- Germany

- /

- Capital Markets

- /

- XTRA:JDC

Discovering Three European Small Caps with Promising Potential

Reviewed by Simply Wall St

In the current European market landscape, small-cap stocks are navigating a complex environment marked by geopolitical tensions and economic shifts, as evidenced by the pan-European STOXX Europe 600 Index's recent decline. Despite these challenges, small-cap companies often present unique opportunities for growth due to their agility and potential for innovation in response to evolving market conditions. As we explore three European small caps with promising potential, it's essential to consider how these companies can leverage their strategic positioning and adaptability in today's dynamic economic climate.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Castellana Properties Socimi | 53.49% | 7.49% | 44.78% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

SpareBank 1 Helgeland (OB:HELG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SpareBank 1 Helgeland offers a range of financial products and services to retail customers, small and medium enterprises, municipal authorities, and institutions in Norway, with a market capitalization of NOK4.76 billion.

Operations: The bank generates revenue primarily from its Retail and Corporate Market segments, with NOK452 million from retail customers and NOK304 million from the corporate market.

SpareBank 1 Helgeland, a relatively small player in the banking sector, boasts total assets of NOK39 billion and total equity of NOK5.1 billion. With earnings growth of 11% over the past year, it outpaces the industry average of 7.1%. The bank's allowance for bad loans stands at a low 42%, while non-performing loans are appropriately managed at 1.9%. Trading at nearly 26% below its estimated fair value suggests potential upside for investors looking for undervalued opportunities. Despite not being free cash flow positive, its high-quality earnings and primarily low-risk funding sources offer stability and confidence in its operations.

Cloetta (OM:CLA B)

Simply Wall St Value Rating: ★★★★★★

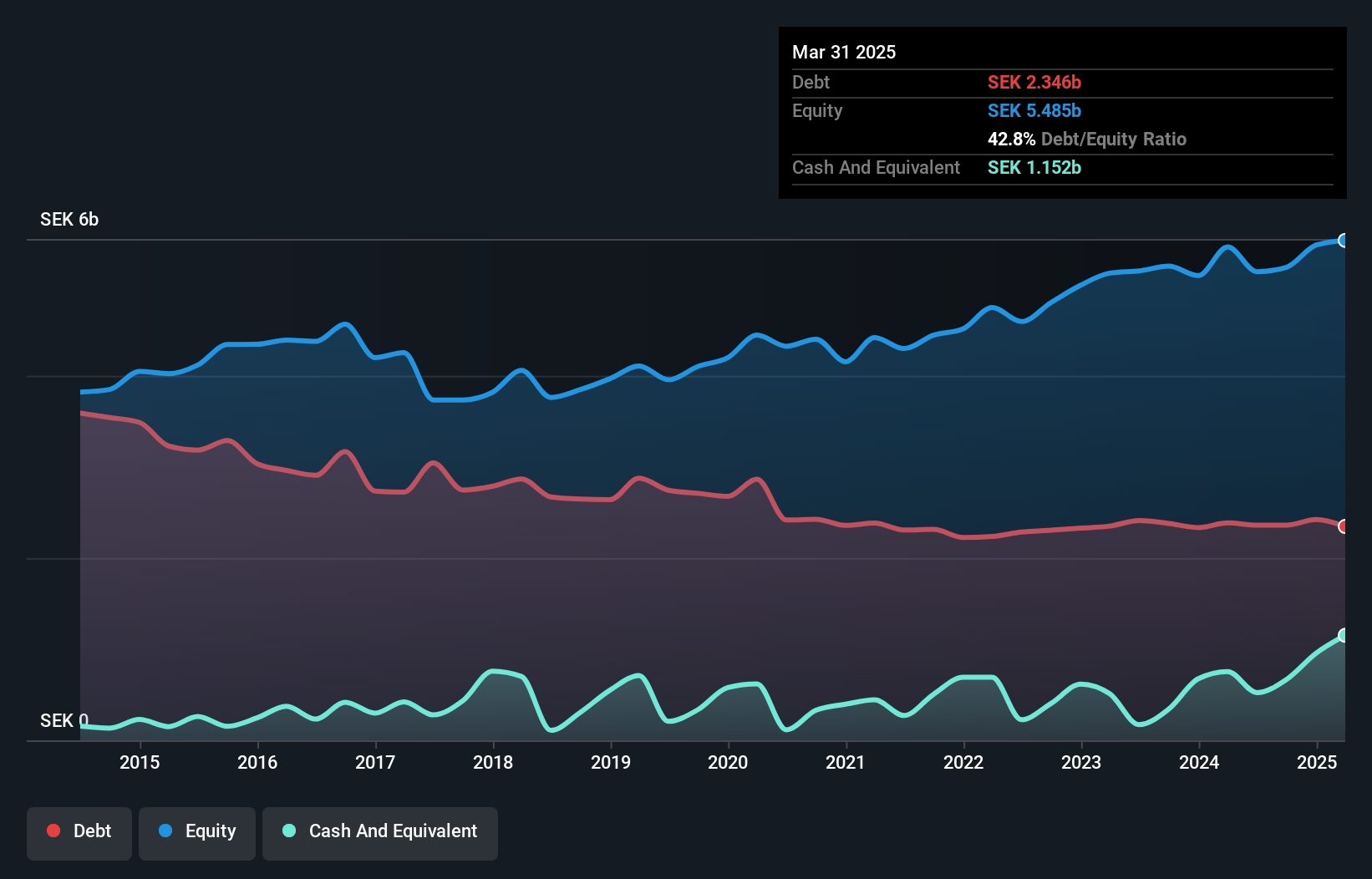

Overview: Cloetta AB (publ) is a confectionery company with a market capitalization of approximately SEK9.65 billion.

Operations: Cloetta generates revenue primarily from two segments: packaged branded goods, contributing SEK6.14 billion, and pick & mix, accounting for SEK2.42 billion.

Cloetta, a notable player in the European confectionery scene, has been making waves with its robust financial performance. The company's earnings have surged by 30.1% over the past year, outpacing the Food industry average of 20%. Its debt to equity ratio has impressively dropped from 64.5% to 42.8% over five years, indicating effective debt management. Recent results show net income at SEK 253 million for Q1 2025, compared to SEK 107 million a year ago, while basic earnings per share rose from SEK 0.37 to SEK 0.89. Cloetta's dividend policy now targets payouts above half of profit after tax, suggesting confidence in sustained profitability and growth potential within its market niche.

JDC Group (XTRA:JDC)

Simply Wall St Value Rating: ★★★★★☆

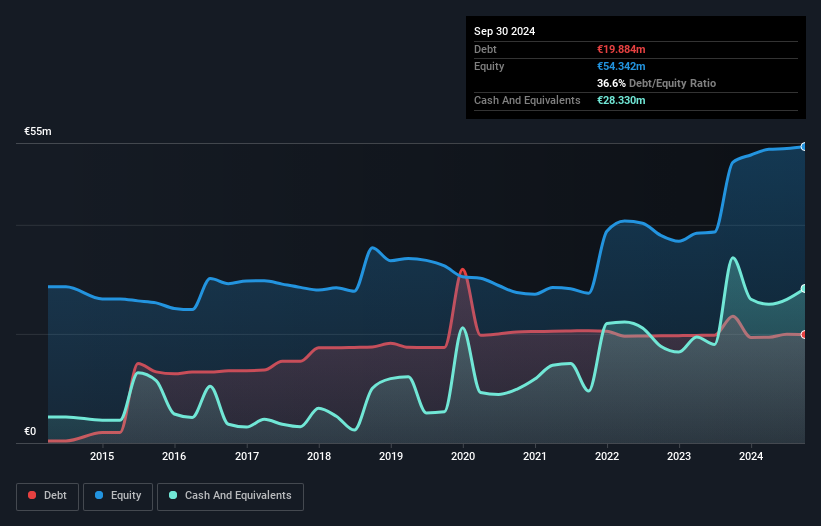

Overview: JDC Group AG is a financial services company operating in Germany and Austria with a market capitalization of approximately €319.10 million.

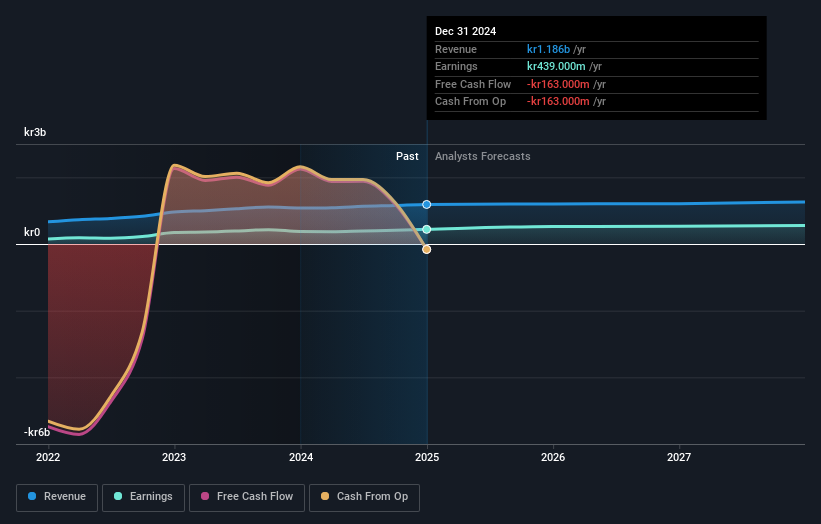

Operations: JDC Group AG generates revenue primarily from its Advisortech segment, contributing €204.04 million, and the Advisory segment with €43.71 million. The Transfer segment shows a negative contribution of -€19.78 million.

JDC Group, a financial services firm in Germany and Austria, is making strides with a focus on digital transformation and AI-driven automation. Over the past year, its earnings surged by 47.5%, outpacing the Capital Markets industry average of 19.4%. The company reported net income of €2.77 million for Q1 2025, up from €2.09 million the previous year, with basic earnings per share rising to €0.20 from €0.15. JDC's debt-to-equity ratio improved significantly over five years to 33%, indicating stronger financial health as it continues to pursue strategic mergers and acquisitions for revenue diversification amidst market challenges.

Where To Now?

- Delve into our full catalog of 337 European Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:JDC

JDC Group

Operates as a financial services company in Germany and Austria.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives