- Germany

- /

- Diversified Financial

- /

- XTRA:DFTK

Should Shareholders Have Second Thoughts About A Pay Rise For DF Deutsche Forfait AG's (ETR:DFTK) CEO This Year?

Key Insights

- DF Deutsche Forfait to hold its Annual General Meeting on 29th of August

- Salary of €250.0k is part of CEO Behrooz Abdolvand's total remuneration

- Total compensation is 31% below industry average

- DF Deutsche Forfait's EPS declined by 35% over the past three years while total shareholder loss over the past three years was 8.3%

Performance at DF Deutsche Forfait AG (ETR:DFTK) has not been particularly rosy recently and shareholders will likely be holding CEO Behrooz Abdolvand and the board accountable for this. At the upcoming AGM on 29th of August, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. From our analysis below, we think CEO compensation looks appropriate for now.

View our latest analysis for DF Deutsche Forfait

Comparing DF Deutsche Forfait AG's CEO Compensation With The Industry

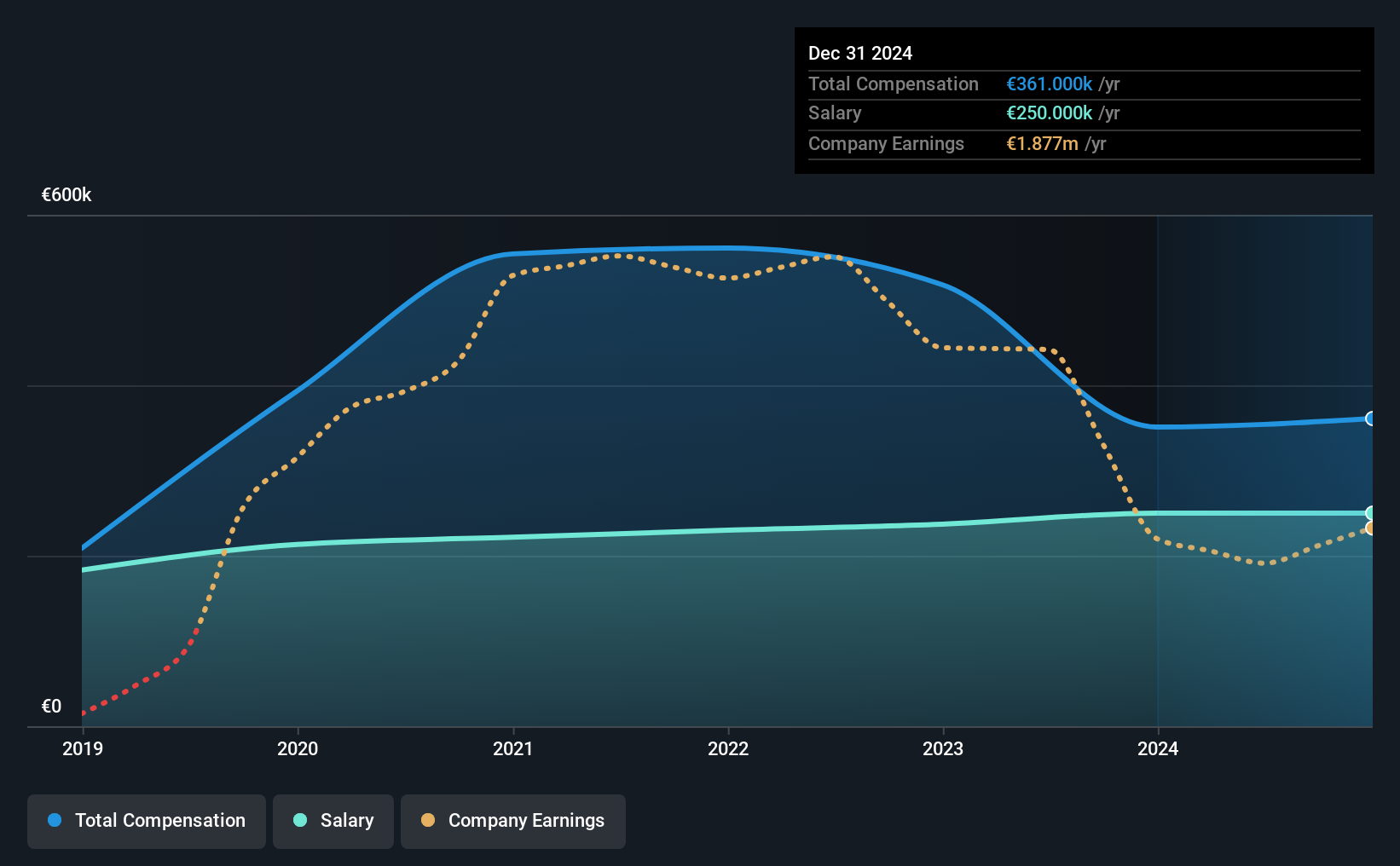

At the time of writing, our data shows that DF Deutsche Forfait AG has a market capitalization of €21m, and reported total annual CEO compensation of €361k for the year to December 2024. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at €250.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the German Diversified Financial industry with market capitalizations below €171m, we found that the median total CEO compensation was €526k. This suggests that Behrooz Abdolvand is paid below the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | €250k | €250k | 69% |

| Other | €111k | €101k | 31% |

| Total Compensation | €361k | €351k | 100% |

On an industry level, around 51% of total compensation represents salary and 49% is other remuneration. It's interesting to note that DF Deutsche Forfait pays out a greater portion of remuneration through salary, compared to the industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

DF Deutsche Forfait AG's Growth

Over the last three years, DF Deutsche Forfait AG has shrunk its earnings per share by 35% per year. It saw its revenue drop 65% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has DF Deutsche Forfait AG Been A Good Investment?

Given the total shareholder loss of 8.3% over three years, many shareholders in DF Deutsche Forfait AG are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 4 warning signs (and 2 which can't be ignored) in DF Deutsche Forfait we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DFTK

DF Deutsche Forfait

Provides foreign trade finance and related services for exporters, importers, and other financial companies in the Middle East and Eastern Europe.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion