- Sweden

- /

- Electric Utilities

- /

- OM:DE

Exploring Dala Energi And 2 Other Undiscovered Gems In Europe

Reviewed by Simply Wall St

In the wake of higher-than-expected U.S. trade tariffs, European markets have experienced significant volatility, with the pan-European STOXX Europe 600 Index seeing its largest drop in five years. Amidst this challenging environment, investors are increasingly seeking resilient small-cap stocks that demonstrate strong fundamentals and adaptability to navigate economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| FRoSTA | 6.15% | 4.62% | 14.67% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -2.06% | -8.96% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Dala Energi (OM:DE)

Simply Wall St Value Rating: ★★★★★★

Overview: Dala Energi AB (publ) is a Swedish company that supplies electricity, heating, and fiber networks, with a market capitalization of approximately SEK2.63 billion.

Operations: Dala Energi generates revenue primarily from supplying electricity, heating, and fiber networks. The company's financial performance is highlighted by a market capitalization of approximately SEK2.63 billion.

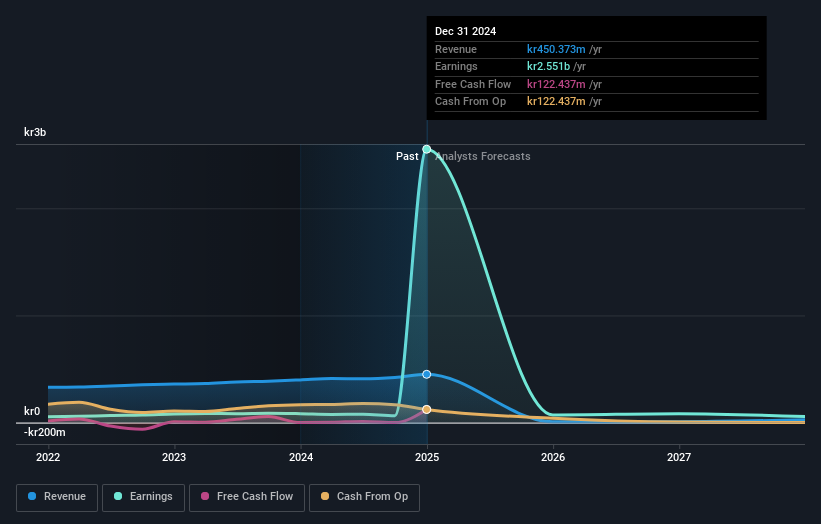

Dala Energi's recent performance paints a compelling picture, with earnings skyrocketing by 2971.4% over the past year, significantly outpacing the Electric Utilities industry's modest 1.4% growth. The company reported net income of SEK 2.55 billion for 2024, compared to SEK 83.07 million in the previous year, highlighting robust profitability despite being debt-free and having reduced its debt from a ratio of 57.4% five years ago. While its price-to-earnings ratio at just 1x suggests it is undervalued against the Swedish market's average of 20.3x, future earnings are expected to decline significantly over the next three years.

- Delve into the full analysis health report here for a deeper understanding of Dala Energi.

Explore historical data to track Dala Energi's performance over time in our Past section.

JDC Group (XTRA:JDC)

Simply Wall St Value Rating: ★★★★★☆

Overview: JDC Group AG is a financial services company operating in Germany and Austria with a market capitalization of €265.02 million.

Operations: The company generates revenue primarily through its financial services operations in Germany and Austria, with a market capitalization of €265.02 million.

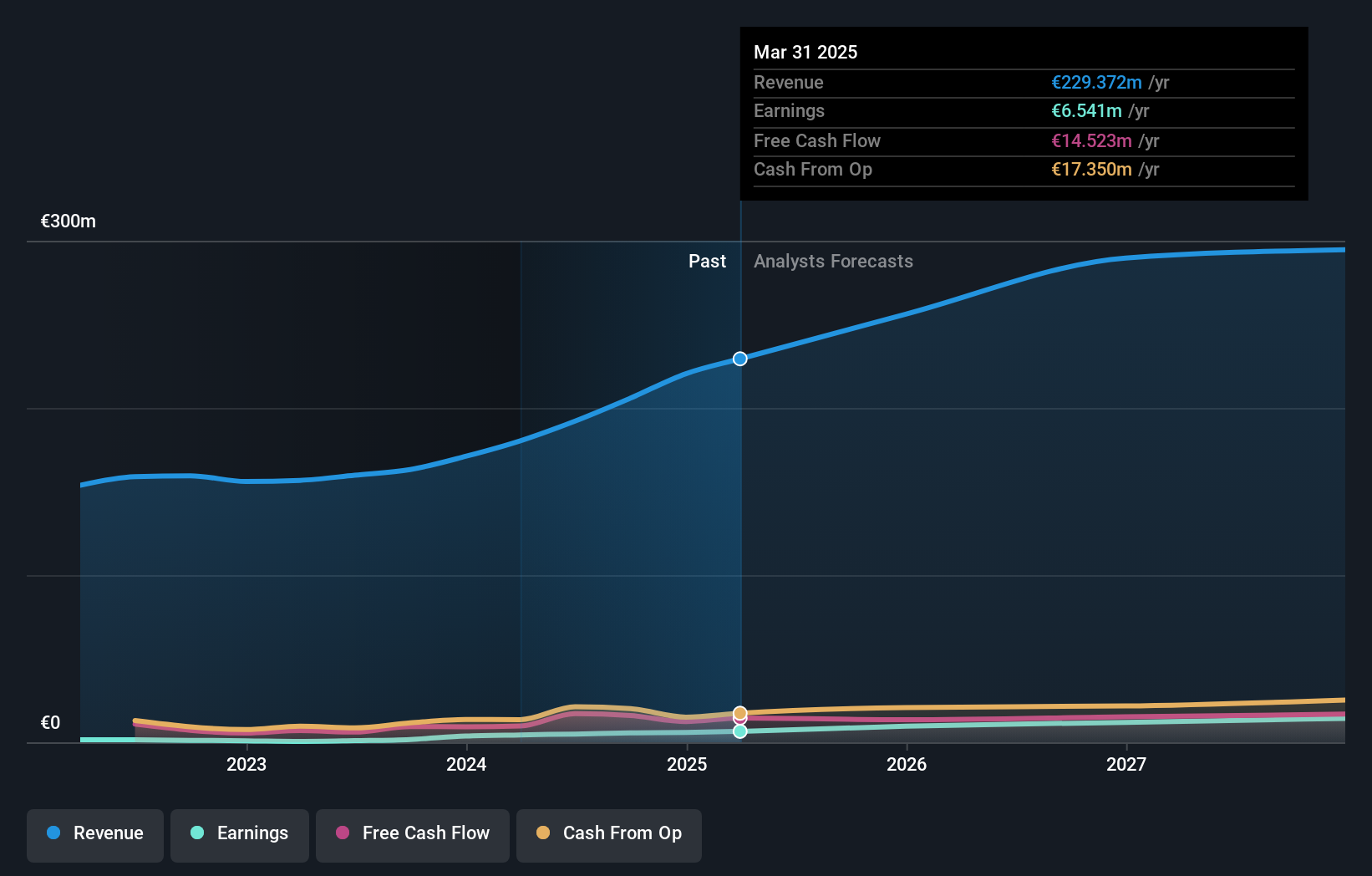

JDC Group, a financial services player in Germany and Austria, is making waves with its impressive earnings growth of 55.8% over the past year, outpacing the industry average of 19.7%. The company has significantly reduced its debt to equity ratio from 104.5% to 34.7% in five years and enjoys high-quality earnings with positive free cash flow. Recent results show net income rising to €5.87 million from €3.77 million last year, while basic earnings per share improved from €0.28 to €0.43. Future revenue is expected between €245 million and €265 million for 2025, highlighting strong growth potential despite competitive pressures and economic uncertainties.

Uzin Utz (XTRA:UZU)

Simply Wall St Value Rating: ★★★★★★

Overview: Uzin Utz SE is engaged in the development, manufacturing, and sale of construction chemical system products across Germany, the United States, Netherlands, and other international markets with a market cap of €277.44 million.

Operations: Uzin Utz generates revenue primarily from the sale of construction chemical system products. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

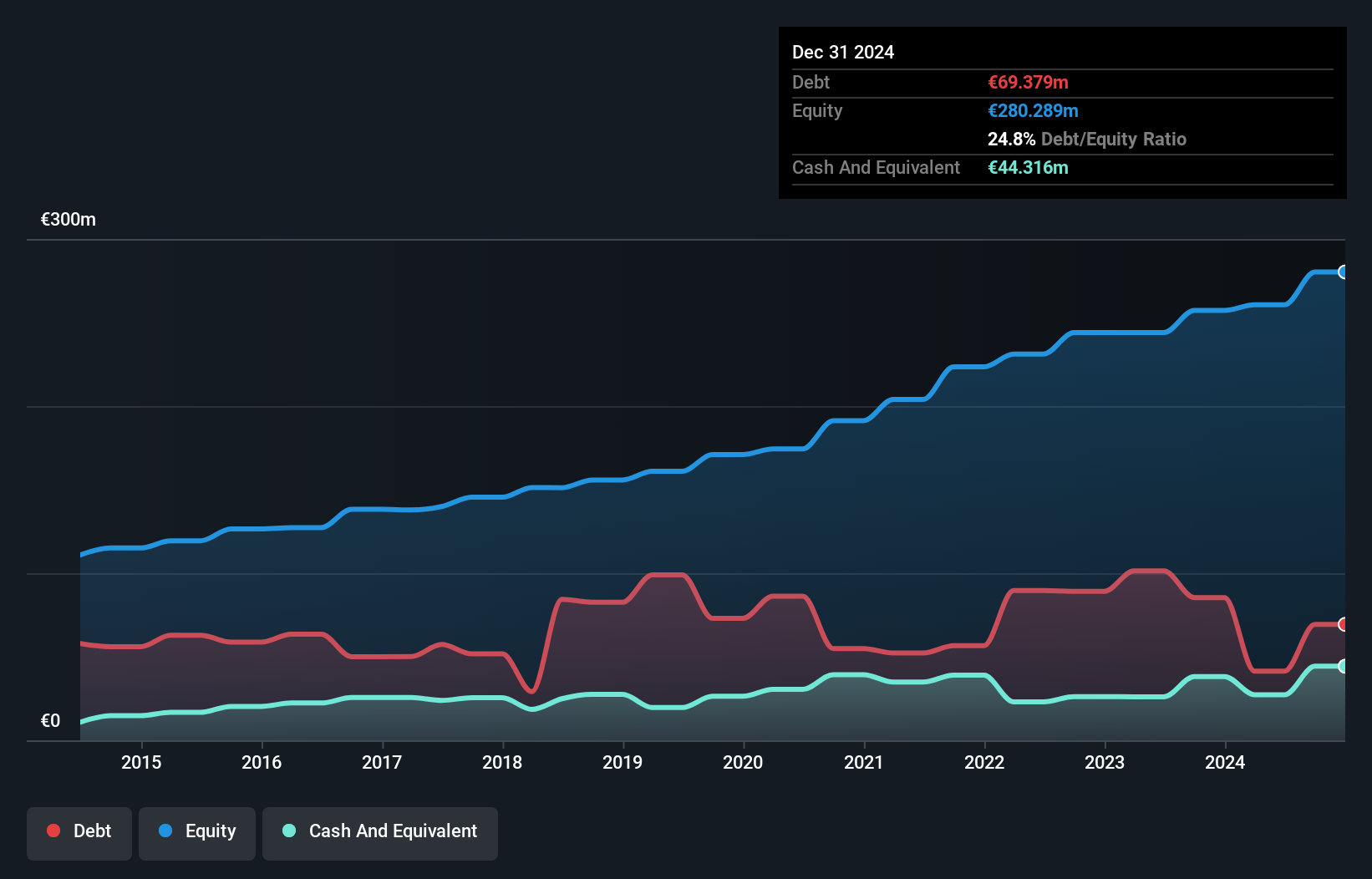

Uzin Utz, a player in the European chemicals sector, has demonstrated robust financial health with net income climbing to €29.44 million from €22.58 million last year and basic earnings per share rising to €5.84 from €4.48. The company seems undervalued with a price-to-earnings ratio of 9.4x, notably lower than Germany's market average of 17.1x, suggesting potential for value investors. Uzin Utz's debt management appears effective as its net debt to equity ratio improved significantly over five years from 42.7% to 24.8%. Additionally, the recent dividend increase to €1.90 per share indicates confidence in future cash flows and profitability prospects.

Seize The Opportunity

- Unlock our comprehensive list of 346 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dala Energi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DE

Dala Energi

Operates as a supplier of electricity, heating, and fiber networks in Sweden.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives