- Germany

- /

- Capital Markets

- /

- XTRA:DWS

DWS Group (XTRA:DWS) Margin Jump Challenges Cautious Forecasts Despite Revenue Decline Outlook

Reviewed by Simply Wall St

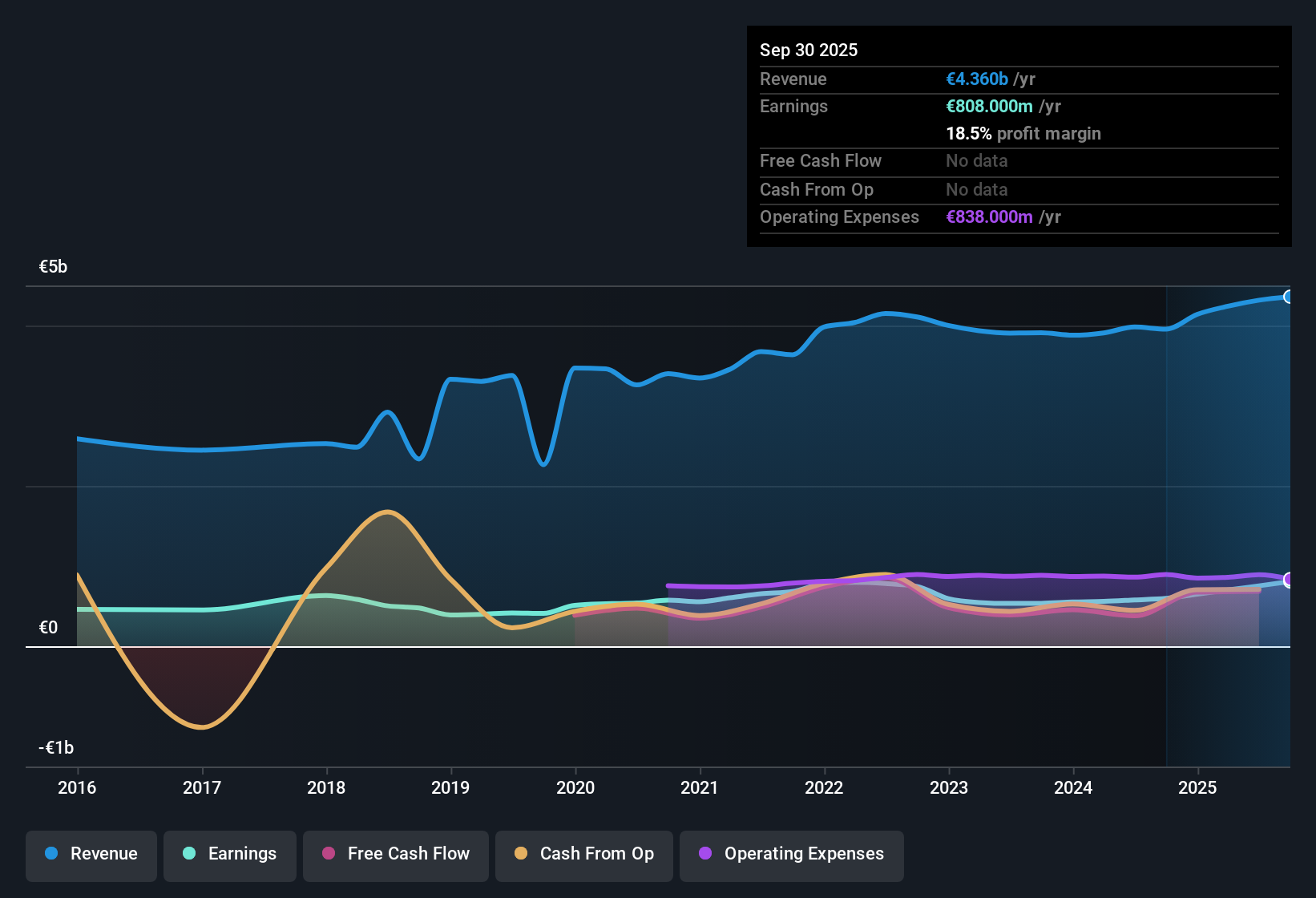

DWS Group GmbH KGaA (XTRA:DWS) just posted annual earnings growth of 35.3%, a sharp jump over its five-year trend of only 1% annual growth. Although net profit margins have climbed from 15.1% to 18.5%, revenue is forecast to decline by 5.9% per year over the next three years, and earnings growth of 6.9% per year is projected to trail the broader German market’s 16.6% average. With the company trading at €55.4 per share, well below a fair value estimate of €94.44, and no major risks on the horizon, the latest results spotlight a mix of improving profitability and muted top-line expectations for investors to weigh.

See our full analysis for DWS Group GmbH KGaA.The next section compares these headline results against the prevailing narratives around DWS, revealing where the numbers fit and where they might push back on conventional wisdom.

See what the community is saying about DWS Group GmbH KGaA

Profit Margins Poised for Expansion

- Analysts expect DWS’s net profit margin to rise from 17.5% today to 30.7% in three years, a sizable projected gain even as revenues fall.

- According to the analysts' consensus view, margin gains are tied to ongoing investments in digital infrastructure and product innovation, which are assumed to drive:

- Cost-to-income ratio improvements from scalable digital hubs and automation. These enhancements aim to offset fee pressure on core asset management products.

- Mix benefits from ESG-aligned and alternative investment products, which typically carry higher fees and are expected to enhance margins despite challenges from regulatory scrutiny and pricing competition.

- What stands out from the consensus narrative is the sharp divergence between shrinking forecasted revenue and a steep margin ramp. Analysts see operating efficiencies from technology upgrades and product mix compensating for declining top-line performance, betting on margin expansion as the main earnings lever through 2028.

See how this margin growth shapes the DWS investment thesis in the full consensus narrative: 📊 Read the full DWS Group GmbH KGaA Consensus Narrative.

DCF Fair Value Far Above Market Price

- DWS trades at €55.40, well below the DCF fair value estimate of €94.44, suggesting a discount of over 40% versus intrinsic value.

- Consensus narrative points to this gap as a function of strong recent earnings quality and solid profit margins. However, it also highlights several competing factors:

- Relative to broad German capital markets, DWS's price-to-earnings multiple is attractive. It appears less compelling alongside direct peers who may grow faster or command higher investor confidence.

- The €56.38 analyst price target, which is 2% above the current share price, signals that despite headline discounts to DCF value, analysts think DWS is close to fairly priced given subdued revenue outlook and rising structural industry risks.

Asset Growth Faces Fee Pressure Headwinds

- Revenue is anticipated to decrease by 5.9% annually over the next three years, even though net inflows from ETFs, ESG funds, and alternative products are expected to be positive.

- Consensus narrative underscores that while DWS is strategically expanding its suite of scalable investment products, there are tensions at play:

- Competitive fee compression, regulatory demands, and the industry's structural move from active to passive strategies put persistent pressure on traditional revenue streams.

- These headwinds complicate DWS’s ability to translate product innovation and distribution strength into tangible top-line growth, despite demographic and sustainability tailwinds cited by bulls.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for DWS Group GmbH KGaA on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on the numbers? Put your viewpoint into context and share your perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding DWS Group GmbH KGaA.

See What Else Is Out There

Despite margin expansion, DWS faces declining revenue and subdued growth projections. These factors put its long-term earnings momentum at risk.

If reliable performance appeals more, check out stable growth stocks screener (2119 results) for companies showing consistently strong growth and steadier revenue trends than DWS.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DWS

DWS Group GmbH KGaA

Offers asset management services in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)