates revenue through its development, production, and sale of computer and information system equipment specifically designed for pachinko halls in Japan.

Dividend Yield: 4.5%

Daikoku Denki's dividend payments have grown over the past decade, supported by a low payout ratio of 5.3% and a cash payout ratio of 27.6%, ensuring sustainability through earnings and cash flows. Despite this, the dividends have been volatile, with an unstable track record over ten years. The stock offers a competitive dividend yield of 4.48%, ranking in the top quartile of Japan's market, while trading significantly below its estimated fair value.

- Unlock comprehensive insights into our analysis of Daikoku Denki stock in this dividend report.

- The valuation report we've compiled suggests that Daikoku Denki's current price could be quite moderate.

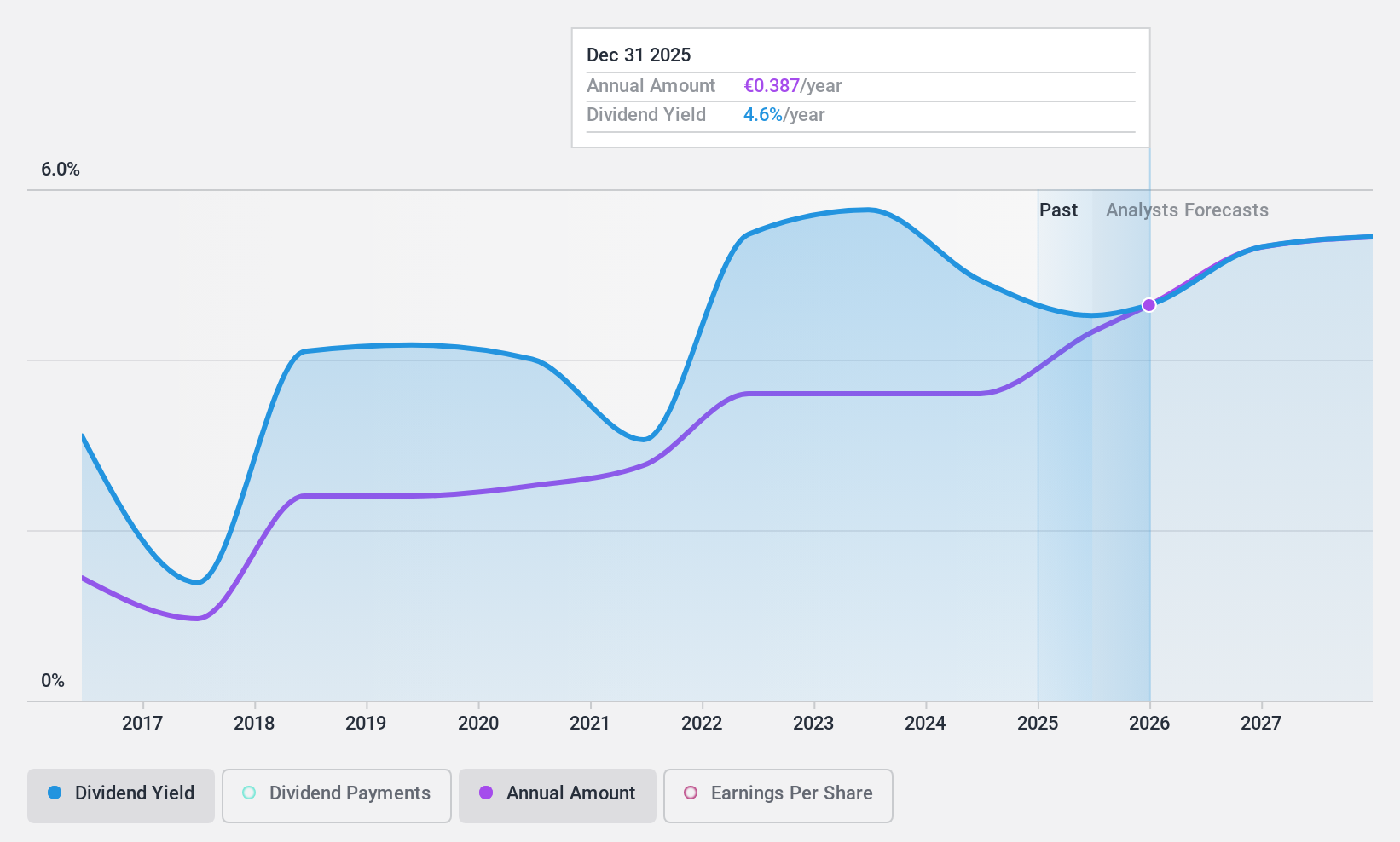

MLP (XTRA:MLP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MLP SE, with a market cap of €755.65 million, offers financial services to private, corporate, and institutional clients in Germany through its subsidiaries.

Operations: MLP SE generates revenue through various segments, including Financial Consulting (€436.56 million), FERI (€253.38 million), Banking (€216.22 million), DOMCURA (€128.50 million), Deutschland.Immobilien (€57.54 million), and Industrial Broker (€37.20 million).

Dividend Yield: 4.3%

MLP's dividend payments are well-supported by a low cash payout ratio of 15.5% and a reasonable earnings payout ratio of 51.1%, indicating strong coverage by both cash flows and earnings. However, the dividends have been volatile over the past decade, with an unstable track record. Despite this, MLP's dividends have grown over ten years, though its current yield of 4.33% is slightly below Germany's top quartile for dividend payers.

- Take a closer look at MLP's potential here in our dividend report.

- Our valuation report unveils the possibility MLP's shares may be trading at a discount.

Key Takeaways

- Unlock our comprehensive list of 2012 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6430

Daikoku Denki

Daikoku Denki Co., Ltd. development, production, and sale of computer and other information system equipment for pachinko halls in Japan.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives