- Switzerland

- /

- Luxury

- /

- SWX:UHR

3 European Growth Stocks With Insider Ownership Up To 33%

Reviewed by Simply Wall St

As European markets continue to show resilience, with the pan-European STOXX Europe 600 Index closing 2.35% higher and major single-country indexes also rising, investors are paying close attention to growth opportunities within the region. In this context, companies with high insider ownership often attract interest as they can indicate strong confidence from those who know the business best, potentially aligning management's interests with shareholders'.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Underneath we present a selection of stocks filtered out by our screen.

INFICON Holding (SWX:IFCN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: INFICON Holding AG develops instruments for gas analysis, measurement, and control in Switzerland and internationally, with a market cap of CHF2.55 billion.

Operations: INFICON Holding AG generates revenue through its development of instruments for gas analysis, measurement, and control across various markets in Switzerland and internationally.

Insider Ownership: 10%

INFICON Holding AG demonstrates potential as a growth company with high insider ownership, supported by its forecasted earnings growth of 12.7% annually, surpassing the Swiss market average. The company's revenue is expected to grow at 7.8% per year, which is faster than the broader market but not significantly high. Despite share price volatility and no recent insider trading activity, INFICON's P/E ratio of 30.6x suggests good value relative to industry peers and it maintains a robust return on equity forecast of 24.7%. Recent guidance indicates confidence in order volumes despite external uncertainties impacting sales projections between US$660 million and US$680 million for 2025 with an operating margin around 16%-17%.

- Delve into the full analysis future growth report here for a deeper understanding of INFICON Holding.

- Upon reviewing our latest valuation report, INFICON Holding's share price might be too optimistic.

Swatch Group (SWX:UHR)

Simply Wall St Growth Rating: ★★★★☆☆

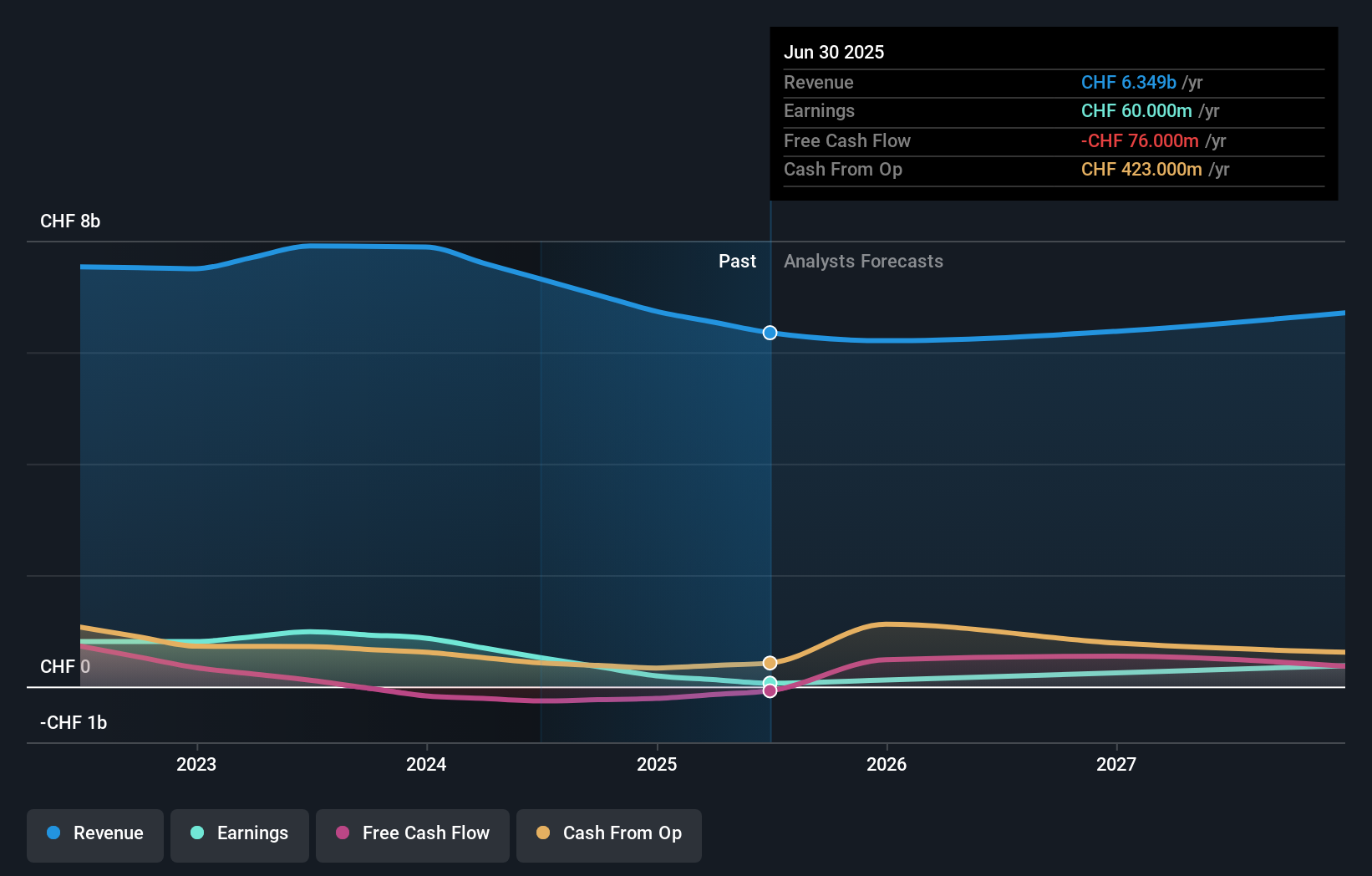

Overview: The Swatch Group AG is a global company that designs, manufactures, and sells watches, jewelry, and watch components across various regions including Switzerland, Europe, Greater China, Asia, America, Oceania, and Africa with a market cap of CHF8.70 billion.

Operations: The company's revenue is primarily derived from its Watches & Jewelry segment, which accounts for CHF6.01 billion, and its Electronic Systems segment, contributing CHF355 million.

Insider Ownership: 11.2%

Swatch Group's earnings are projected to grow significantly at 40.2% per year, outpacing the Swiss market's 10.4%. However, revenue growth is moderate at 4.1% annually, slightly above the market average but not high overall. The company's return on equity forecast remains low at 2.9%, and profit margins have declined from last year’s figures of 7.1% to 0.9%. No substantial insider trading activity has been reported recently, and dividend coverage is weak.

- Unlock comprehensive insights into our analysis of Swatch Group stock in this growth report.

- The valuation report we've compiled suggests that Swatch Group's current price could be inflated.

Hypoport (XTRA:HYQ)

Simply Wall St Growth Rating: ★★★★☆☆

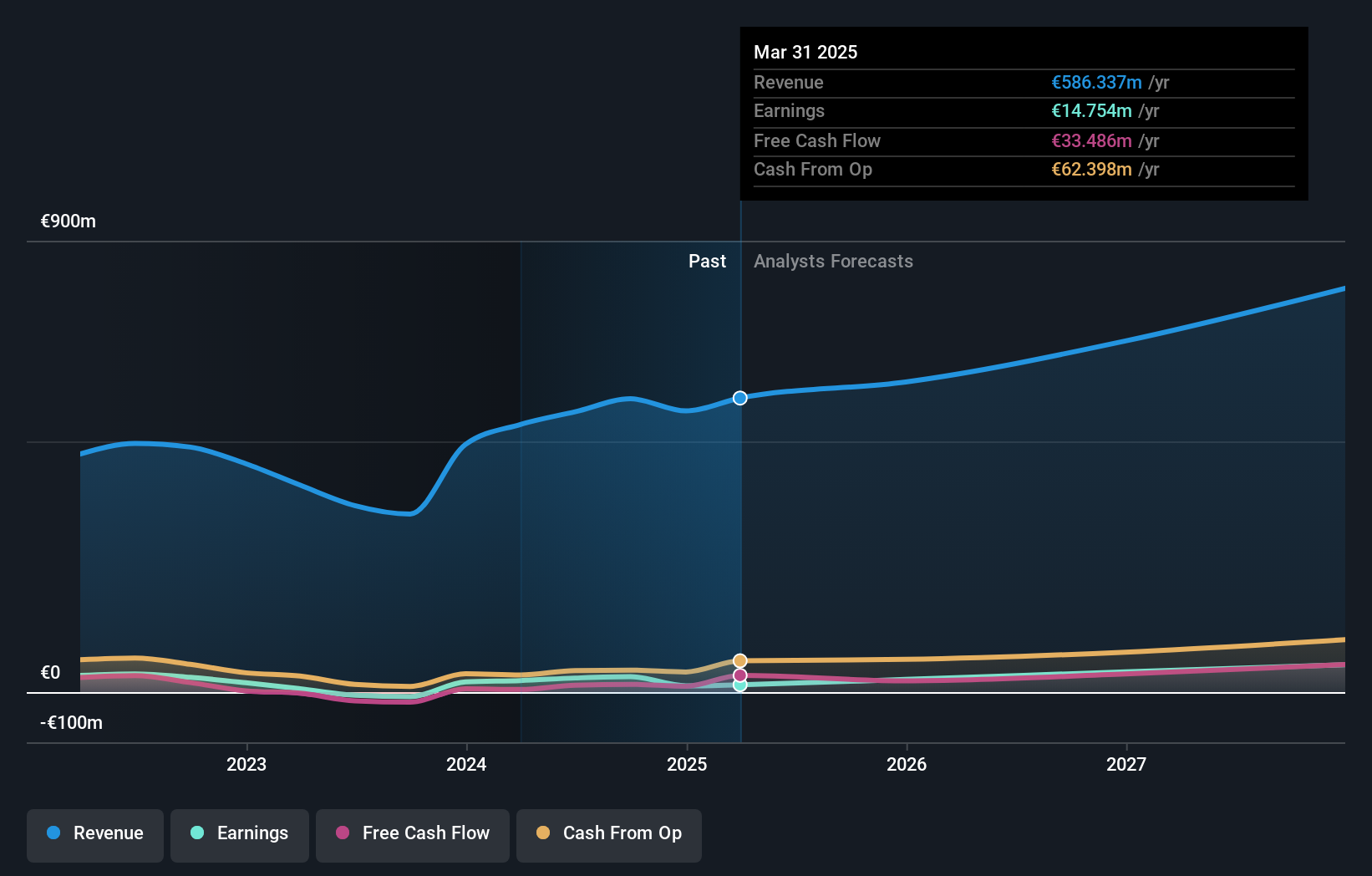

Overview: Hypoport SE develops, operates, and markets technology platforms for the credit, housing, and insurance industries in Germany with a market cap of €913.24 million.

Operations: The company's revenue is derived from its Financing Platforms (€80.32 million), Insurance Platforms (€63.95 million), and Real Estate & Mortgage Platforms (€466.36 million).

Insider Ownership: 33.3%

Hypoport's earnings are expected to grow significantly at 35.3% annually, surpassing the German market's 16.9%. Revenue growth is forecasted at 9.9% per year, above the market average but not exceptionally high. The company's recent quarterly results showed improved net income of €15.42 million, up from €7.31 million a year ago, despite a volatile share price and declining profit margins from last year's figures of 6.9% to 2.7%. No substantial insider trading activity has been observed recently.

- Navigate through the intricacies of Hypoport with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Hypoport's shares may be trading at a premium.

Summing It All Up

- Discover the full array of 205 Fast Growing European Companies With High Insider Ownership right here.

- Ready For A Different Approach? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UHR

Swatch Group

Designs, manufactures, and sells finished watches, jewelry, and watch movements and components in Switzerland, rest of Europe, Greater China, rest of Asia, America, Oceania, and Africa.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026