- Switzerland

- /

- Machinery

- /

- SWX:SRAIL

Top European Growth Stocks With Insider Ownership September 2025

Reviewed by Simply Wall St

As the European markets navigate a period of mixed performance, with the pan-European STOXX Europe 600 Index slightly down amid global growth concerns and currency fluctuations, investors are increasingly focusing on growth companies with significant insider ownership. In this environment, stocks that combine potential for expansion with strong insider stakes can be particularly appealing, as they often indicate confidence from those closest to the company's operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13.1% | 112.0% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 73.9% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| Circus (XTRA:CA1) | 24.5% | 72.6% |

| CD Projekt (WSE:CDR) | 29.7% | 42.7% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.7% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Let's dive into some prime choices out of the screener.

INFICON Holding (SWX:IFCN)

Simply Wall St Growth Rating: ★★★★☆☆

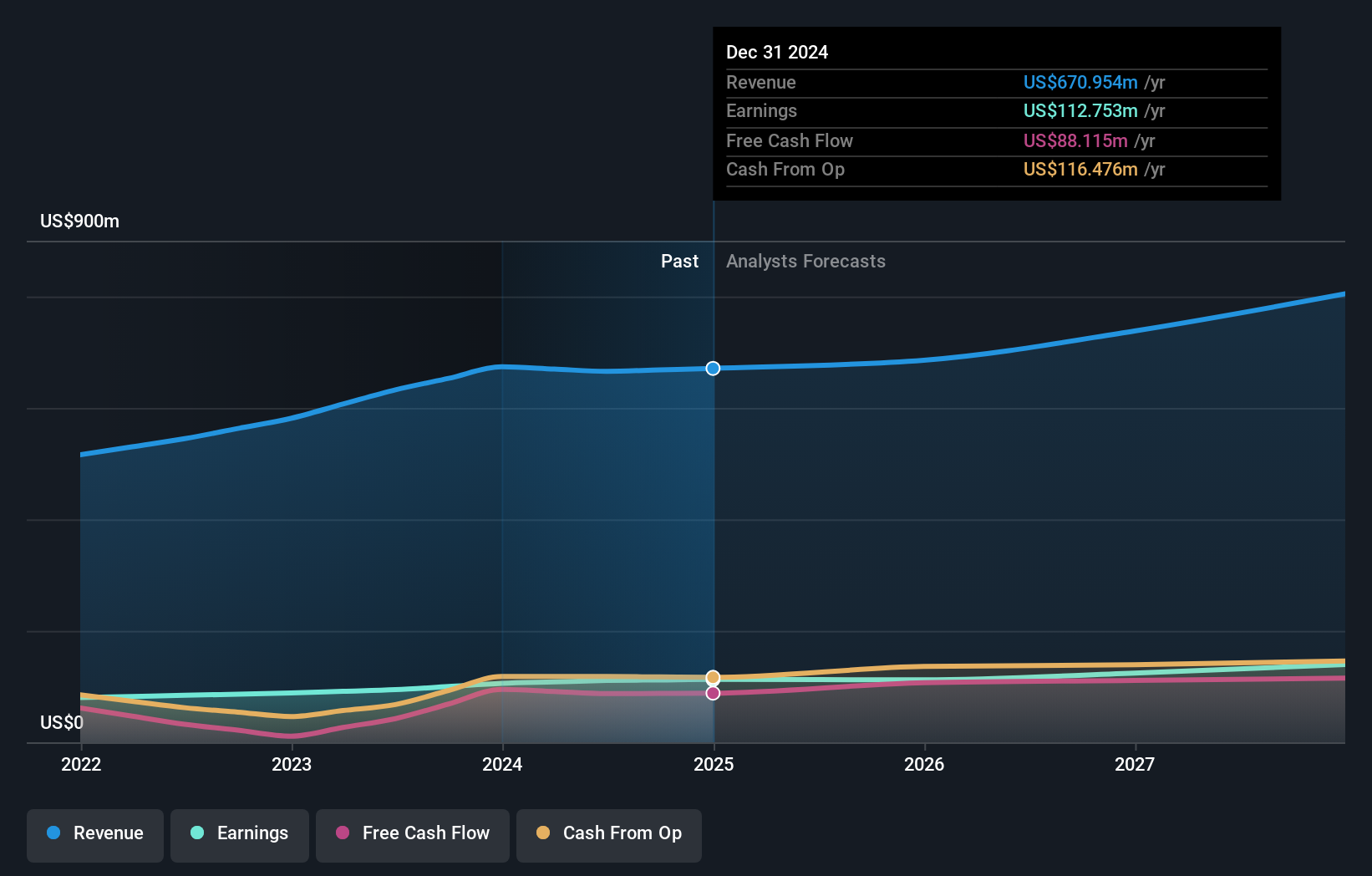

Overview: INFICON Holding AG specializes in developing instruments for gas analysis, measurement, and control both in Switzerland and internationally, with a market cap of CHF2.30 billion.

Operations: The company's revenue segments include instruments for gas analysis, measurement, and control across various international markets.

Insider Ownership: 11%

INFICON Holding demonstrates potential as a growth company with high insider ownership. Despite recent earnings guidance revision and lower net income for the first half of 2025, its forecasted earnings growth of 12.79% annually surpasses the Swiss market average. Revenue is expected to grow at 8% per year, outpacing the local market's 4%. The company's Return on Equity is projected to reach a robust 24.7%, indicating strong future profitability prospects.

- Delve into the full analysis future growth report here for a deeper understanding of INFICON Holding.

- Our valuation report unveils the possibility INFICON Holding's shares may be trading at a premium.

Stadler Rail (SWX:SRAIL)

Simply Wall St Growth Rating: ★★★★★☆

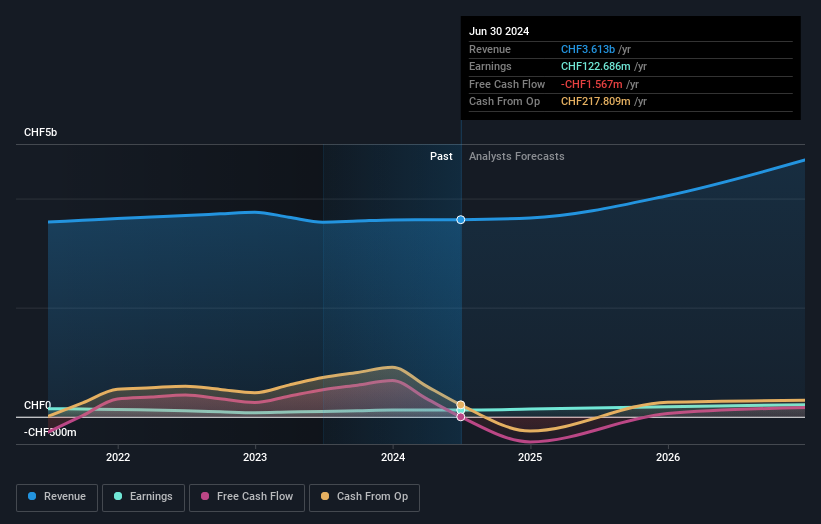

Overview: Stadler Rail AG, with a market cap of CHF2.02 billion, manufactures and sells trains across Switzerland, Germany, Austria, Europe, the Americas, CIS countries and other international markets.

Operations: Stadler Rail's revenue segments include CHF87.31 million from Signalling, CHF2.83 billion from Rolling Stock, and CHF949.78 million from Service & Components.

Insider Ownership: 14.5%

Stadler Rail shows promise as a growth company with high insider ownership, despite challenges in recent earnings. While net income fell to CHF 17.07 million for H1 2025, revenue increased to CHF 1.40 billion from the previous year. Earnings are expected to grow significantly at 52.44% annually, outpacing the Swiss market average, while revenue is forecasted to exceed CHF 5 billion by 2026 with substantial order book commitments for future years.

- Click to explore a detailed breakdown of our findings in Stadler Rail's earnings growth report.

- Our valuation report here indicates Stadler Rail may be overvalued.

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

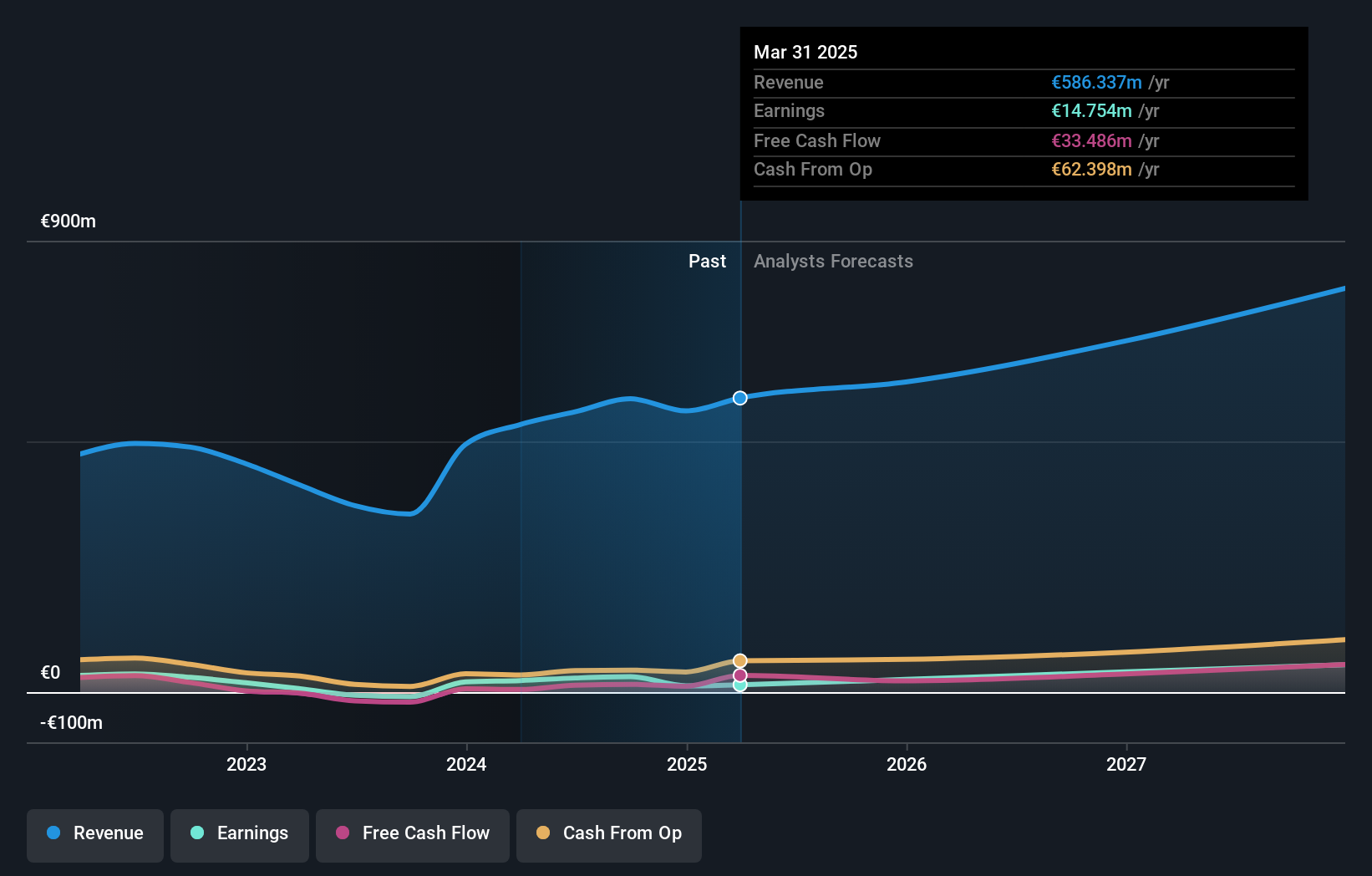

Overview: Hypoport SE develops, operates, and markets technology platforms for the credit, housing, and insurance industries in Germany with a market cap of approximately €926.58 million.

Operations: The company's revenue segments include Financing Platforms (€77.69 million), Insurance Platforms (€65.71 million), and Real Estate & Mortgage Platforms (€453.13 million).

Insider Ownership: 33.3%

Hypoport's earnings are projected to grow significantly at 41.3% annually, surpassing the German market average. Recent results for Q2 2025 showed sales of €145.77 million and net income of €4.83 million, both improving from last year. Despite lower profit margins than the previous year, revenue growth is expected to outpace the German market at 9.8% annually. Insider trading activity over three months shows no substantial buying or selling, reflecting stability in insider sentiment.

- Take a closer look at Hypoport's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Hypoport shares in the market.

Turning Ideas Into Actions

- Dive into all 213 of the Fast Growing European Companies With High Insider Ownership we have identified here.

- Curious About Other Options? Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SRAIL

Stadler Rail

Through its subsidiaries, engages in the manufacture and sale of trains in Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, the CIS countries, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives